Question: I need help with those wrong questions, I will give thumbs up for the good answer On December 31, Year 1. P Company purchased 90%

I need help with those wrong questions, I will give thumbs up for the good answer

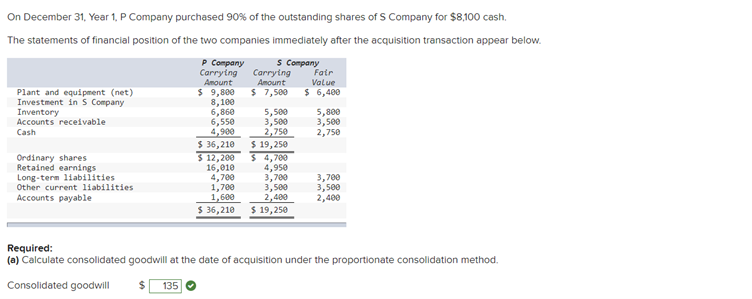

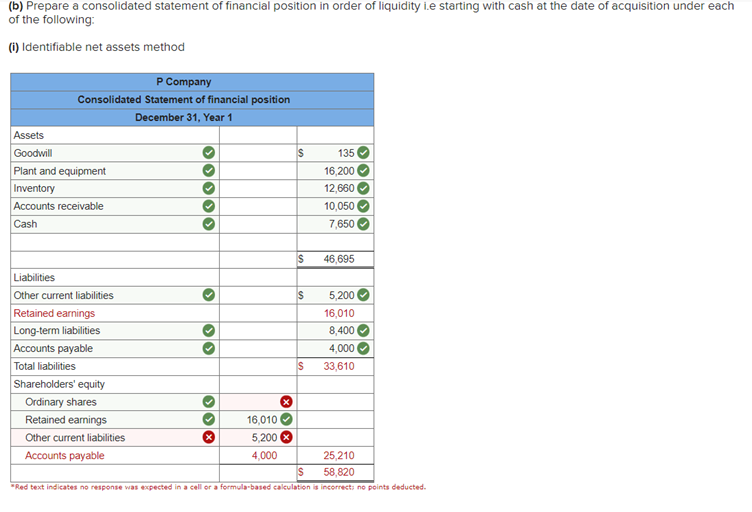

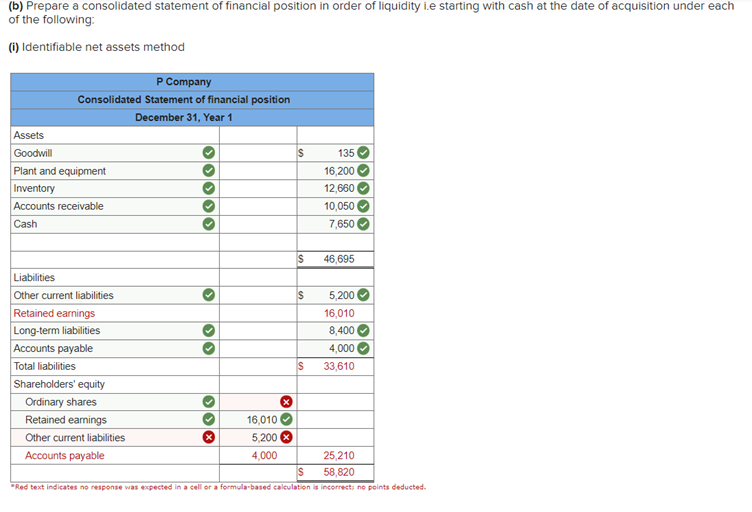

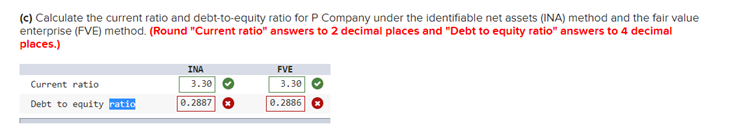

On December 31, Year 1. P Company purchased 90% of the outstanding shares of Company for $8,100 cash. The statements of financial position of the two companies immediately after the acquisition transaction appear below. Plant and equipment (net) Investment in s Company Inventory Accounts receivable Cash TIT P Company 5 Corpany Carrying Carrying Fair Amount Amount Value $ 9,800 $ 7,500 $ 6,480 8,109 6,860 5,500 5,800 6,55 3,500 3,500 4,900 2.750 2,750 5 36,210 $ 19, 250 $ 12,200 $ 4,700 16,010 4,700 3,780 3,700 1,700 3,500 3,500 1,600 2,480 2,400 $ 36,210 $ 19, 250 4,950 Ordinary shares Retained earnings Long-term liabilities Other current liabilities Accounts payable Required: (a) Calculate consolidated goodwill at the date of acquisition under the proportionate consolidation method. Consolidated goodwill $ 135 (6) Prepare a consolidated statement of financial position in order of liquidity i.e starting with cash at the date of acquisition under each of the following: (i) Identifiable net assets method P Company Consolidated Statement of financial position December 31, Year 1 Assets Goodwill Plant and equipment Inventory Accounts receivable S 135 16,200 12,660 10,050 7,650 00 Cash lo 00 $ 46,695 Liabilities Other current liabilities $ 5,200 Retained earnings 16,010 Long-term liabilities 8,400 Accounts payable 4,000 Total liabilities S 33,610 Shareholders' equity Ordinary shares Retained earnings 16,010 Other current liabilities 5,200 $ Accounts payable 4,000 25,210 $ 58,820 "Red text indicates no response was expected in a cell or a formula-based calculation is incorrects no points deducted. OO > (6) Prepare a consolidated statement of financial position in order of liquidity i.e starting with cash at the date of acquisition under each of the following: (i) Identifiable net assets method P Company Consolidated Statement of financial position December 31, Year 1 Assets Goodwill Plant and equipment Inventory Accounts receivable S 135 16,200 12,660 10,050 7,650 00 Cash lo 00 $ 46,695 Liabilities Other current liabilities $ 5,200 Retained earnings 16,010 Long-term liabilities 8,400 Accounts payable 4,000 Total liabilities S 33,610 Shareholders' equity Ordinary shares Retained earnings 16,010 Other current liabilities 5,200 $ Accounts payable 4,000 25,210 $ 58,820 "Red text indicates no response was expected in a cell or a formula-based calculation is incorrects no points deducted. OO > (c) Calculate the current ratio and debt-to-equity ratio for P Company under the identifiable net assets (INA) method and the fair value enterprise (FVE) method. (Round "Current ratio" answers to 2 decimal places and "Debt to equity ratio" answers to 4 decimal places.) INA 3.30 FVE 3.30 Current ratio Debt to equity ratio 0.2887 0.2886

Step by Step Solution

There are 3 Steps involved in it

To address the questions lets break them down a Calculate consolidated goodwill at the date of acquisition under the proportionate consolidation metho... View full answer

Get step-by-step solutions from verified subject matter experts