Question: I need help with this. Viktor exchanges stock (adjusted basis $23,000, FMV $34,000) and real estate (adjusted basis $23,000, FMV $54,000) held for investment for

I need help with this.

I need help with this.

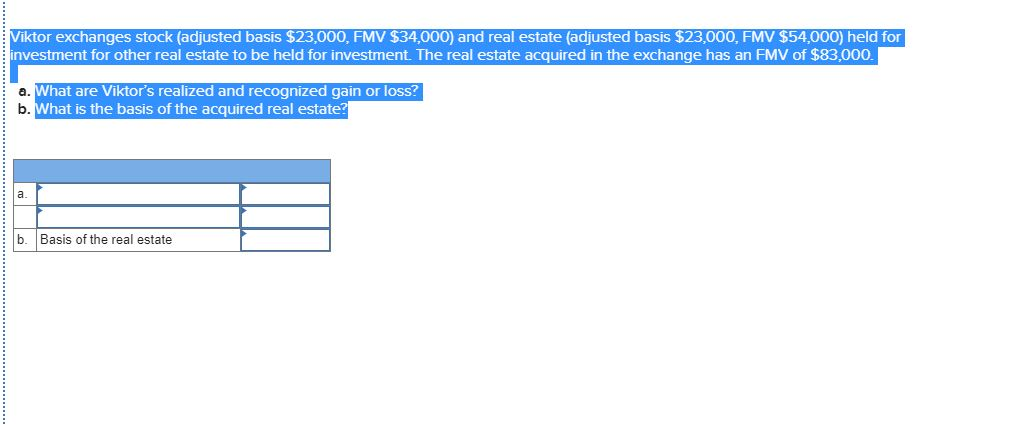

Viktor exchanges stock (adjusted basis $23,000, FMV $34,000) and real estate (adjusted basis $23,000, FMV $54,000) held for investment for other real estate to be held for investment. The real estate acquired in the exchange has an FMV of $83,000. a. What are Viktor's realized and recognized gain or loss? b. What is the basis of the acquired real estate? b. Basis of the real estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts