Question: i need help with this whole project gotta make sure the trial balance equals up and can you do the General journal July 1 Horrow

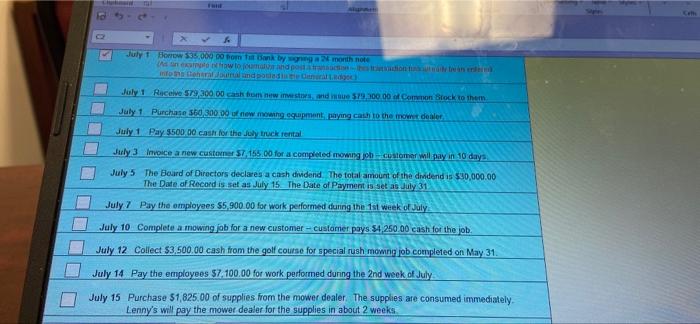

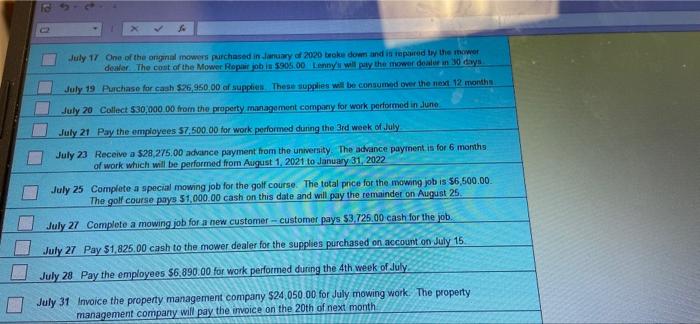

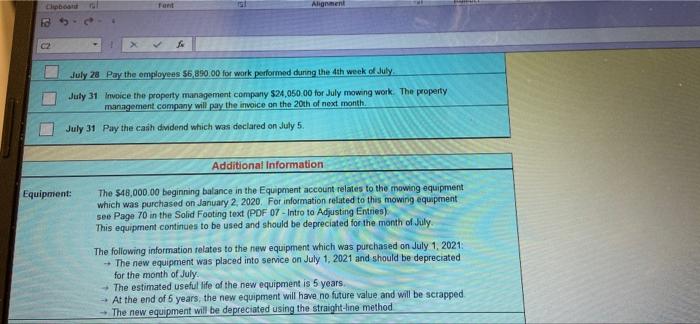

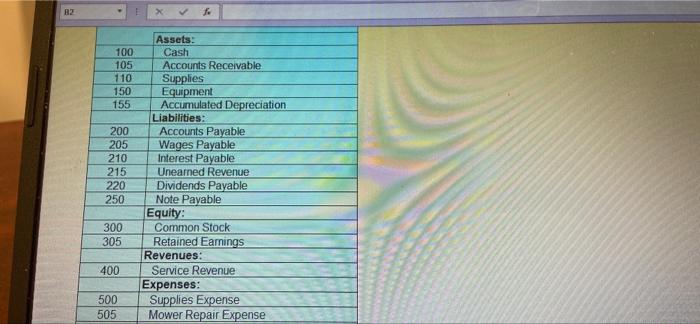

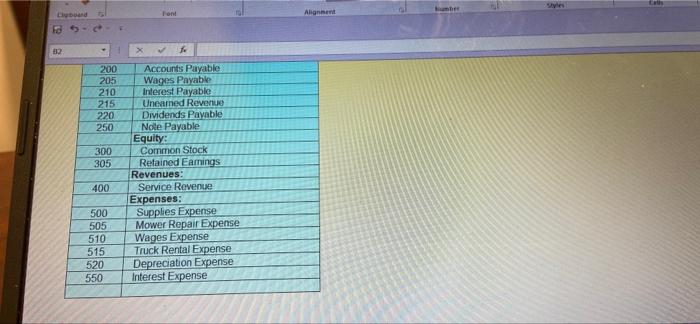

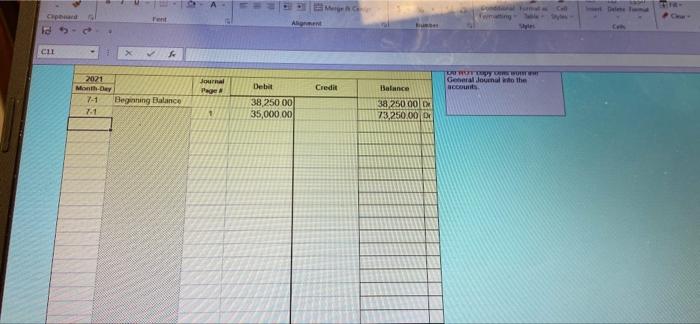

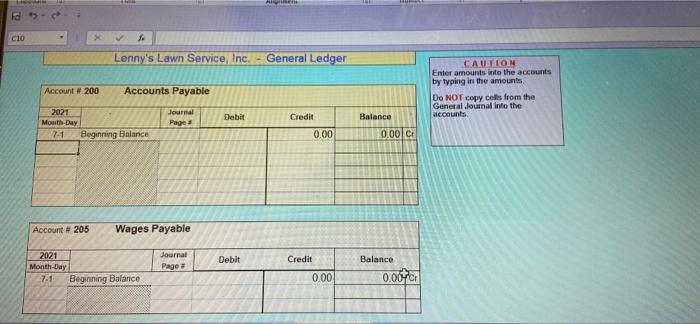

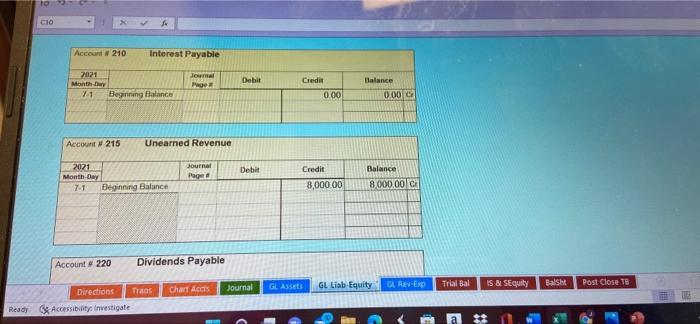

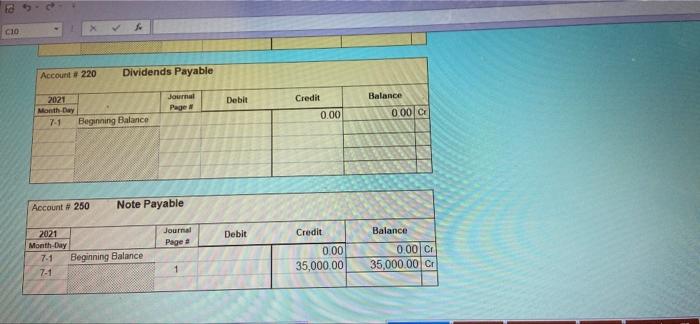

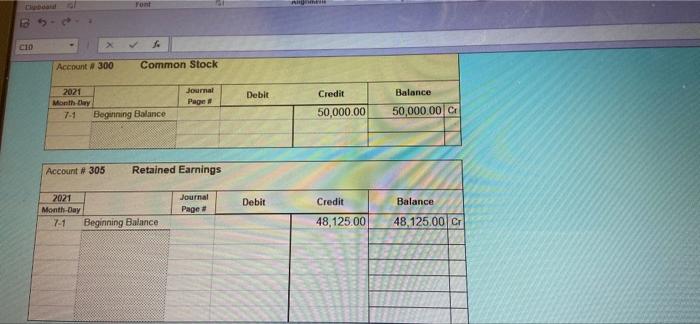

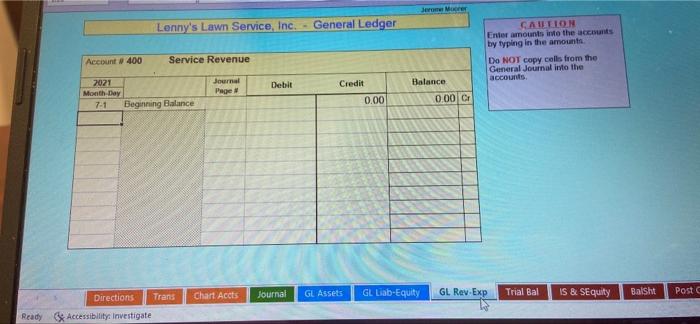

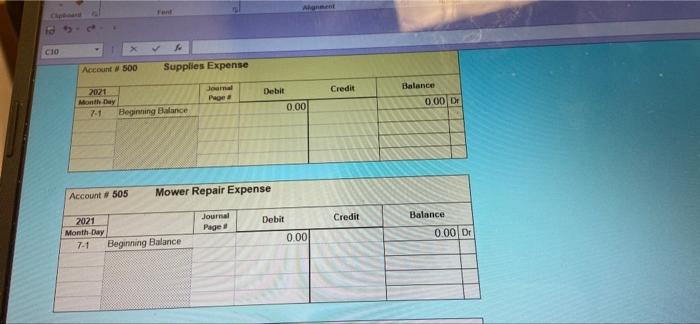

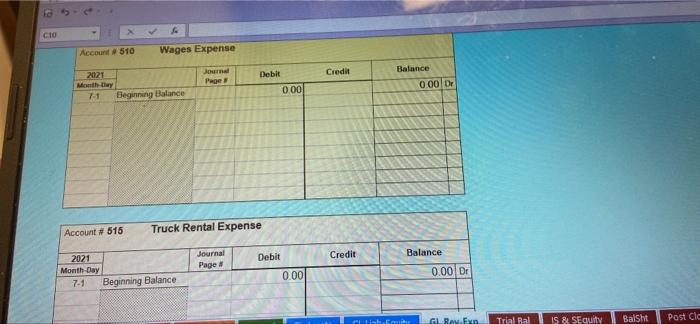

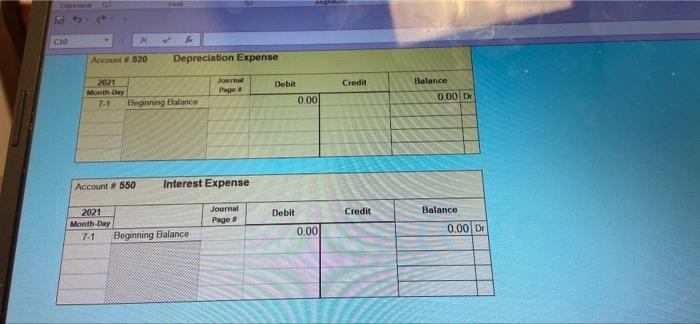

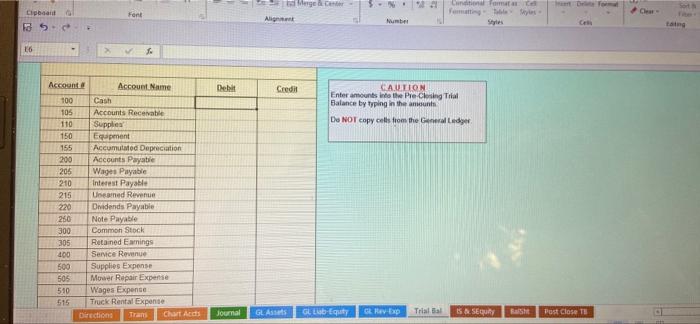

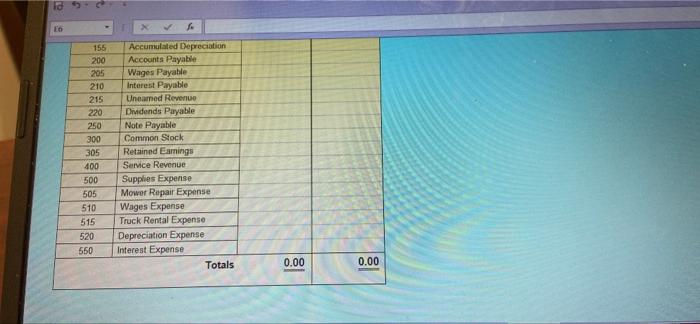

July 1 Horrow 335,000 Do tom ak by month note wordpohon July 1 Receive 579,300.00 cash bom new investors and we 579,300.00 of Common Stock to them July 1 Purchase 560,300 00 of new mowie egpment paying catch to the most dealer July 1 Pay 5500 00 cash for the July truck rental July 3 Invoice a new customer S7 155.00 for a completed mowing on customer will pay in 10 days July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $90,000.00 The Date of Record is set as July 15 The Date of Payment is set as July 31 July 7 Pay the employees 55,900.00 for work performed during the 1st week of July July 10 Complete a mowing job for a new customer-customer pays $4,250.00 cash for the job July 12 Collect $3,500.00 cash from the golf course for special rush mowing job completed on May 31 LIL July 14 Pay the employees $7.100.00 for work performed during the 2nd week of July July 15 Purchase 51,825.00 of supplies from the mower dealer. The supplies are consumed immediately Lenny's will pay the mower dealer for the supplies in about 2 weeks July 17 One of the orginal mowers purchased in January of 2020 broke down and is reported by the mower dealer The cost of the Mower Ropa job in 1905.00 Lenny's will pay the mower dealer in 30 days July 19 Purchase for cash $26.950 00 of supplies. These supplies will be consumed over the next 12 months July 20 Collect 530 000 00 from the property management company for work performed in June July 21 Pay the employees 57.500.00 for work performed during the 3rd week of July July 23 Receive a $28,275.00 advance payment from the university The advance payment is for 6 months of work which will be performed from August 1, 2021 to January 31, 2022 July 25 Complete a special mowing job for the golf course. The total price for the mowing job is $6,500.00 The golf course pays 51,000.00 cash on this date and will pay the remainder on August 25 July 27 Complete a mowing job for a new customer -- customer pays $3.725,00 cash for the job. July 27 Pay $1.825.00 cash to the mower dealer for the supplies purchased on account on July 15 July 28 Pay the employees $6,890.00 for work performed during the 4th week of July July 31 Invoice the property management company $24,050.00 for July mowing work. The property management company will pay the invoice on the 20th of next month Chboard fant Alignment 02 July 28 Pay the employees $6,890.00 for work performed during the 4th week of July July 31 Invoice the property management company $24,050.00 for July mowing work. The property management company will pay the invoice on the 20th of next month July 31 Pay the cash dividend which was declared on July 5 Additional Information Equipment: The 548,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For information related to this mowing equipment see Page 70 in the Sold Footing text (PDF 07 - Intro to Adjusting Entries) This equipment continues to be used and should be depreciated for the month of July The following information relates to the new equipment which was purchased on July 1, 2021 - The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped The new equipment will be depreciated using the straight-line method 82 205 Assets: 100 Cash 105 Accounts Receivable 110 Supplies 150 Equipment 155 Accumulated Depreciation Liabilities: 200 Accounts Payable Wages Payable 210 Interest Payable 215 Uneamed Revenue 220 Dividends Payable 250 Note Payable Equity: 300 Common Stock 305 Retained Earnings Revenues: 400 Service Revenue Expenses: 500 Supplies Expense 505 Mower Repair Expense CE Font Alion 32 fo 200 Accounts Payable 205 Wages Payable 210 Interest Payable 215 Unearned Revenue 220 Dividends Payable 250 Note Payable Equity: 300 Common Stock 305 Retained Eamings Revenues: 400 Service Revenue Expenses: 500 Supplies Expense 505 Mower Repair Expense 510 Wages Expense 515 Truck Rental Expense 520 Depreciation Expense 550 Interest Expense po AB CIL 2021 Month-Day 7-1 Journal Page UWUN General Journal of the accounts Deb Credit Beginning Balance Balance 38,250 000 73,250.00 38 250 00 35,000.00 + CIO Lenny's Lawn Service, Inc. General Ledger Account # 200 Accounts Payable CAUTION Enter amounts into the accounts by typing in the amounts Do NOT copy cells from the General Journal into the accounts Journal Page Debit Credit 2021 Mouth Day 741 Beginning Balance Balance 0.00 0.00 CM Account # 205 Wages Payable Journal Page Debit 2021 Month-Day 7.1 Beginning Balance Credit Balance 0.00+ 0.00 to CIO f Account 210 Interest Payable 2021 Month Day 71 Beginning Balance Joma POR Debit Credit 000! Flalance 0.000 Account # 215 Unearned Revenue Journal Page Debit 2021 Month Day 7.1 Beginning Balance Credit Balance 8000.00 8,000.00 Account # 220 Dividends Payable GL Liab Equity GL Rey Exp Trial Bal GL Assets Balsh Journal IS & SEquity Chart Accts Post Close T5 Directions Trans Ready Accessibility Investigate CIO Account . 220 Dividends Payable Journal Page Debit Credit 2021 Month Day 7-1 Beginning Balance Balance 000 CE 0.00 Account # 250 Note Payable Journal Page 2 Balance Debit Credit 2021 Month-Day 7.1 Beginning Balance 7.1 0.00 35,000.00 0.00 CE 35,000.00 CE 1 Font C10 Account # 300 Common Stock Journal Page Debit 2021 Monthly 7-1 Beginning Balance Credit Balance 50,000.00 CI 50,000.00 Account # 305 Retained Earnings Journal Page Debit 2021 Month-Day 7-1 Beginning Balance Balance Credit 48,125.00 48,125.00C Lenny's Lawn Service, Inc. General Ledger CAUTION Enter amounts into the accounts by typing in the amount Do NOT copy cells from the General Journal into the Bccounts Account # 400 Service Revenue Journal Debit Credit Balance 2021 Month Day 7-1 Beginning Balance 0.00 0.00 C Trans Chart Accts GL Assets Journal Directions GL Liab-Equity GL Rev Exp Trial Bal Postc Balsht IS & SEquity Ready Accessibility: Investigate 1 C10 Account # 500 Supplies Expense Debit Credit Page 2021 Month Day 7.1 Beginning Balance Balance 0.00 DI 0.00 Account # 505 Mower Repair Expense Journal Page 1 Debit Credit 2021 Month-Day 7-1 Beginning Balance Balance 0.00 Dr 0.00 CIO Account #510 Wages Expense Journal Poe Debit Credit 2021 Mittlery 71 Beginning balance Balance 0001 0.001 Account # 515 Truck Rental Expense Journal Page Debit Credit Balance 2021 Month-Day 7-1 Beginning Balance 0.00 0.00 Dr Rev. Fxn Plist Trial Ral IS & SEquity Balsht Post Cic CIO Account # 520 Depreciation Expense Journal Credit 221 Monthly 7-1 Beginning Balance Debit 0.00 Balance 0.00 DI Account # 550 Interest Expense 2021 Month-Day 7-1 Beginning Balance Journal Page 1 Credit Debit 0.00 Balance 0.00 Dr Chroma Font Car Clipbaan 18 Ali Numb 26 Debit Credit CAUTION Enter amounts to the Pre-Clesing Ta Balance by typing in the sun Do NOT copy cells from the General Led Account Account Name 100 Cash 105 Accounts Receivable 110 Supplies 150 Egament 155 Accumulated Depreciation 200 Accounts Payati 205 Wages Payable 210 Interest Payable 215 Uneamed Revenue 220 Dividends Payable 250 Note Payable 300 Common Stock 305 Retained Eaming 400 Service Revenue 500 Supplies Expense 505 Mower Repair Expense 510 Wages Expense 515 Truck Rental Expense Directions Tram C Ads 888 Salalalalalalalala Journal GL Assets GL-Equity Rev Exp Trial al 15.SE Post Close Tu a 0 155 200 205 210 215 220 250 300 305 400 500 505 510 515 520 550 Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Uneared Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expenso Depreciation Expense Interest Expense Totals 0.00 0.00 July 1 Horrow 335,000 Do tom ak by month note wordpohon July 1 Receive 579,300.00 cash bom new investors and we 579,300.00 of Common Stock to them July 1 Purchase 560,300 00 of new mowie egpment paying catch to the most dealer July 1 Pay 5500 00 cash for the July truck rental July 3 Invoice a new customer S7 155.00 for a completed mowing on customer will pay in 10 days July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $90,000.00 The Date of Record is set as July 15 The Date of Payment is set as July 31 July 7 Pay the employees 55,900.00 for work performed during the 1st week of July July 10 Complete a mowing job for a new customer-customer pays $4,250.00 cash for the job July 12 Collect $3,500.00 cash from the golf course for special rush mowing job completed on May 31 LIL July 14 Pay the employees $7.100.00 for work performed during the 2nd week of July July 15 Purchase 51,825.00 of supplies from the mower dealer. The supplies are consumed immediately Lenny's will pay the mower dealer for the supplies in about 2 weeks July 17 One of the orginal mowers purchased in January of 2020 broke down and is reported by the mower dealer The cost of the Mower Ropa job in 1905.00 Lenny's will pay the mower dealer in 30 days July 19 Purchase for cash $26.950 00 of supplies. These supplies will be consumed over the next 12 months July 20 Collect 530 000 00 from the property management company for work performed in June July 21 Pay the employees 57.500.00 for work performed during the 3rd week of July July 23 Receive a $28,275.00 advance payment from the university The advance payment is for 6 months of work which will be performed from August 1, 2021 to January 31, 2022 July 25 Complete a special mowing job for the golf course. The total price for the mowing job is $6,500.00 The golf course pays 51,000.00 cash on this date and will pay the remainder on August 25 July 27 Complete a mowing job for a new customer -- customer pays $3.725,00 cash for the job. July 27 Pay $1.825.00 cash to the mower dealer for the supplies purchased on account on July 15 July 28 Pay the employees $6,890.00 for work performed during the 4th week of July July 31 Invoice the property management company $24,050.00 for July mowing work. The property management company will pay the invoice on the 20th of next month Chboard fant Alignment 02 July 28 Pay the employees $6,890.00 for work performed during the 4th week of July July 31 Invoice the property management company $24,050.00 for July mowing work. The property management company will pay the invoice on the 20th of next month July 31 Pay the cash dividend which was declared on July 5 Additional Information Equipment: The 548,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For information related to this mowing equipment see Page 70 in the Sold Footing text (PDF 07 - Intro to Adjusting Entries) This equipment continues to be used and should be depreciated for the month of July The following information relates to the new equipment which was purchased on July 1, 2021 - The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped The new equipment will be depreciated using the straight-line method 82 205 Assets: 100 Cash 105 Accounts Receivable 110 Supplies 150 Equipment 155 Accumulated Depreciation Liabilities: 200 Accounts Payable Wages Payable 210 Interest Payable 215 Uneamed Revenue 220 Dividends Payable 250 Note Payable Equity: 300 Common Stock 305 Retained Earnings Revenues: 400 Service Revenue Expenses: 500 Supplies Expense 505 Mower Repair Expense CE Font Alion 32 fo 200 Accounts Payable 205 Wages Payable 210 Interest Payable 215 Unearned Revenue 220 Dividends Payable 250 Note Payable Equity: 300 Common Stock 305 Retained Eamings Revenues: 400 Service Revenue Expenses: 500 Supplies Expense 505 Mower Repair Expense 510 Wages Expense 515 Truck Rental Expense 520 Depreciation Expense 550 Interest Expense po AB CIL 2021 Month-Day 7-1 Journal Page UWUN General Journal of the accounts Deb Credit Beginning Balance Balance 38,250 000 73,250.00 38 250 00 35,000.00 + CIO Lenny's Lawn Service, Inc. General Ledger Account # 200 Accounts Payable CAUTION Enter amounts into the accounts by typing in the amounts Do NOT copy cells from the General Journal into the accounts Journal Page Debit Credit 2021 Mouth Day 741 Beginning Balance Balance 0.00 0.00 CM Account # 205 Wages Payable Journal Page Debit 2021 Month-Day 7.1 Beginning Balance Credit Balance 0.00+ 0.00 to CIO f Account 210 Interest Payable 2021 Month Day 71 Beginning Balance Joma POR Debit Credit 000! Flalance 0.000 Account # 215 Unearned Revenue Journal Page Debit 2021 Month Day 7.1 Beginning Balance Credit Balance 8000.00 8,000.00 Account # 220 Dividends Payable GL Liab Equity GL Rey Exp Trial Bal GL Assets Balsh Journal IS & SEquity Chart Accts Post Close T5 Directions Trans Ready Accessibility Investigate CIO Account . 220 Dividends Payable Journal Page Debit Credit 2021 Month Day 7-1 Beginning Balance Balance 000 CE 0.00 Account # 250 Note Payable Journal Page 2 Balance Debit Credit 2021 Month-Day 7.1 Beginning Balance 7.1 0.00 35,000.00 0.00 CE 35,000.00 CE 1 Font C10 Account # 300 Common Stock Journal Page Debit 2021 Monthly 7-1 Beginning Balance Credit Balance 50,000.00 CI 50,000.00 Account # 305 Retained Earnings Journal Page Debit 2021 Month-Day 7-1 Beginning Balance Balance Credit 48,125.00 48,125.00C Lenny's Lawn Service, Inc. General Ledger CAUTION Enter amounts into the accounts by typing in the amount Do NOT copy cells from the General Journal into the Bccounts Account # 400 Service Revenue Journal Debit Credit Balance 2021 Month Day 7-1 Beginning Balance 0.00 0.00 C Trans Chart Accts GL Assets Journal Directions GL Liab-Equity GL Rev Exp Trial Bal Postc Balsht IS & SEquity Ready Accessibility: Investigate 1 C10 Account # 500 Supplies Expense Debit Credit Page 2021 Month Day 7.1 Beginning Balance Balance 0.00 DI 0.00 Account # 505 Mower Repair Expense Journal Page 1 Debit Credit 2021 Month-Day 7-1 Beginning Balance Balance 0.00 Dr 0.00 CIO Account #510 Wages Expense Journal Poe Debit Credit 2021 Mittlery 71 Beginning balance Balance 0001 0.001 Account # 515 Truck Rental Expense Journal Page Debit Credit Balance 2021 Month-Day 7-1 Beginning Balance 0.00 0.00 Dr Rev. Fxn Plist Trial Ral IS & SEquity Balsht Post Cic CIO Account # 520 Depreciation Expense Journal Credit 221 Monthly 7-1 Beginning Balance Debit 0.00 Balance 0.00 DI Account # 550 Interest Expense 2021 Month-Day 7-1 Beginning Balance Journal Page 1 Credit Debit 0.00 Balance 0.00 Dr Chroma Font Car Clipbaan 18 Ali Numb 26 Debit Credit CAUTION Enter amounts to the Pre-Clesing Ta Balance by typing in the sun Do NOT copy cells from the General Led Account Account Name 100 Cash 105 Accounts Receivable 110 Supplies 150 Egament 155 Accumulated Depreciation 200 Accounts Payati 205 Wages Payable 210 Interest Payable 215 Uneamed Revenue 220 Dividends Payable 250 Note Payable 300 Common Stock 305 Retained Eaming 400 Service Revenue 500 Supplies Expense 505 Mower Repair Expense 510 Wages Expense 515 Truck Rental Expense Directions Tram C Ads 888 Salalalalalalalala Journal GL Assets GL-Equity Rev Exp Trial al 15.SE Post Close Tu a 0 155 200 205 210 215 220 250 300 305 400 500 505 510 515 520 550 Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Uneared Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expenso Depreciation Expense Interest Expense Totals 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts