Question: i need help working through these two problems Oda Company produces three lines of greeting cards: scented, musical, and regular. A segmented income statement for

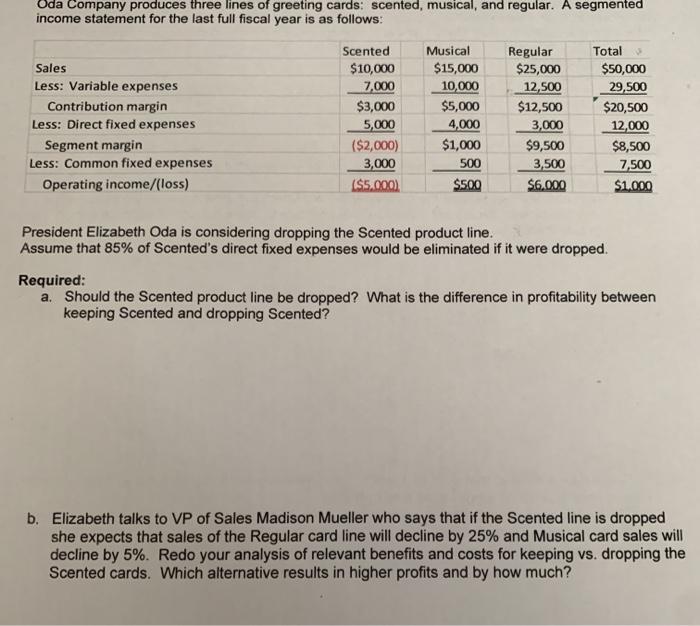

Oda Company produces three lines of greeting cards: scented, musical, and regular. A segmented income statement for the last full fiscal year is as follows: Sales Less: Variable expenses Contribution margin Less: Direct fixed expenses Segment margin Less: Common fixed expenses Operating income/(loss) Scented $10,000 7,000 $3,000 5,000 ($2,000) 3,000 (55.000) Musical $15,000 10,000 $5,000 4,000 $1,000 500 $500 Regular $25,000 12,500 $12,500 3,000 $9,500 3,500 $6.000 Total $50,000 29,500 $20,500 12,000 $8,500 7,500 $1.000 President Elizabeth Oda is considering dropping the Scented product line. Assume that 85% of Scented's direct fixed expenses would be eliminated if it were dropped. Required: a. Should the Scented product line be dropped? What is the difference in profitability between keeping Scented and dropping Scented? b. Elizabeth talks to VP of Sales Madison Mueller who says that if the Scented line is dropped she expects that sales of the Regular card line will decline by 25% and Musical card sales will decline by 5%. Redo your analysis of relevant benefits and costs for keeping vs. dropping the Scented cards. Which alternative results in higher profits and by how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts