Question: I need help with two ways a) Find WACC using rs b) Find WACC using re. 764 Case 4A - Non-Directed- Cost of Capital budgeting

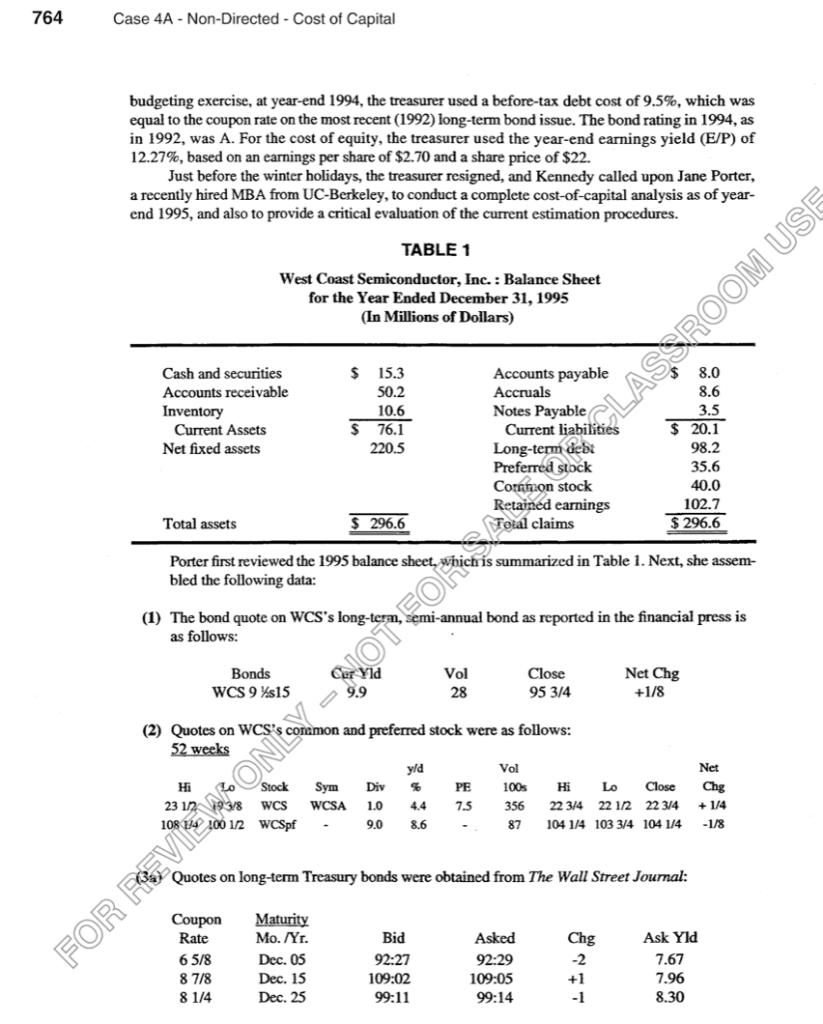

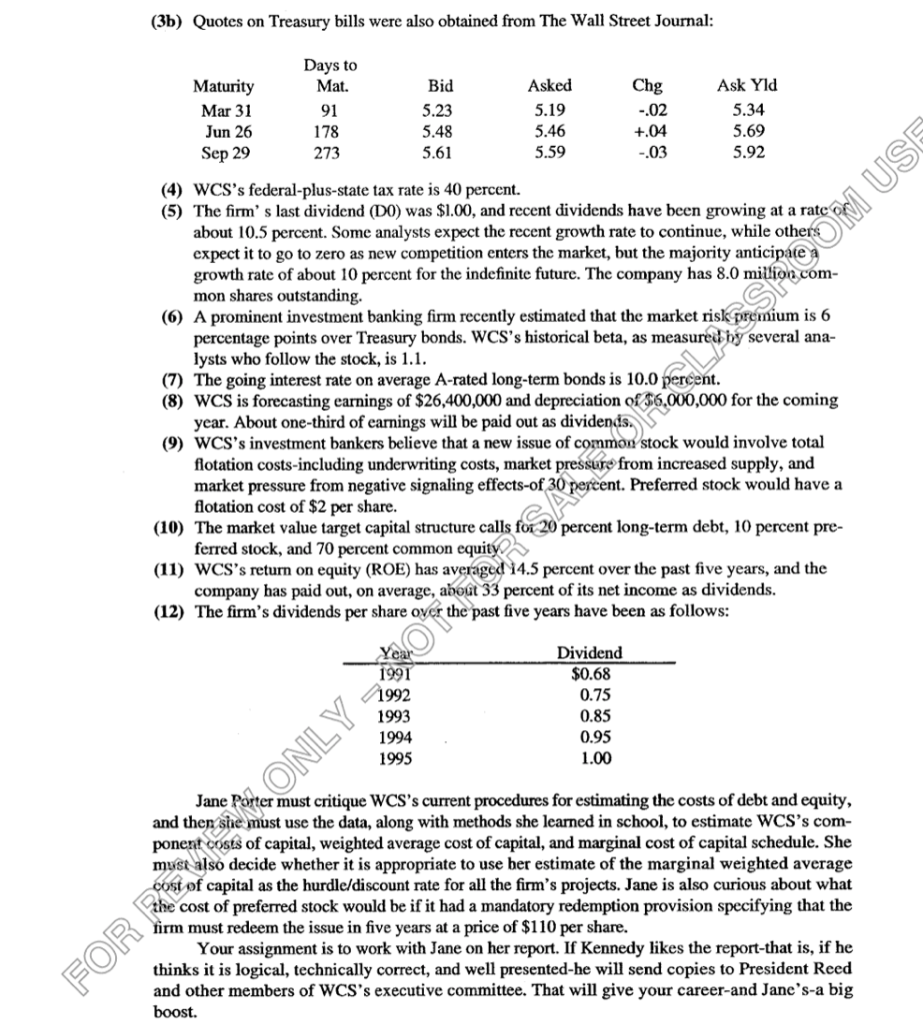

I need help with two ways a) Find WACC using rs b) Find WACC using re. 764 Case 4A - Non-Directed- Cost of Capital budgeting exercise, at year-end 1994, the treasurer used a before-tax debt cost of 9.5%, which was equal to the coupon rate on the most recent (1992) long-term bond issue. The bond rating in 1994, as in 1992, was A. For the cost of equity, the treasurer used the year-end earnings yield (E/P) of 12.27%, based on an earnings per share of $2.70 and a share price of $22. Just before the winter holidays, the treasurer resigned, and Kennedy called upon Jane Porter, a recently hired MBA from UC-Berkeley, to conduct a complete cost-of-capital analysis as of year- end 1995, and also to provide a critical evaluation of the current estimation procedures. TABLE 1 West Coast Semiconductor, Inc.: Balance Sheet for the Year Ended December 31, 1995 (In Millions of Dollars) $ 15.3 50.2 10.6 $ 76.1 220.5 $8.0 8.6 3.5 $ 20.1 98.2 35.6 40.0 102.7 $ 296.6 Cash and securities Accounts receivable Inventory Accounts payable Notes Payable Current Assets Net fixed assets Current liabilities Long-term dedi Preferred stock Conmon stock Retained earnings Toial claims Total assets S 296.6 Porter first reviewed the 1995 balance sheet,whichis summarized in Table 1. Next, she assem- bled the following data: (1) The bond quote on WCS's long-term, as follows: bond as reported in the financial press is Vol 28 Net Chg Close 95 3/4 WCS 9 Ys15 (2) Quotes on WCS's common and preferred stock were as follows: Vol Net 2317Ps wcs wCSA 10 44 75 356 22 314 22 12 2234 +14 1081 9.0 8.6 87 104 1/4 103 3/4 104 1/4 -1/8 A3a) Quotes on long-term Treasury bonds were obtained from The Wall Street Journal: Coupon Rate 6 5/8 8 7/8 8 1/4 Maturity Mo. /Yr. Dec. 05 Dec. 15 Dec. 25 Chg -2 Ask Yld 7.67 7.96 8.30 Bid 109:02 99:11 109:05 99:14 (3b) Quotes on Treasury bills were also obtained from The Wall Street Journal Days Maturity Mar 31 Jun 26 Sep 29 Mat. 91 178 273 Bid 5.23 5.48 5.61 Asked 5.19 5.46 5.59 Chg .02 +.04 03 Ask Yld 5.34 5.69 5.92 (4) WCS's federal-plus-state tax rate is 40 percent. (5) The firm' s last dividend (DO) was $1.00, and recent dividends have been growing at a rate about 10.5 percent. Some analysts expect the recent growth rate to continue, while others expect it to go to zero as new competition enters the market, but the majority anticipate growth rate of about 10 percent for the indefinite future. The company has 8.0 miion cm- mon shares outstanding. (6) A prominent investment banking firm recently estimated that the market riskpremium is 6 percentage points over Treasury bonds. WCS's historical beta, as measureby several ana lysts who follow the stock, is 1.1. (7) The going interest rate on average A-rated long-term bonds is 10.0 percent. (8) WCS is forecasting earnings of $26,400,000 and depreciation of6.000,000 for the coming year. About one-third of earnings will be paid out as dividend stock would involve total from increased supply, and ent. Preferred stock would have a 9) wCS's investment bankers believe that a new issue of c flotation costs-including underwriting costs, market market pressure from negative signaling effects-of flotation cost of $2 per share. (10) The market value target capital structure calls (11) WCS's return on equity (ROE) has averaged 14.5 percent over the past five years, and the (12) The firm's dividends per share over the past five years have been as follows: percent long-term debt, 10 percent pre- ferred stock, and 70 percent common equity company has paid out, on average, ahoat 33 percent of its net income as dividends. YC 1991 1992 1993 1994 1995 Dividend 0.68 0.75 0.85 0.95 1.00 Jane Porter must critique WCS's current procedures for estimating the costs of debt and equity, and then she must use the data, along with methods she learned in school, to estimate WCS's com- ponent oosts of capital, weighted average cost of capital, and marginal cost of capital schedule. She must also decide whether it is appropriate to use her estimate of the marginal weighted average f capital as the hurdle/discount rate for all the firm's projects. Jane is also curious about what cost of preferred stock would be if it had a mandatory redemption provision specifying that the firm must redeem the issue in five years at a price of $110 per share. Your assignment is to work with Jane on her report. If Kennedy likes the report-that is, if he thinks it is logical, technically correct, and well presented-he will send copies to President Reed and other members of WCS's executive committee. That will give your career-and Janc's-a big boost. I need help with two ways a) Find WACC using rs b) Find WACC using re. 764 Case 4A - Non-Directed- Cost of Capital budgeting exercise, at year-end 1994, the treasurer used a before-tax debt cost of 9.5%, which was equal to the coupon rate on the most recent (1992) long-term bond issue. The bond rating in 1994, as in 1992, was A. For the cost of equity, the treasurer used the year-end earnings yield (E/P) of 12.27%, based on an earnings per share of $2.70 and a share price of $22. Just before the winter holidays, the treasurer resigned, and Kennedy called upon Jane Porter, a recently hired MBA from UC-Berkeley, to conduct a complete cost-of-capital analysis as of year- end 1995, and also to provide a critical evaluation of the current estimation procedures. TABLE 1 West Coast Semiconductor, Inc.: Balance Sheet for the Year Ended December 31, 1995 (In Millions of Dollars) $ 15.3 50.2 10.6 $ 76.1 220.5 $8.0 8.6 3.5 $ 20.1 98.2 35.6 40.0 102.7 $ 296.6 Cash and securities Accounts receivable Inventory Accounts payable Notes Payable Current Assets Net fixed assets Current liabilities Long-term dedi Preferred stock Conmon stock Retained earnings Toial claims Total assets S 296.6 Porter first reviewed the 1995 balance sheet,whichis summarized in Table 1. Next, she assem- bled the following data: (1) The bond quote on WCS's long-term, as follows: bond as reported in the financial press is Vol 28 Net Chg Close 95 3/4 WCS 9 Ys15 (2) Quotes on WCS's common and preferred stock were as follows: Vol Net 2317Ps wcs wCSA 10 44 75 356 22 314 22 12 2234 +14 1081 9.0 8.6 87 104 1/4 103 3/4 104 1/4 -1/8 A3a) Quotes on long-term Treasury bonds were obtained from The Wall Street Journal: Coupon Rate 6 5/8 8 7/8 8 1/4 Maturity Mo. /Yr. Dec. 05 Dec. 15 Dec. 25 Chg -2 Ask Yld 7.67 7.96 8.30 Bid 109:02 99:11 109:05 99:14 (3b) Quotes on Treasury bills were also obtained from The Wall Street Journal Days Maturity Mar 31 Jun 26 Sep 29 Mat. 91 178 273 Bid 5.23 5.48 5.61 Asked 5.19 5.46 5.59 Chg .02 +.04 03 Ask Yld 5.34 5.69 5.92 (4) WCS's federal-plus-state tax rate is 40 percent. (5) The firm' s last dividend (DO) was $1.00, and recent dividends have been growing at a rate about 10.5 percent. Some analysts expect the recent growth rate to continue, while others expect it to go to zero as new competition enters the market, but the majority anticipate growth rate of about 10 percent for the indefinite future. The company has 8.0 miion cm- mon shares outstanding. (6) A prominent investment banking firm recently estimated that the market riskpremium is 6 percentage points over Treasury bonds. WCS's historical beta, as measureby several ana lysts who follow the stock, is 1.1. (7) The going interest rate on average A-rated long-term bonds is 10.0 percent. (8) WCS is forecasting earnings of $26,400,000 and depreciation of6.000,000 for the coming year. About one-third of earnings will be paid out as dividend stock would involve total from increased supply, and ent. Preferred stock would have a 9) wCS's investment bankers believe that a new issue of c flotation costs-including underwriting costs, market market pressure from negative signaling effects-of flotation cost of $2 per share. (10) The market value target capital structure calls (11) WCS's return on equity (ROE) has averaged 14.5 percent over the past five years, and the (12) The firm's dividends per share over the past five years have been as follows: percent long-term debt, 10 percent pre- ferred stock, and 70 percent common equity company has paid out, on average, ahoat 33 percent of its net income as dividends. YC 1991 1992 1993 1994 1995 Dividend 0.68 0.75 0.85 0.95 1.00 Jane Porter must critique WCS's current procedures for estimating the costs of debt and equity, and then she must use the data, along with methods she learned in school, to estimate WCS's com- ponent oosts of capital, weighted average cost of capital, and marginal cost of capital schedule. She must also decide whether it is appropriate to use her estimate of the marginal weighted average f capital as the hurdle/discount rate for all the firm's projects. Jane is also curious about what cost of preferred stock would be if it had a mandatory redemption provision specifying that the firm must redeem the issue in five years at a price of $110 per share. Your assignment is to work with Jane on her report. If Kennedy likes the report-that is, if he thinks it is logical, technically correct, and well presented-he will send copies to President Reed and other members of WCS's executive committee. That will give your career-and Janc's-a big boost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts