Question: I need help with what work to show for the last 2 that discusses the intrinsic values as well as the net profit / loss.

I need help with what work to show for the last 2 that discusses the intrinsic values as well as the net profit / loss.

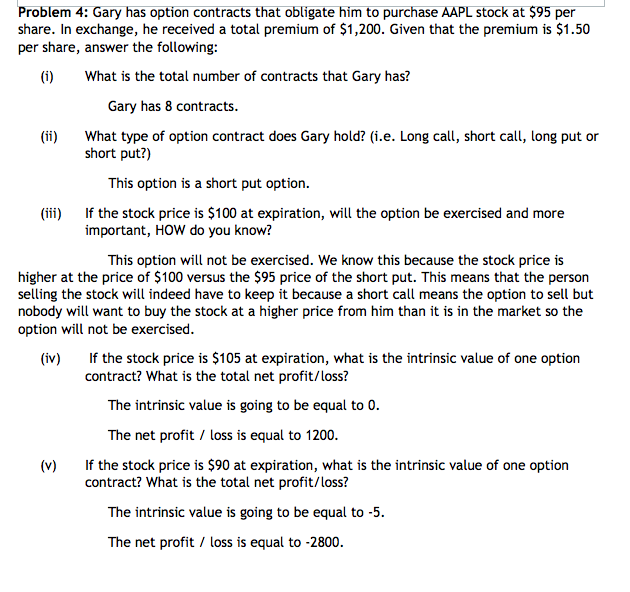

Problem 4: Gary has option contracts that obligate him to purchase AAPL stock at $95 per share. In exchange, he received a total premium of $1,200. Given that the premium is $1.50 per share, answer the following: (1) What is the total number of contracts that Gary has? Gary has 8 contracts. (ii) What type of option contract does Gary hold? (i.e. Long call, short call, long put or short put?) This option is a short put option. (iii) If the stock price is $100 at expiration, will the option be exercised and more important, HOW do you know? This option will not be exercised. We know this because the stock price is higher at the price of $100 versus the $95 price of the short put. This means that the person selling the stock will indeed have to keep it because a short call means the option to sell but nobody will want to buy the stock at a higher price from him than it is in the market so the option will not be exercised. (iv) If the stock price is $105 at expiration, what is the intrinsic value of one option contract? What is the total net profit/loss? The intrinsic value is going to be equal to 0. The net profit / loss is equal to 1200. (v) If the stock price is $90 at expiration, what is the intrinsic value of one option contract? What is the total net profit/loss? The intrinsic value is going to be equal to -5. The net profit / loss is equal to - 2800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts