Question: I need help with those homework questions please QUESTION 2 10 points Saved You would like to purchase a home and are interested to find

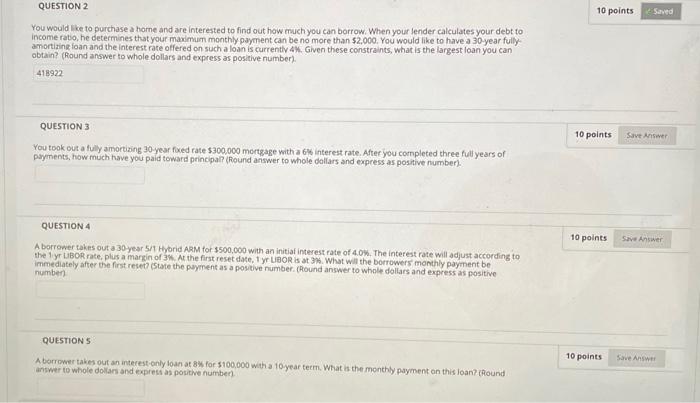

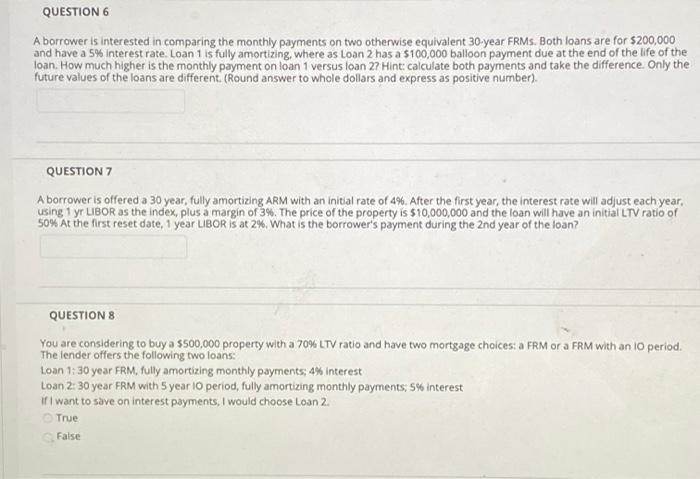

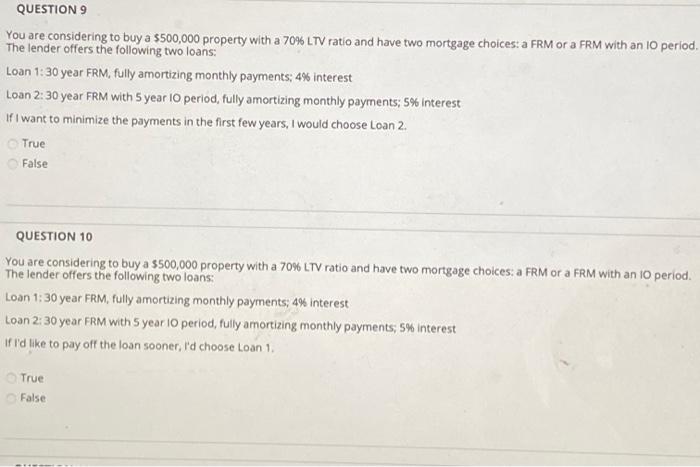

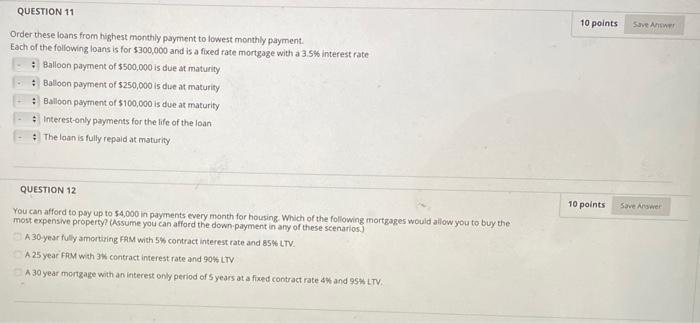

QUESTION 2 10 points Saved You would like to purchase a home and are interested to find out how much you can borrow. When your ender calculates your debt to income ratio, he determines that your maximum monthly payment can be no more than $2,000. You would like to have a 30 year fully amortizing loan and the interest rate offered on such a loan is currently 4. Given these constraints, what is the largest loan you can obtain? (Round answer to whole dollars and express as positive number) 418922 QUESTION 3 10 points Save Answer You took out a fully amortizing 30 year foredrate $300,000 mortgage with a 66 interest rate. After you completed three full years of payments, how much have you paid toward principal (Round answer to whole dollars and express as positive number). QUESTION 4 10 points Save Answer A borrower takes out a 30-year 5/1 Hybrid ARM for $500,000 with an initial interest rate of 4.0%. The interest rate will adjust according to the 1yr LIBOR rate, plus a margin of 3. At the first reset date, 1 yr UBOR is at 3. What will the borrowers monthly payment be immediately after the first reset (State the payment as a positive number. (Round answer to whole dollars and express as positive number QUESTIONS 10 points Save Answer A borrower takes out an interest only loan at 8% for $100.000 with a 10 year term. What is the monthly payment on this loan? (Round answer to whole dollars and express as politive number QUESTION 6 A borrower is interested in comparing the monthly payments on two otherwise equivalent 30-year FRMs. Both loans are for $200,000 and have a 5% interest rate. Loan 1 is fully amortizing, where as Loan 2 has a $100,000 balloon payment due at the end of the life of the loan. How much higher is the monthly payment on loan 1 versus loan 27 Hint calculate both payments and take the difference Only the future values of the loans are different. (Round answer to whole dollars and express as positive number). QUESTION 7 A borrower is offered a 30 year, fully amortizing ARM with an initial rate of 4%. After the first year, the interest rate will adjust each year, using 1 yr LIBOR as the index, plus a margin of 3%. The price of the property is $10,000,000 and the loan will have an initial LTV ratio of 50% At the first reset date, 1 year LIBOR is at 2%. What is the borrower's payment during the 2nd year of the loan? QUESTION 8 You are considering to buy a $500,000 property with a 70% LTV ratio and have two mortgage choices: a FRM or a FRM with an io period. The lender offers the following two loans: Loan 1:30 year FRM, fully amortizing monthly payments; 4% interest Loan 2: 30 year FRM with 5 year 10 period, fully amortizing monthly payments, 5% interest want to save on interest payments, I would choose Loan 2. True False QUESTION 9 You are considering to buy a 5500,000 property with a 70% LTV ratio and have two mortgage choices: a FRM or a FRM with an 10 period, The lender offers the following two loans: Loan 1:30 year FRM, fully amortizing monthly payments: 4% interest Loan 2:30 year Frm with 5 year 10 period, fully amortizing monthly payments; 5% Interest I want to minimize the payments in the first few years, I would choose Loan 2. True False QUESTION 10 You are considering to buy a 5500,000 property with a 70% LTV ratio and have two mortgage choices: a FRM or a FRM with an 10 period. The lender offers the following two loans: Loan 1: 30 year FRM, Fully amortizing monthly payments; 4% interest Loan 2: 30 year Frm with 5 year 10 period, fully amortizing monthly payments; 5% Interest If I'd like to pay off the loan sooner, I'd choose Loan 1, True False QUESTION 11 10 points Save A Order these loans from highest monthly payment to lowest monthly payment. Each of the following loans is for $300,000 and is a fixed rate mortgage with a 3.5% interest rate Balloon payment of $500,000 is due at maturity Balloon payment of $250,000 is due at maturity : Balloon payment of $100,000 is due at maturity Interest-only payments for the life of the loan The loan is fully repaid at maturity QUESTION 12 10 points Save Answer You can afford to pay up to 54,000 in payments every month for housing Which of the following mortgages would allow you to buy the most expensive property (Assume you can afford the down payment in any of these scenarios) A 30 yearfully amortiring FAM with 5% contract interest rate and 85% LTV. A 25 year FM with 3% contract interest rate and 90% LTV A 30 year mortgage with an interest only period of 5 years at a fixed contract rate and 95% LTV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts