Question: I need it to be solved by excel Reliable is a cell phone manufacturer serving the Asian and North American markets. The current annual demand

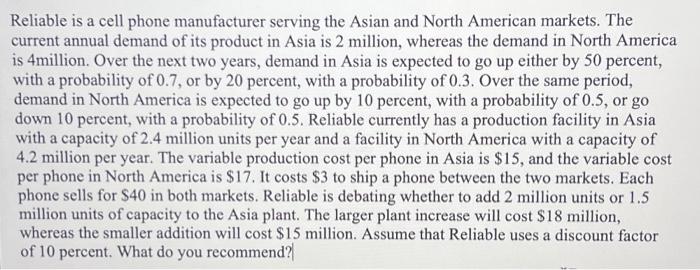

Reliable is a cell phone manufacturer serving the Asian and North American markets. The current annual demand of its product in Asia is 2 million, whereas the demand in North America is 4 million. Over the next two years, demand in Asia is expected to go up either by 50 percent, with a probability of 0.7 , or by 20 percent, with a probability of 0.3 . Over the same period, demand in North America is expected to go up by 10 percent, with a probability of 0.5 , or go down 10 percent, with a probability of 0.5 . Reliable currently has a production facility in Asia with a capacity of 2.4 million units per year and a facility in North America with a capacity of 4.2 million per year. The variable production cost per phone in Asia is $15, and the variable cost per phone in North America is $17. It costs $3 to ship a phone between the two markets. Each phone sells for $40 in both markets. Reliable is debating whether to add 2 million units or 1.5 million units of capacity to the Asia plant. The larger plant increase will cost $18 million, whereas the smaller addition will cost $15 million. Assume that Reliable uses a discount factor of 10 percent. What do you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts