Question: i need it written on world excl Governmental Accounting Maximum Time Allowed: 30 Minutes Total Marks: 10 Marks Oblained: Name of Student Student ID: Assignment

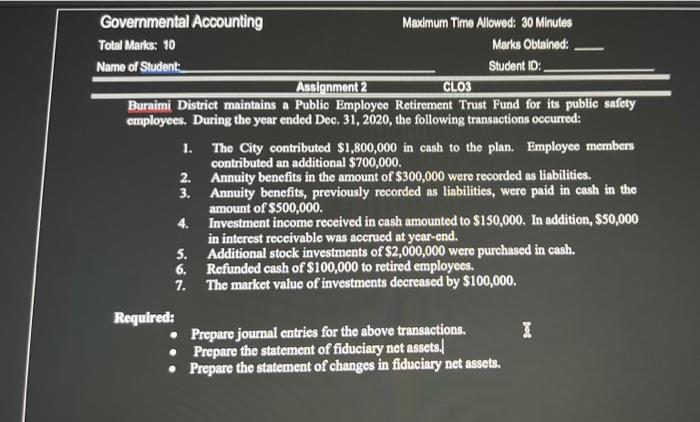

Governmental Accounting Maximum Time Allowed: 30 Minutes Total Marks: 10 Marks Oblained: Name of Student Student ID: Assignment 2 CLO3 Buraimi District maintains a Public Employee Retirement Trust Fund for its public safety employees. During the year ended Dec. 31, 2020, the following transactions occurred: 1. The City contributed $1,800,000 in cash to the plan. Employee members contributed an additional $700,000. 2. Annuity benefits in the amount of $300,000 were recorded as liabilities. 3. Annuity benefits, previously recorded as liabilities, were paid in cash in the amount of $500,000. 4. Investment income received in cash amounted to $150,000. In addition, $50,000 in interest receivable was accrued at year-end. 5. Additional stock investments of $2,000,000 were purchased in cash. 6. Refunded cash of $100,000 to retired employees. 7. The market value of investments decreased by $100,000. Required: Prepare journal entries for the above transactions. I Prepare the statement of fiduciary net assets. Prepare the statement of changes in fiduciary net assets. Governmental Accounting Maximum Time Allowed: 30 Minutes Total Marks: 10 Marks Oblained: Name of Student Student ID: Assignment 2 CLO3 Buraimi District maintains a Public Employee Retirement Trust Fund for its public safety employees. During the year ended Dec. 31, 2020, the following transactions occurred: 1. The City contributed $1,800,000 in cash to the plan. Employee members contributed an additional $700,000. 2. Annuity benefits in the amount of $300,000 were recorded as liabilities. 3. Annuity benefits, previously recorded as liabilities, were paid in cash in the amount of $500,000. 4. Investment income received in cash amounted to $150,000. In addition, $50,000 in interest receivable was accrued at year-end. 5. Additional stock investments of $2,000,000 were purchased in cash. 6. Refunded cash of $100,000 to retired employees. 7. The market value of investments decreased by $100,000. Required: Prepare journal entries for the above transactions. I Prepare the statement of fiduciary net assets. Prepare the statement of changes in fiduciary net assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts