Question: Solve using modeling , sensitivity analysis and financial excel functions with excel or written. Part2: Sara is going to buy a new car. The amount

Solve using modeling , sensitivity analysis and financial excel functions with excel or written.

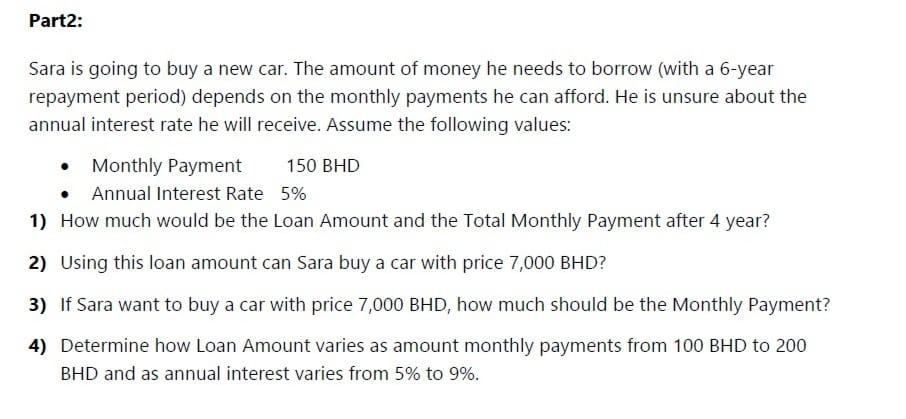

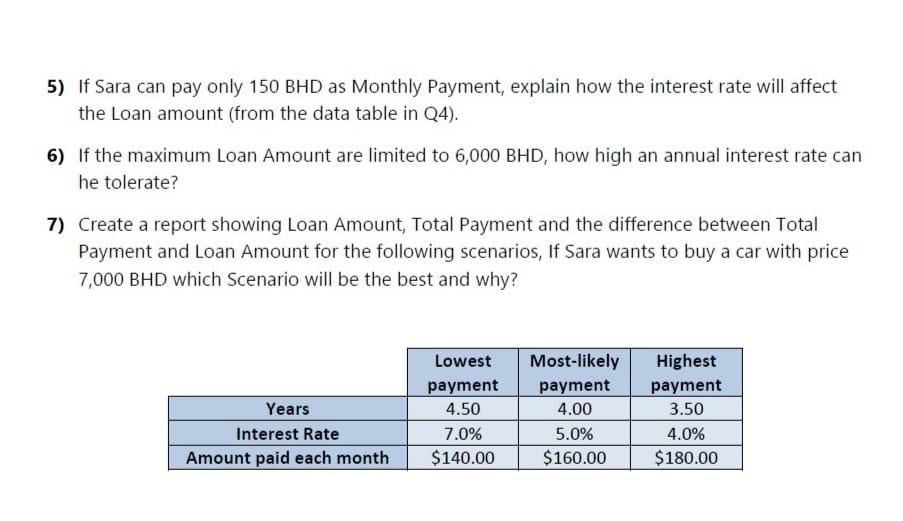

Part2: Sara is going to buy a new car. The amount of money he needs to borrow (with a 6-year repayment period) depends on the monthly payments he can afford. He is unsure about the annual interest rate he will receive. Assume the following values: Monthly Payment 150 BHD Annual Interest Rate 5% 1) How much would be the Loan Amount and the Total Monthly Payment after 4 year? 2) Using this loan amount can Sara buy a car with price 7,000 BHD? 3) If Sara want to buy a car with price 7,000 BHD, how much should be the Monthly Payment? 4) Determine how Loan Amount varies as amount monthly payments from 100 BHD to 200 BHD and as annual interest varies from 5% to 9%.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

1 Loan Amount Total Monthly Payment After 4 years Sara will owe the bank a total of 7200 BHD The total monthly payment will be 150 BHD The interest rate will have no effect on the monthly payment but ... View full answer

Get step-by-step solutions from verified subject matter experts