Question: I need Journal entry for the sencond pages. Below are the financial statements of Zipparoo, Inc. Zipparoo sells rubber work boots called Zips. In this

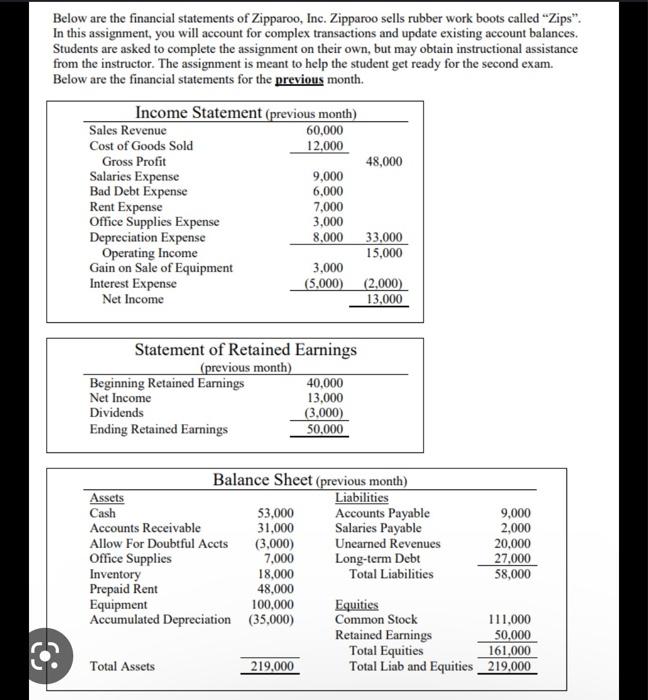

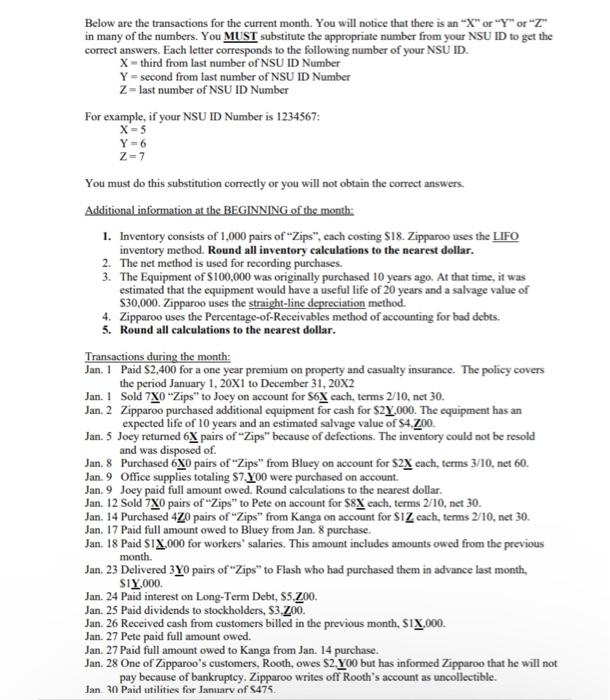

Below are the financial statements of Zipparoo, Inc. Zipparoo sells rubber work boots called "Zips". In this assignment, you will account for complex transactions and update existing account balances. Students are asked to complete the assignment on their own, but may obtain instructional assistance from the instructor. The assignment is meant to help the student get ready for the second exam. Below are the financial statements for the previous month. Below are the transactions for the current month. You will notice that there is an "X" or "Y" or "Z" in many of the numbers. You MUST substitute the appropriate number from your NSU ID to get the correct answers. Each letter corresponds to the following number of your NSU ID. X= third from last number of NSU ID Number Y= second from last number of NSU ID Number Z= last number of NSU ID Number For example, if your NSU ID Number is 1234567: X=5Y=6Z=7 You must do this substitution correctly or you will not obtain the correct answers. Additional information at the BEGINNING of the month: 1. Inventory consists of 1,000 pairs of "Zips", each costing \$18. Zipparoo uses the LIFO inventory method. Round all inventory calculations to the nearest dollar. 2. The net method is used for recording purchases. 3. The Equipment of $100,000 was originally purchased 10 years ago. At that time, it was estimated that the equipment would have a useful life of 20 years and a salvage value of $30,000. Zipparoo uses the straight-line depreciation method. 4. Zipparoo uses the Percentage-of-Receivables method of accounting for bad debts. 5. Round all calculations to the nearest dollar. Transactions during the month: Jan. I Paid $2,400 for a one year premium on property and casualty insurance. The policy covers the period January 1, 20X1 to December 31, 20X2 Jan. 2 Zipparoo purchased additional equipment for cash for $2Y,000. The equipment has an expected life of 10 years and an estimated salvage value of $4,Z00. Jan. 5 Joey returned 6X pairs of "Zips" because of defections. The inventory could not be resold and was disposed of. Jan. 8 Purchased 6X0 pairs of "Zips" from Blucy on account for $2X each, terms 3/10, net 60. Jan. 9 Office supplies totaling $7,Y00 were purchased on account. Jan. 9 Joey paid full amount owed. Round calculations to the nearest dollar. Jan. 12 Sold 7X0 pairs of "Zips" to Pete on account for $8X each, terms 2/10, net 30 . Jan. 14 Purchased 4Z0 pairs of "Zips" from Kanga on account for $1Z each, terms 2/10, net 30. Jan. 17 Paid full amount owed to Bluey from Jan. 8 purchase. Jan. 18 Paid $1X,000 for workers' salaries. This amount includes amounts owed from the previous month. Jan. 23 Delivered 3 Y 0 pairs of "Zips" to Flash who had purchased them in advance last month, S1Y,000. Jan. 24 Paid interest on Long-Term Debt, $5,Z00. Jan. 25 Paid dividends to stockholders, $3,Z,00. Jan. 26 Received cash from customers billed in the previous month, $1X,000. Jan. 27 Pete paid full amount owed. Jan. 27 Paid full amount owed to Kanga from Jan. 14 purchase. Jan. 28 One of Zipparoo's customers, Rooth, owes $2, Y00 but has informed Zipparoo that he will not pay because of bankruptcy. Zipparoo writes off Rooth's account as uncollectible. Jan. 30 Paid utilities for Januarv of $475

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts