Question: I need help with this Question Ratio Analysis Fill in the blanks Dewey Ltd Huey Ltd 200,000 Louie Ltd 875,000 35,000 180,000 32,000 164,000 102,000

I need help with this Question

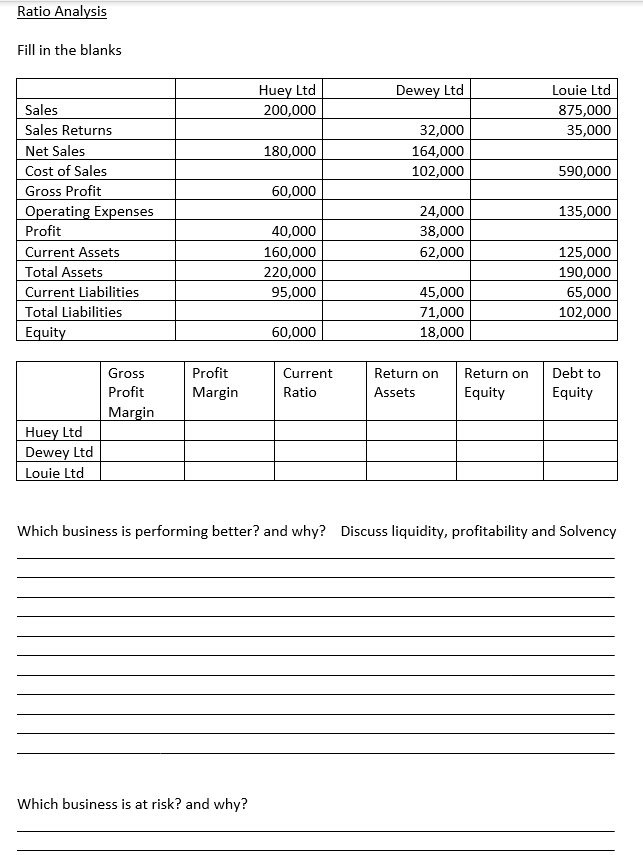

Ratio Analysis Fill in the blanks Dewey Ltd Huey Ltd 200,000 Louie Ltd 875,000 35,000 180,000 32,000 164,000 102,000 590,000 60,000 135,000 Sales Sales Returns Net Sales Cost of Sales Gross Profit Operating Expenses Profit Current Assets Total Assets Current Liabilities Total Liabilities Equity 24,000 38,000 62,000 40,000 160,000 220,000 95,000 125,000 190,000 65,000 102,000 45,000 71,000 18,000 60,000 Gross Profit Margin Profit Margin Current Ratio Return on Assets Return on Equity Debt to Equity Huey Ltd Dewey Ltd Louie Ltd Which business is performing better? and why? Discuss liquidity, profitability and Solvency Which business is at risk? and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts