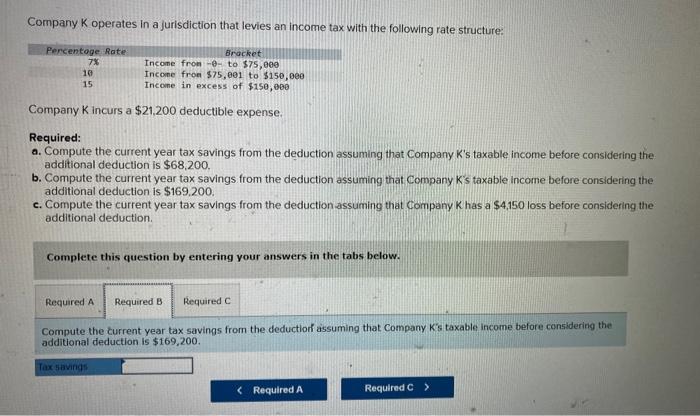

Question: I need help with this question. Required B part. Company K operates in a jurisdiction that levies an income tax with the following rate structure:

Company K operates in a jurisdiction that levies an income tax with the following rate structure: Company K incurs a $21,200 deductible expense. Required: a. Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the: additional deduction is $68,200. b. Compute the current year tax savings from the deduction assuming that Company K 's taxable income before considering the additional deduction is $169,200. c. Compute the current year tax savings from the deduction assuming that Company K has a $4,150 loss before considering the additional deduction. Complete this question by entering your answers in the tabs below. Compute the current year tax savings from the deductiorf assuming that. Company K's taxable income before considering the additional deduction is $169,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts