Question: I need help with this question Shoofitz & Whereit, Inc. is contemplating a new division. Their Marketing Department has suggested that Shoofitz conduct a market

I need help with this question

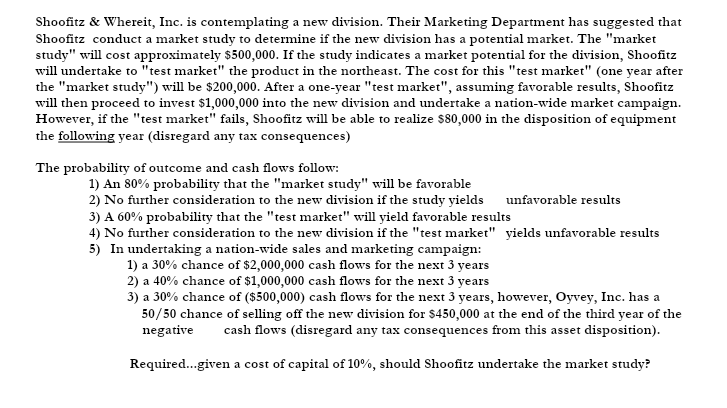

Shoofitz & Whereit, Inc. is contemplating a new division. Their Marketing Department has suggested that Shoofitz conduct a market study to determine if the new division has a potential market. The "market study" will cost approximately $500,000. If the study indicates a market potential for the division, Shoofitz will undertake to "test market" the product in the northeast. The cost for this "test market" (one year after the "market study") will be $200,000. After a one-year "test market", assuming favorable results, Shoofitz will then proceed to invest $1,000,000 into the new division and undertake a nation-wide market campaign. However, if the "test market" fails, Shoofitz will be able to realize $80,000 in the disposition of equipment the following year (disregard any tax consequences) The probability of outcome and cash flows follow: 1) An 80% probability that the "market study" will be favorable 2) No further consideration to the new division if the study yields unfavorable results 3) A 60% probability that the "test market" will yield favorable results 4) No further consideration to the new division if the "test market" yields unfavorable results 5) In undertaking a nation-wide sales and marketing campaign: 1) a 30% chance of $2,000,000 cash flows for the next 3 years 2) a 40% chance of $1,000,000 cash flows for the next 3 years 3) a 30% chance of ($500,000) cash flows for the next 3 years, however, Oyvey, Inc. has a 50/50 chance of selling off the new division for $450,000 at the end of the third year of the negative cash flows (disregard any tax consequences from this asset disposition). Required...given a cost of capital of 10%, should Shoofitz undertake the market study? Shoofitz & Whereit, Inc. is contemplating a new division. Their Marketing Department has suggested that Shoofitz conduct a market study to determine if the new division has a potential market. The "market study" will cost approximately $500,000. If the study indicates a market potential for the division, Shoofitz will undertake to "test market" the product in the northeast. The cost for this "test market" (one year after the "market study") will be $200,000. After a one-year "test market", assuming favorable results, Shoofitz will then proceed to invest $1,000,000 into the new division and undertake a nation-wide market campaign. However, if the "test market" fails, Shoofitz will be able to realize $80,000 in the disposition of equipment the following year (disregard any tax consequences) The probability of outcome and cash flows follow: 1) An 80% probability that the "market study" will be favorable 2) No further consideration to the new division if the study yields unfavorable results 3) A 60% probability that the "test market" will yield favorable results 4) No further consideration to the new division if the "test market" yields unfavorable results 5) In undertaking a nation-wide sales and marketing campaign: 1) a 30% chance of $2,000,000 cash flows for the next 3 years 2) a 40% chance of $1,000,000 cash flows for the next 3 years 3) a 30% chance of ($500,000) cash flows for the next 3 years, however, Oyvey, Inc. has a 50/50 chance of selling off the new division for $450,000 at the end of the third year of the negative cash flows (disregard any tax consequences from this asset disposition). Required...given a cost of capital of 10%, should Shoofitz undertake the market study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts