Question: I need help working on the sheet Directions: DO THESE IN ORDER!!! 1 . The ledger should include each of the accounts from the Chart

I need help working on the sheet

Directions: DO THESE IN ORDER!!!

The ledger should include each of the accounts from the Chart of Accounts, inspect the leger.

Journalize each transaction in July posting daily next page

At the end of the month, prepare an Unadjusted Trial Balance in the worksheet.

The following data was accumulated for month end adjustments: a Supplies on hand, $

b Insurance expired, $

c Salaries accrued, weeks of the salaries.

d Depreciation of Office Equipment, $ Furniture and Fixtures, $

e Bills for July received in August; Telephone, $; Electricity, $f Rent expired this month, $

g Unearned fees remaining at month end, $

h Accrued consulting fees earned in July, $

Finish the manual worksheet.

Prepare the Financial Statements for the month of July X including a Classified Balance Sheet.

Journalize in the General Journal and post the Adjusting Entries. Journalize in GJ and post the Closing Entries.

Prepare the PostClosing Trial Balance.

July The following assets were received from Dustin Larkin: Cash, $ Account Receivable $ Supplies, $ Office Equipment, $ and a long term Note Payable on the Office Equipment, $Compound Entry more than Debit andor Credit

Paid four months rent on a leased rental contract, $

Paid the premium on property and casulty insurance policies for the year, $

Received cash from clients as an advanced payment for services to be provided and recorded it as unearned fees, $

Purchased funiture and fixtures on account for the rental quarters from Century, Inc, $

Received cash from clients on account, $

Paid for a July newspaper advertisement, $

Paid cash for supplies, $

Received cash from clients on account, $

Made a partial payment to Century, Inc. on account, $

Recorded services provided on account for the period July $

Paid parttime receptionist for two weeks' salary, $

Recorded cash from cash clients for fees earned July $

Purchased supplies on account, $

Recorded services provided on account for the period July $

Recorded cash from cash clients for fees earned July $

Wrote a business check to pay for Dustin's home phone bill, $ Received cash from clients on account, $

Recorded cash from cash clients for fees earned July $

Dustin withdrew cash for personal use, $

Southside Food Vendors reported a total of $ of vending machine sales for July. Since the business had already received $ Southside paid the remaining amount due for July begintabularcccccccccccc

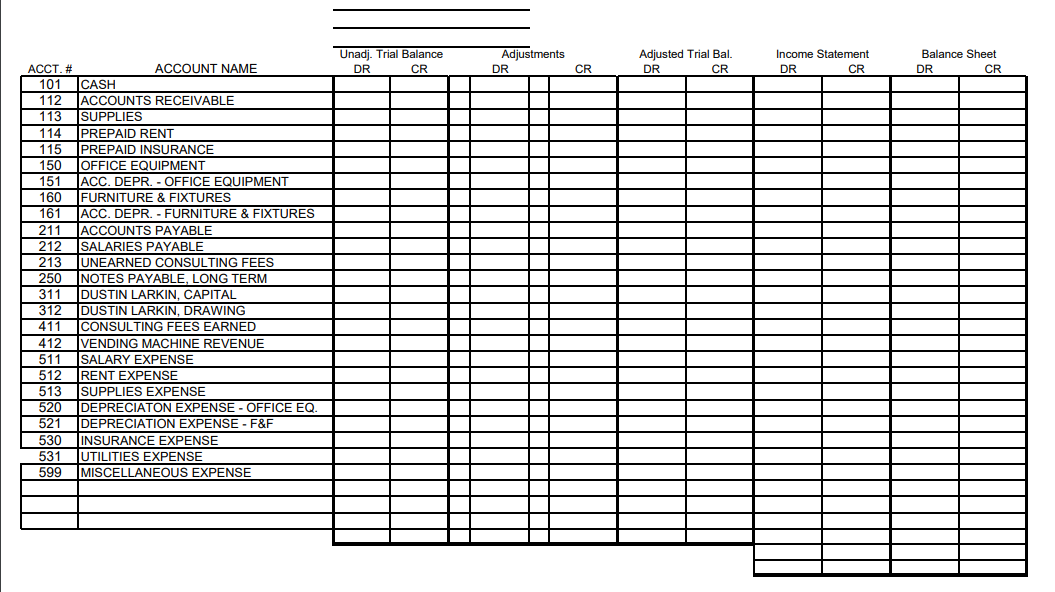

hline multirowbACCT# & multirowbACCOUNT NAME & multicolumnlUnadj Trial Balance & multicolumnlAdjustments & multicolumnlAdjusted Trial Bal. & multicolumnlIncome Statement & multicolumnlBalance Sheet

hline & & DR & CR & DR & CR & DR & CR & DR & CR & DR & CR

hline & CASH & & & & & & & & & &

hline & ACCOUNTS RECEIVABLE & & & & & & & & & &

hline & SUPPLIES & & & & & & & & & &

hline & PREPAID RENT & & & & & & & & & &

hline & PREPAID INSURANCE & & & & & & & & & &

hline & OFFICE EQUIPMENT & & & & & & & & & &

hline & ACC. DEPR. OFFICE EQUIPMENT & & & & & & & & & &

hline & FURNITURE & FIXTURES & & & & & & & & & &

hline & ACC. DEPR. FURNITURE & FIXTURES & & & & & & & & & &

hline & ACCOUNTS PAYABLE & & & & & & & & & &

hline & SALARIES PAYABLE & & & & & & & & & &

hline & UNEARNED CONSULTING FEES & & & & & & & & & &

hline & NOTES PAYABLE, LONG TERM & & & & & & & & & &

hline & DUSTIN LARKIN, CAPITAL & & & & & & & & & &

hline & DUSTIN LARKIN, DRAWING & & & & & & & & & &

hline & CONSULTING FEES EARNED & & & & & & & & & &

hline & VENDING MACHINE REVENUE & & & & & & & & & &

hline & SALARY EXPENSE & & & & & & & & & &

hline & RENT EXPENSE & & & & & & & & & &

hline & SUPPLIES EXPENSE & & & & & & & & & &

hline & DEPRECIATON EXPENSE OFFICE EQ & & & & & & & & & &

hline & DEPRECIATION EXPENSE F&F & & & & & & & & & &

hline & INSURANCE EXPENSE & & & & & & & & & &

hline & UTILITIES EXPENSE & & & & & & & & & &

hline & MISCELLANEOUS EXPENSE & & & & & & & & & &

hline multirowt & & & & & & & & & & &

hline & & & & & & & & & & &

hline & & & & & & & & & & &

hline & & & & & & & & & & &

hline & & & & & & & & & & &

hline & & & & & & & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock