Question: i need help with those problem to prepare for my studying Part A: True/False, Multiple Choice, Short answers (30 points) 1. (8 points) Name the

i need help with those problem to prepare for my studying

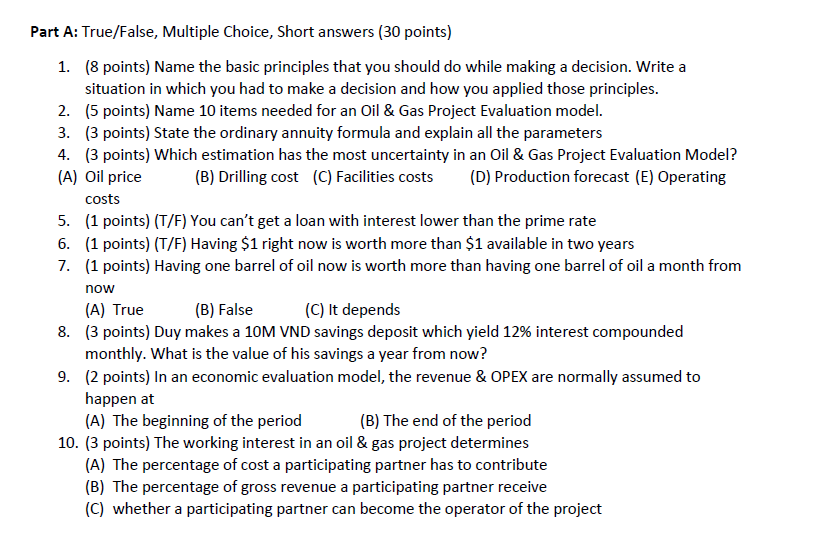

Part A: True/False, Multiple Choice, Short answers (30 points) 1. (8 points) Name the basic principles that you should do while making a decision. Write a situation in which you had to make a decision and how you applied those principles. 2. (5 points) Name 10 items needed for an Oil & Gas Project Evaluation model. 3. (3 points) State the ordinary annuity formula and explain all the parameters 4. (3 points) Which estimation has the most uncertainty in an Oil & Gas Project Evaluation Model? (A) Oil price (B) Drilling cost (C) Facilities costs (D) Production forecast (E) Operating costs 5. (1 points) (T/F) You can't get a loan with interest lower than the prime rate 6. (1 points) (T/F) Having $1 right now is worth more than $1 available in two years 7. (1 points) Having one barrel of oil now is worth more than having one barrel of oil a month from now (A) True (B) False (C) It depends 8. (3 points) Duy makes a 10M VND savings deposit which yield 12% interest compounded monthly. What is the value of his savings a year from now? 9. (2 points) In an economic evaluation model, the revenue & OPEX are normally assumed to happen at (A) The beginning of the period (B) The end of the period 10. (3 points) The working interest in an oil & gas project determines (A) The percentage of cost a participating partner has to contribute (B) The percentage of gross revenue a participating partner receive (C) whether a participating partner can become the operator of the project Part A: True/False, Multiple Choice, Short answers (30 points) 1. (8 points) Name the basic principles that you should do while making a decision. Write a situation in which you had to make a decision and how you applied those principles. 2. (5 points) Name 10 items needed for an Oil & Gas Project Evaluation model. 3. (3 points) State the ordinary annuity formula and explain all the parameters 4. (3 points) Which estimation has the most uncertainty in an Oil & Gas Project Evaluation Model? (A) Oil price (B) Drilling cost (C) Facilities costs (D) Production forecast (E) Operating costs 5. (1 points) (T/F) You can't get a loan with interest lower than the prime rate 6. (1 points) (T/F) Having $1 right now is worth more than $1 available in two years 7. (1 points) Having one barrel of oil now is worth more than having one barrel of oil a month from now (A) True (B) False (C) It depends 8. (3 points) Duy makes a 10M VND savings deposit which yield 12% interest compounded monthly. What is the value of his savings a year from now? 9. (2 points) In an economic evaluation model, the revenue & OPEX are normally assumed to happen at (A) The beginning of the period (B) The end of the period 10. (3 points) The working interest in an oil & gas project determines (A) The percentage of cost a participating partner has to contribute (B) The percentage of gross revenue a participating partner receive (C) whether a participating partner can become the operator of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts