Question: ASSUMPTIONS: Lexus IS-250-2 years Purchase Price = $34,000 Down payment = $6,800* - 2-year loan for $27,500 at 8% monthly payment of $1,230.18 5%

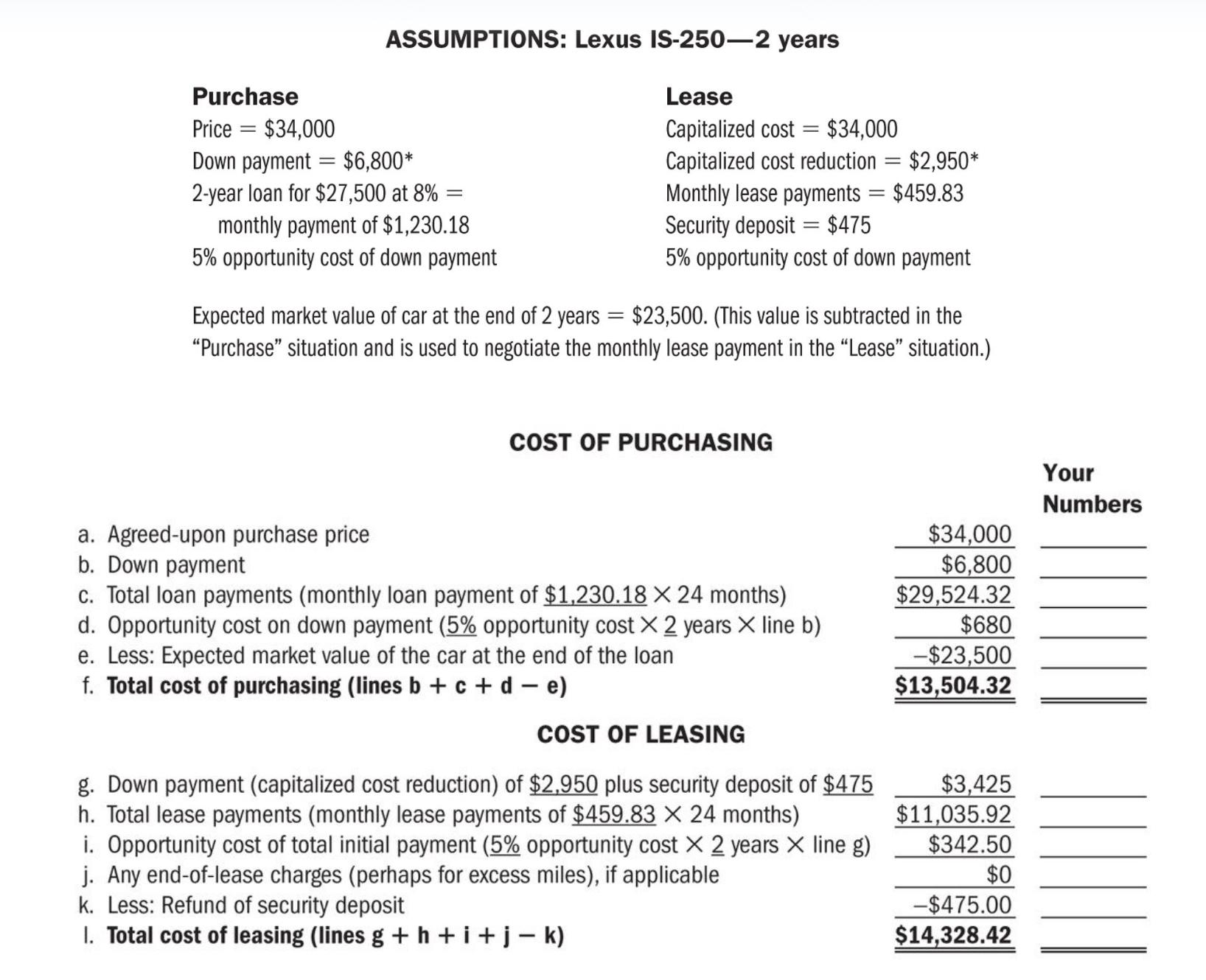

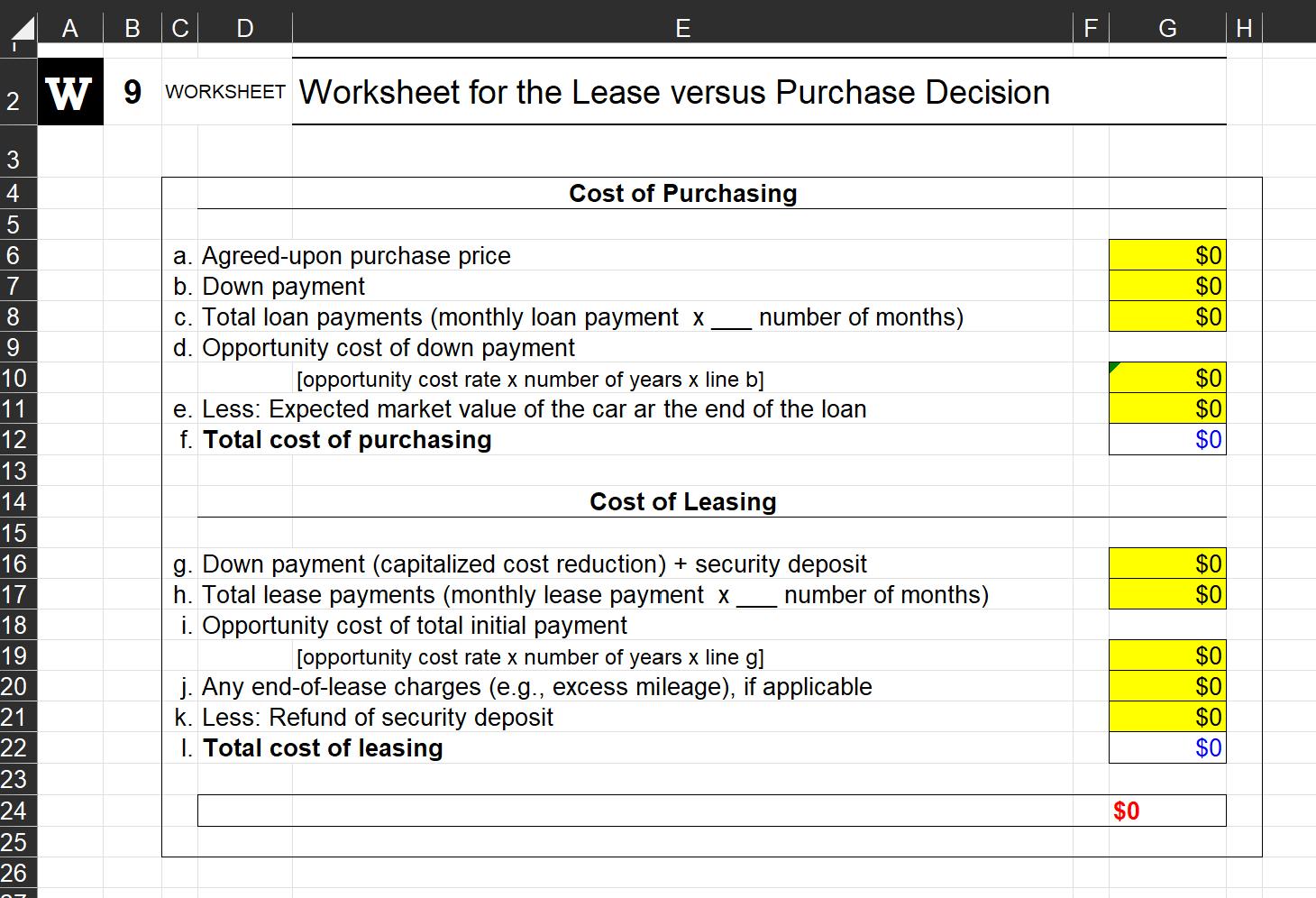

ASSUMPTIONS: Lexus IS-250-2 years Purchase Price = $34,000 Down payment = $6,800* - 2-year loan for $27,500 at 8% monthly payment of $1,230.18 5% opportunity cost of down payment a. Agreed-upon purchase price b. Down payment Lease Capitalized cost $34,000 Capitalized cost reduction = $2,950* Monthly lease payments = $459.83 Security deposit = $475 5% opportunity cost of down payment Expected market value of car at the end of 2 years = $23,500. (This value is subtracted in the "Purchase" situation and is used to negotiate the monthly lease payment in the "Lease" situation.) COST OF PURCHASING c. Total loan payments (monthly loan payment of $1,230.18 X 24 months) d. Opportunity cost on down payment (5% opportunity cost X 2 years X line b) e. Less: Expected market value of the car at the end of the loan f. Total cost of purchasing (lines b + c + d - e) COST OF LEASING g. Down payment (capitalized cost reduction) of $2,950 plus security deposit of $475 h. Total lease payments (monthly lease payments of $459.83 X 24 months) i. Opportunity cost of total initial payment (5% opportunity cost X 2 years X line g) j. Any end-of-lease charges (perhaps for excess miles), if applicable k. Less: Refund of security deposit 1. Total cost of leasing (lines g +h+i+j-k) $34,000 $6,800 $29,524.32 $680 -$23,500 $13,504.32 $3,425 $11,035.92 $342.50 $0 -$475.00 $14,328.42 Your Numbers A B C 2 W 9 WORKSHEET Worksheet for the Lease versus Purchase Decision 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 a. Agreed-upon purchase price b. Down payment E Cost of Purchasing c. Total loan payments (monthly loan payment x d. Opportunity cost of down payment number of months) [opportunity cost rate x number of years x line b] e. Less: Expected market value of the car ar the end of the loan f. Total cost of purchasing Cost of Leasing g. Down payment (capitalized cost reduction) + security deposit h. Total lease payments (monthly lease payment x number of months) i. Opportunity cost of total initial payment [opportunity cost rate x number of years x line g] j. Any end-of-lease charges (e.g., excess mileage), if applicable k. Less: Refund of security deposit 1. Total cost of leasing LL F $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 H

Step by Step Solution

There are 3 Steps involved in it

It seems that you have provided a worksheet for comparing the cost of purchasing and leasing a Lexus ... View full answer

Get step-by-step solutions from verified subject matter experts