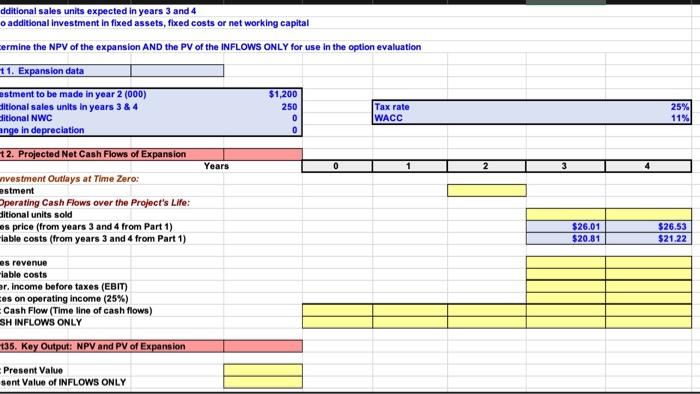

Question: I need it worked in excel along with the formulas Tax rate 25% 11% 0 2 4 dditional sales units expected in years 3 and

Tax rate 25% 11% 0 2 4 dditional sales units expected in years 3 and 4 o additional investment in fixed assets, fixed costs or net working capital ermine the NPV of the expansion AND the PV of the INFLOWS ONLY for use in the option evaluation 11. Expansion data estment to be made in year 2 (000) $1,200 itional sales units in years 3 & 4 250 ditional NWC 0 WACC ange in depreciation 0 12. Projected Net Cash Flows of Expansion Years nvestment Outlays at Time Zero: estment Operating Cash Flows over the Project's Life: Sitional units sold es price (from years 3 and 4 from Part 1) lable costs (from years 3 and 4 from Part 1) es revenue iable costs Dr. Income before taxes (EBIT) Ces on operating Income (25%) Cash Flow (Time line of cash flows) SH INFLOWS ONLY 136. Key Output: NPV and PV of Expansion Present Value sont Value of INFLOWS ONLY $26.01 $20.81 $26.53 $21.22 Tax rate 25% 11% 0 2 4 dditional sales units expected in years 3 and 4 o additional investment in fixed assets, fixed costs or net working capital ermine the NPV of the expansion AND the PV of the INFLOWS ONLY for use in the option evaluation 11. Expansion data estment to be made in year 2 (000) $1,200 itional sales units in years 3 & 4 250 ditional NWC 0 WACC ange in depreciation 0 12. Projected Net Cash Flows of Expansion Years nvestment Outlays at Time Zero: estment Operating Cash Flows over the Project's Life: Sitional units sold es price (from years 3 and 4 from Part 1) lable costs (from years 3 and 4 from Part 1) es revenue iable costs Dr. Income before taxes (EBIT) Ces on operating Income (25%) Cash Flow (Time line of cash flows) SH INFLOWS ONLY 136. Key Output: NPV and PV of Expansion Present Value sont Value of INFLOWS ONLY $26.01 $20.81 $26.53 $21.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts