Question: i need it early as possible Paragraph A. ABC Inc. manufactures a specialized motor for solar tracking devices. The company expects to manufacture and sell

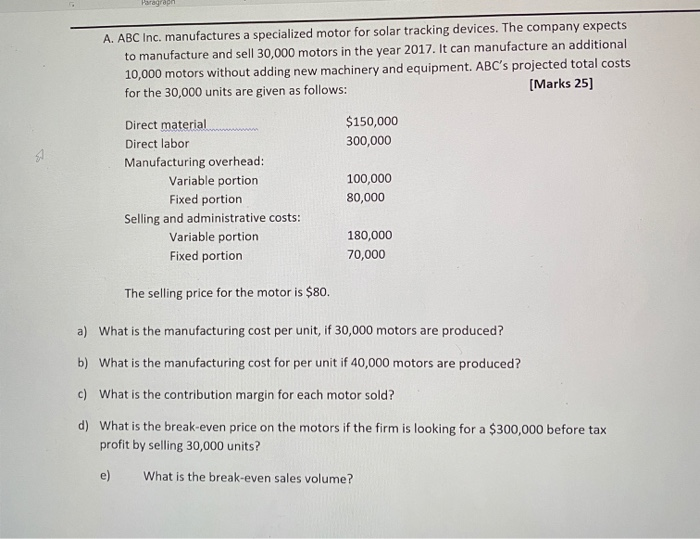

Paragraph A. ABC Inc. manufactures a specialized motor for solar tracking devices. The company expects to manufacture and sell 30,000 motors in the year 2017. It can manufacture an additional 10,000 motors without adding new machinery and equipment. ABC's projected total costs for the 30,000 units are given as follows: [Marks 25) $150,000 300,000 Direct material Direct labor Manufacturing overhead: Variable portion Fixed portion Selling and administrative costs: Variable portion Fixed portion 100,000 80,000 180,000 70,000 The selling price for the motor is $80. a) What is the manufacturing cost per unit, if 30,000 motors are produced? b) What is the manufacturing cost for per unit if 40,000 motors are produced? c) What is the contribution margin for each motor sold? d) What is the break-even price on the motors if the firm is looking for a $300,000 before tax profit by selling 30,000 units? e) What is the break-even sales volume

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts