Question: i need it now i have exam final please.. please .. A firm has the following Information: Debt: Par value $1,000 Coupon rate 0.025 Maturity

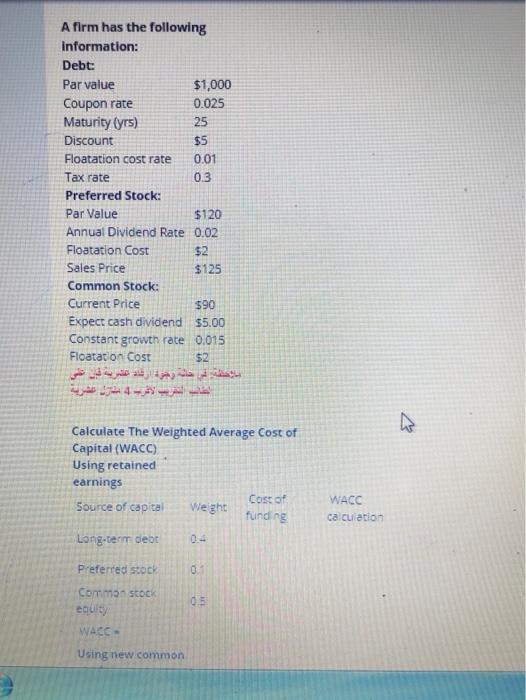

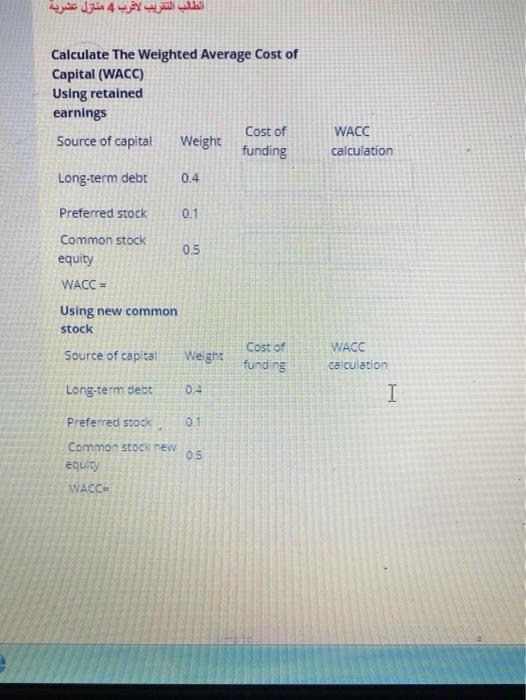

A firm has the following Information: Debt: Par value $1,000 Coupon rate 0.025 Maturity (yrs) 25 Discount $5 Floatation cost rate 0.01 Tax rate 0.3 Preferred Stock: Par Value $120 Annual Dividend Rate 0.02 Floatation Cost $2 Sales Price $125 Common Stock: Current Price $90 Expect cash dividend $5.00 Constant growth rate 0.015 Floatation Cost $2 Calculate The Weighted Average Cost of Capital (WACC) Using retained earnings Cost of Source of capita Weight funding Long-term det WACC calculation Preferred stock 0.5 Common stoc equity WACC - Using new common 4 Calculate The Weighted Average Cost of Capital (WACC) Using retained earnings Cost of Source of capital Weight funding Long-term debt 0.4 WACC calculation Preferred stock 0.1 0.5 Common stock equity WACC = Using new common stock Source of capital Weight Cost of funding WACC calculation Long-term debt 0,4 I Preferred stock 0.1 0.5 Common Stock new equity WACC=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts