Question: I need help with this. Thanks:) Chapter 9 Homework Saved Help Save & Exit Submit Check my work 11 Required information Exercise 9-17A Record the

I need help with this. Thanks:)

I need help with this. Thanks:)

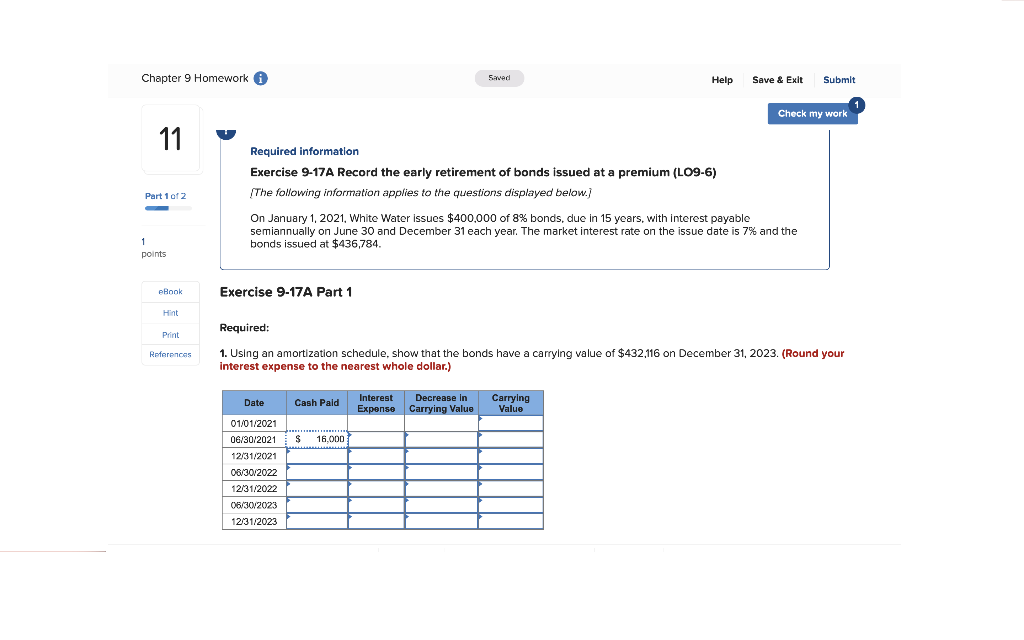

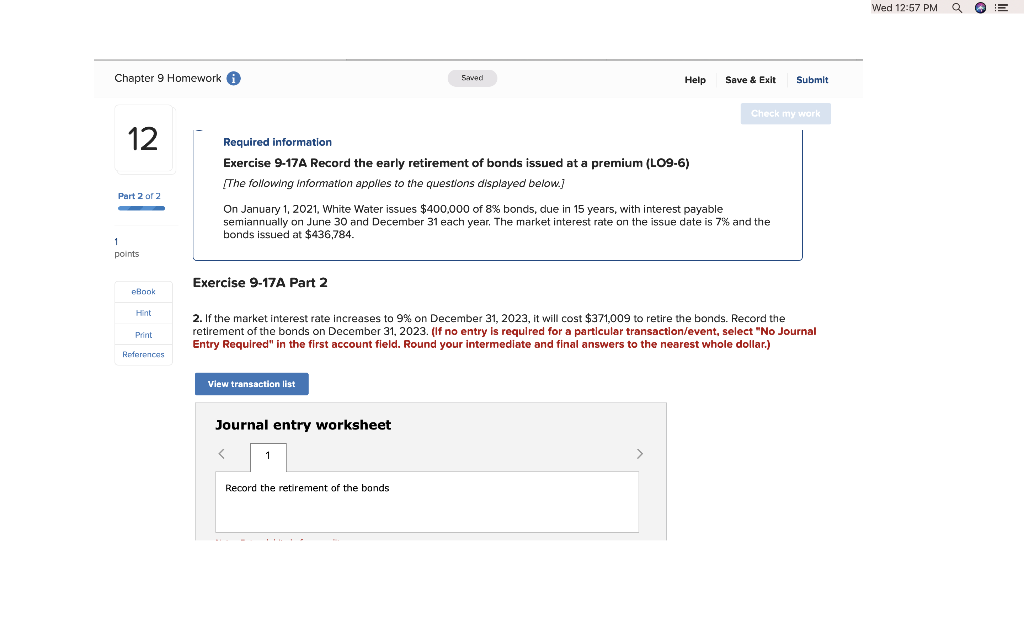

Chapter 9 Homework Saved Help Save & Exit Submit Check my work 11 Required information Exercise 9-17A Record the early retirement of bonds issued at a premium (L09-6) The following information applies to the questions displayed below. Part 1 of 2 On January 1, 2021, White Water issues $400,000 of 8% bonds, duc in 15 years, with interest payable ember 31 each year. The market interest rate on the issue date is 7% and the bonds issued at $436,784. points eBook Exercise 9-17A Part 1 Hint Required: Print References 1. Using an amortization schedule, show that the bonds have a carrying value of $432,116 on December 31, 2023. (Round your interest expense to the nearest whole dollar.) Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value 01/01/2021 06/30/2021 12/31/2021 08/30/2022 12/31/2022 06/30/2023 12/31/2023 Wed 12:57 PM Q E Chapter 9 Homework Saved Help Save & Exit Submit Check my work 12 Required information Exercise 9-17A Record the early retirement of bonds issued at a premium (LO9-6) The following Information applies to the questions displayed below.) Part 2 of 2 On January 1, 2021, White Water issues $400,000 of 8% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 7% and the bonds issued at $436,784. points Exercise 9-17A Part 2 eBook Hint Print 2. If the market interest rate increases to 9% on December 31, 2023, it will cost $371,009 to retire the bonds. Record the retirement of the bonds on December 31, 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field. Round your intermediate and final answers to the nearest whole dollar.) References View transaction list Journal entry worksheet Record the retirement of the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts