Question: I need java programming to find the biggest Range, shortPattern, longPattern and other coding as well. JACK-IN-THE-BOX STRATEGY As I have mentioned, I am a

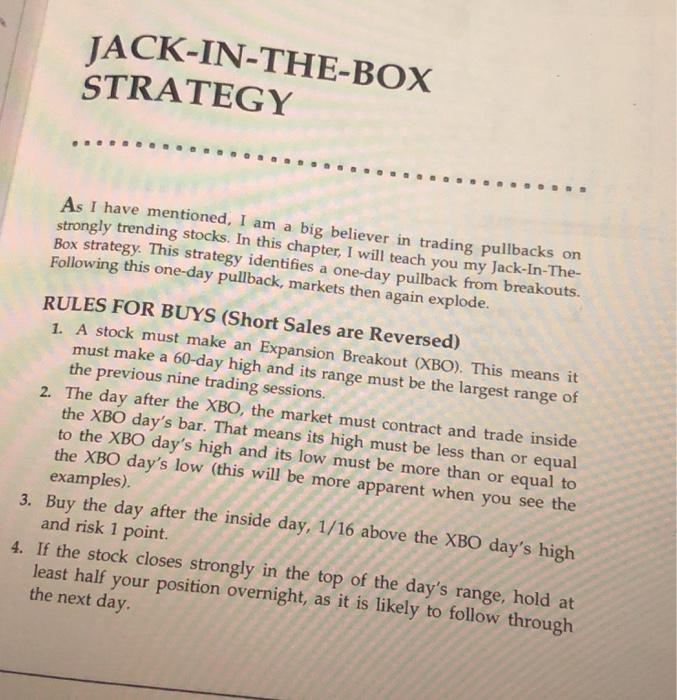

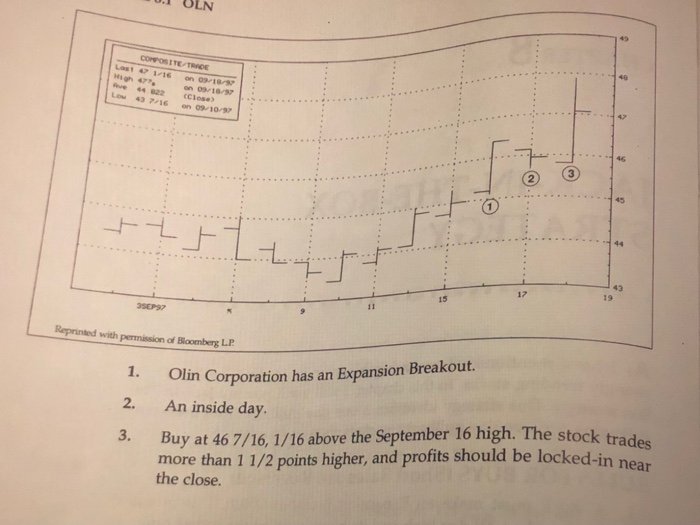

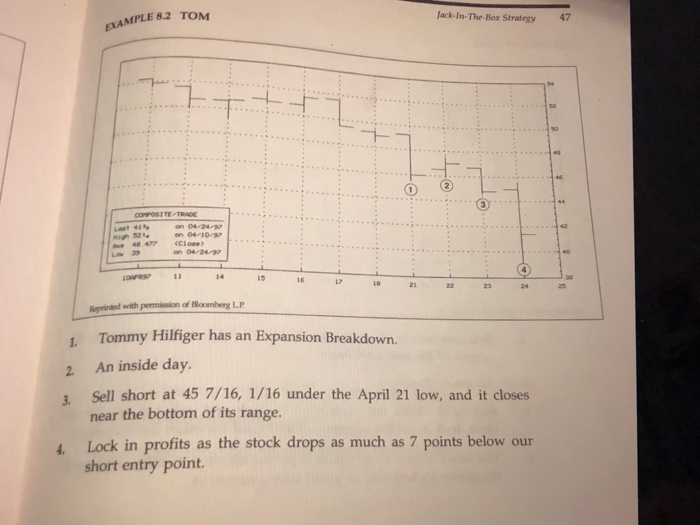

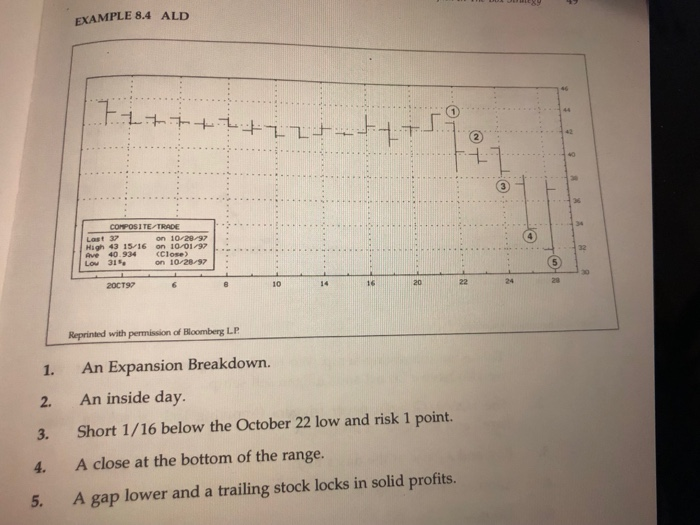

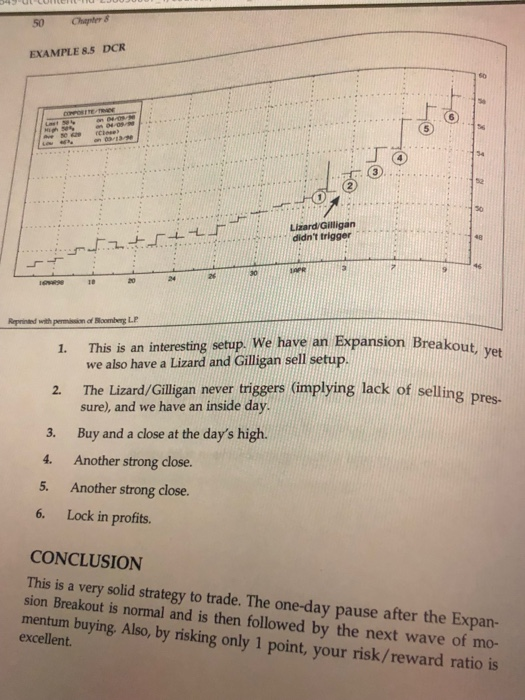

JACK-IN-THE-BOX STRATEGY As I have mentioned, I am a big believer in trading pullbacks on strongly trending stocks. In this chapter, I will teach you my Jack-In-The- Box strategy. This strategy identifies a one-day pullback from breakouts. Following this one-day pullback, markets then again explode. RULES FOR BUYS (Short Sales are Reversed) 1. A stock must make an Expansion Breakout (XBO). This means it must make a 60-day high and its range must be the largest range of the previous nine trading sessions. 2. The day after the XBO, the market must contract and trade inside the XBO day's bar. That means its high must be less than or equal to the XBO day's high and its low must be more than or equal to the XBO day's low (this will be more apparent when you see the examples). and risk 1 point. least half your position overnight, as it is likely to follow through 3. Buy the day after the inside day, 1/16 above the XBO day's high 4. If the stock closes strongly in the top of the day's range, hold at the next day JACK-IN-THE-BOX STRATEGY As I have mentioned, I am a big believer in trading pullbacks on strongly trending stocks. In this chapter, I will teach you my Jack-In-The- Box strategy. This strategy identifies a one-day pullback from breakouts. Following this one-day pullback, markets then again explode. RULES FOR BUYS (Short Sales are Reversed) 1. A stock must make an Expansion Breakout (XBO). This means it must make a 60-day high and its range must be the largest range of the previous nine trading sessions. 2. The day after the XBO, the market must contract and trade inside the XBO day's bar. That means its high must be less than or equal to the XBO day's high and its low must be more than or equal to the XBO day's low (this will be more apparent when you see the examples). and risk 1 point. least half your position overnight, as it is likely to follow through 3. Buy the day after the inside day, 1/16 above the XBO day's high 4. If the stock closes strongly in the top of the day's range, hold at the next day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts