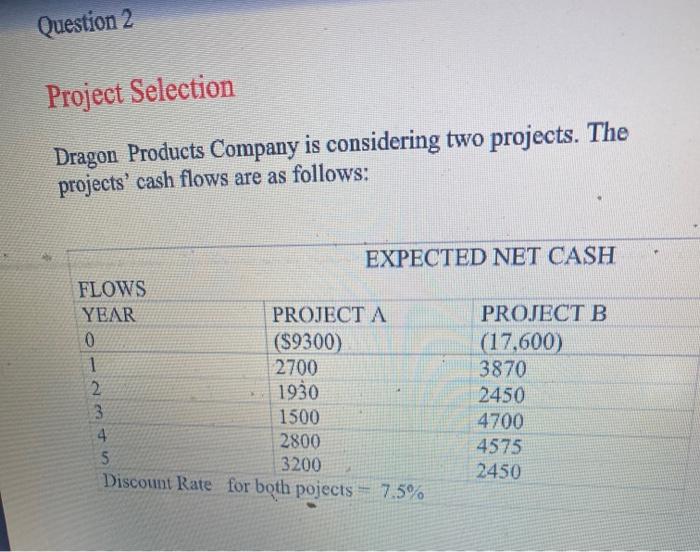

Question: i need it asap please Question 2 Project Selection Dragon Products Company is considering two projects. The projects' cash flows are as follows: EXPECTED NET

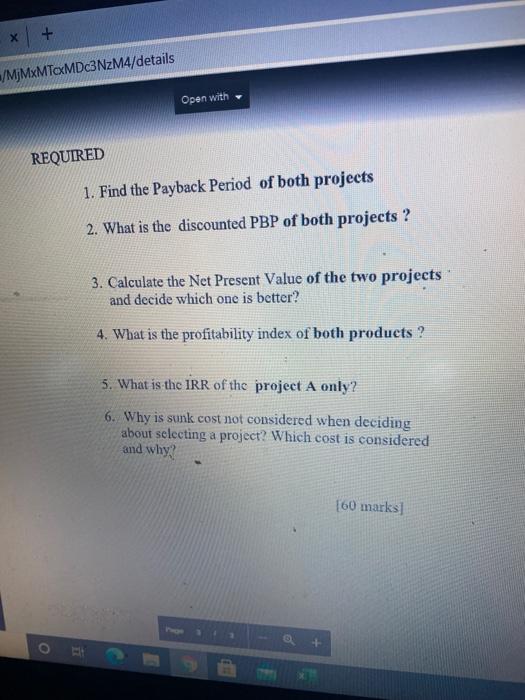

Question 2 Project Selection Dragon Products Company is considering two projects. The projects' cash flows are as follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B 0 ($9300) (17.600) 1 2700 3870 2 1930 2450 1500 4700 4 2800 4575 5 3200 2450 Discount Rate for both pojects 7.5% + /MjMxMTcxMDc3NzM4/details Open with REQUIRED 1. Find the Payback Period of both projects 2. What is the discounted PBP of both projects ? 3. Calculate the Net Present Value of the two projects and decide which one is better? 4. What is the profitability index of both products ? 5. What is the IRR of the project A only? 6. Why is sunk cost not considered when deciding about selecting a project? Which cost is considered and why? 160 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts