Question: i need help with this Tax Accounting problem do scheduale c 1040 (2021) and scheduale SE (2021) Tim Smith is self-employed of an internet business

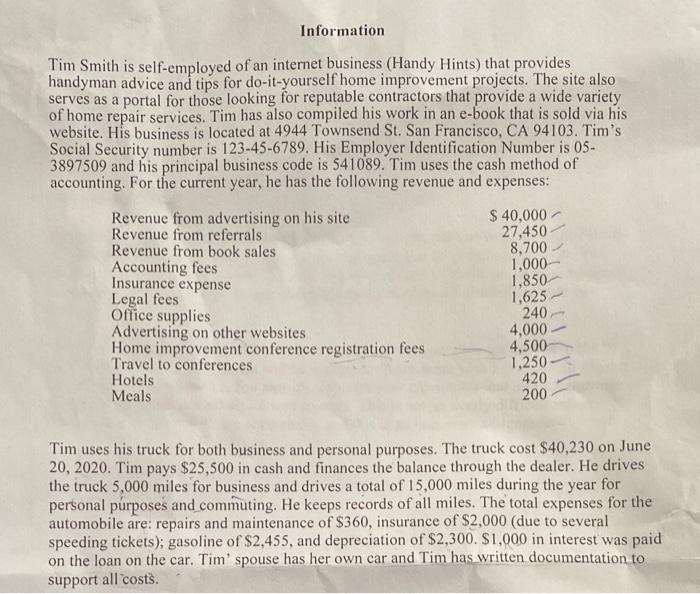

Tim Smith is self-employed of an internet business (Handy Hints) that provides handyman advice and tips for do-it-yourself home improvement projects. The site also serves as a portal for those looking for reputable contractors that provide a wide variety of home repair services. Tim has also compiled his work in an e-book that is sold via his website. His business is located at 4944 Townsend St. San Francisco, CA 94103 . Tim's Social Security number is 123-45-6789. His Employer Identification Number is 053897509 and his principal business code is 541089 . Tim uses the cash method of accounting. For the current year, he has the following revenue and expenses: Tim uses his truck for both business and personal purposes. The truck cost $40,230 on June 20,2020 . Tim pays $25,500 in cash and finances the balance through the dealer. He drives the truck 5,000 miles for business and drives a total of 15,000 miles during the year for personal purposes and commuting. He keeps records of all miles. The total expenses for the automobile are: repairs and maintenance of $360, insurance of $2,000 (due to several speeding tickets); gasoline of $2,455, and depreciation of $2,300.$1,000 in interest was paid on the loan on the car. Tim' spouse has her own car and Tim has written documentation to support all costs. Tim Smith is self-employed of an internet business (Handy Hints) that provides handyman advice and tips for do-it-yourself home improvement projects. The site also serves as a portal for those looking for reputable contractors that provide a wide variety of home repair services. Tim has also compiled his work in an e-book that is sold via his website. His business is located at 4944 Townsend St. San Francisco, CA 94103 . Tim's Social Security number is 123-45-6789. His Employer Identification Number is 053897509 and his principal business code is 541089 . Tim uses the cash method of accounting. For the current year, he has the following revenue and expenses: Tim uses his truck for both business and personal purposes. The truck cost $40,230 on June 20,2020 . Tim pays $25,500 in cash and finances the balance through the dealer. He drives the truck 5,000 miles for business and drives a total of 15,000 miles during the year for personal purposes and commuting. He keeps records of all miles. The total expenses for the automobile are: repairs and maintenance of $360, insurance of $2,000 (due to several speeding tickets); gasoline of $2,455, and depreciation of $2,300.$1,000 in interest was paid on the loan on the car. Tim' spouse has her own car and Tim has written documentation to support all costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts