Question: I need missing items in red. The following is a payroll sheet for Shamrock Imports for the month of September. The company is allowed a

I need missing items in red.

I need missing items in red.

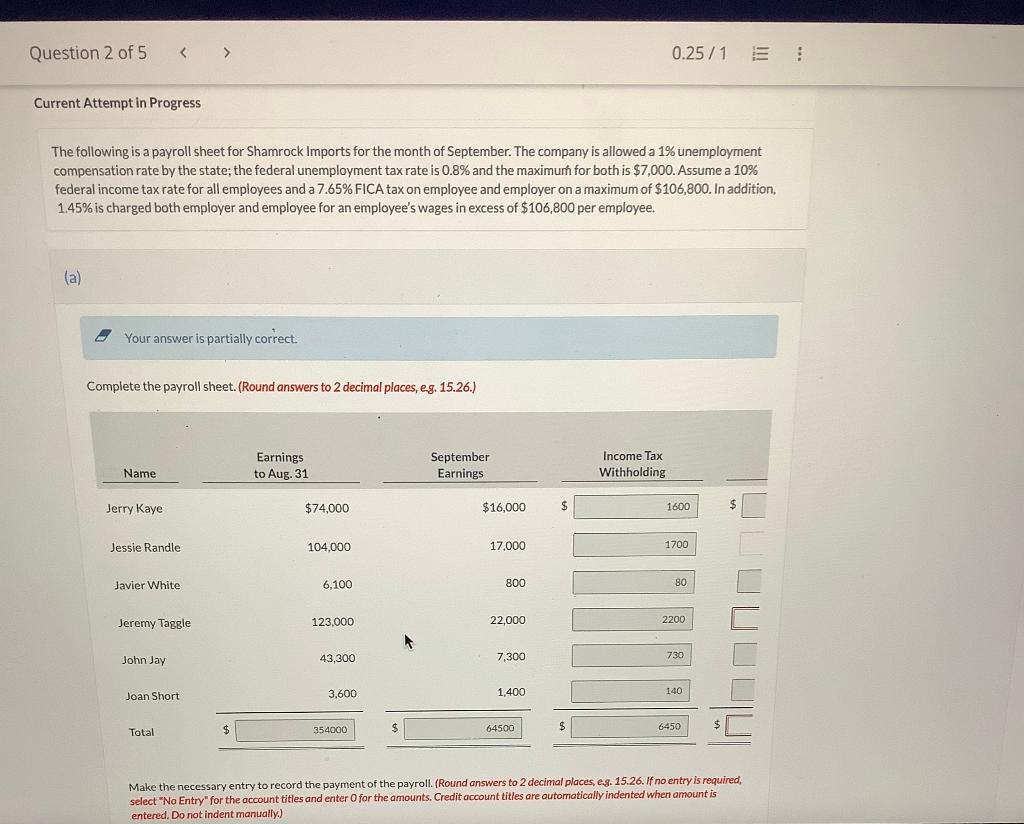

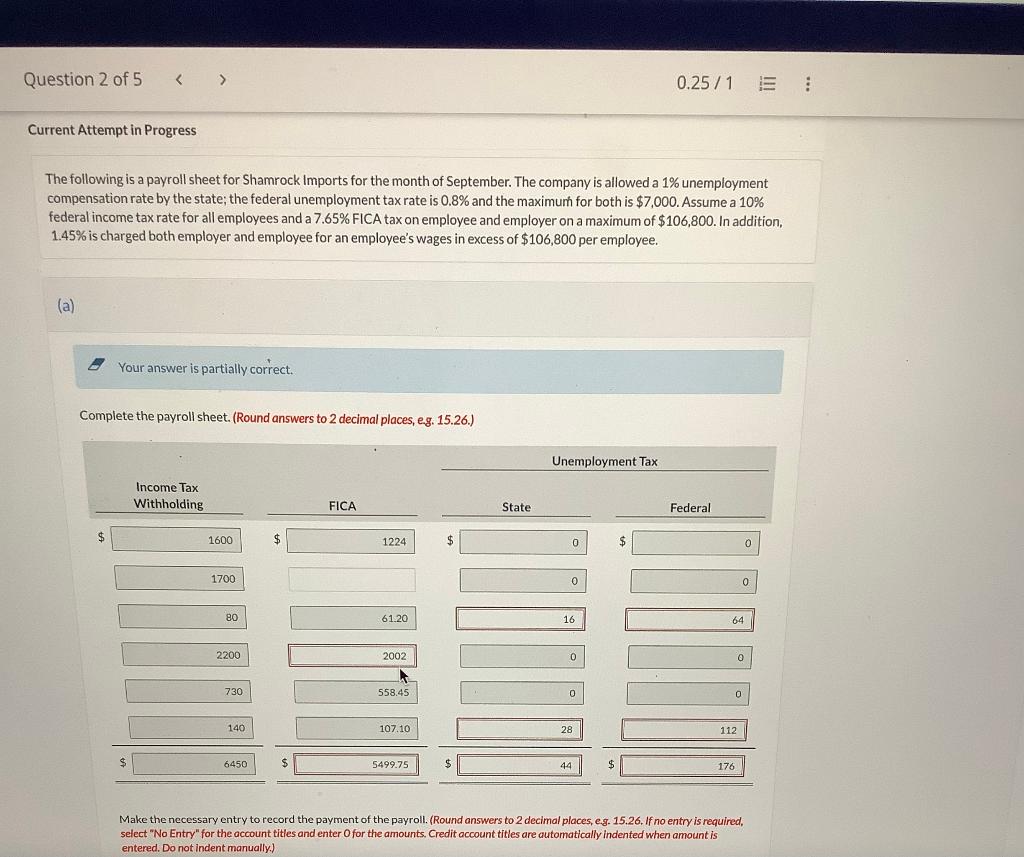

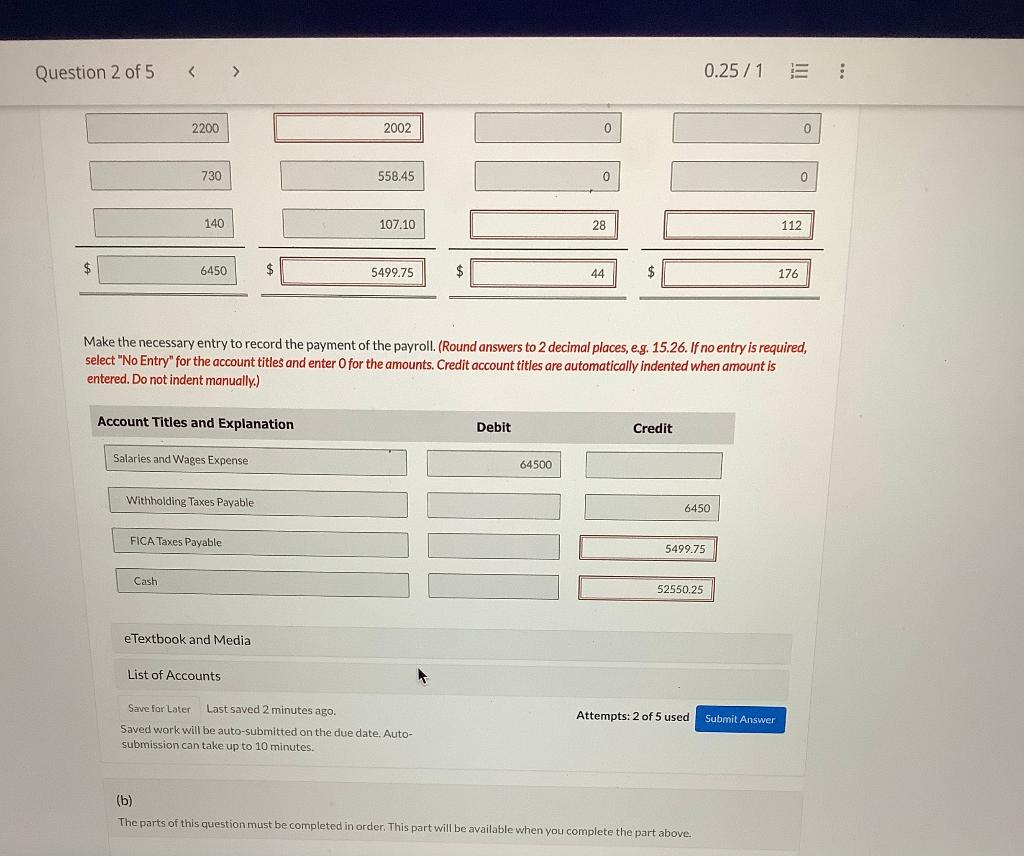

The following is a payroll sheet for Shamrock Imports for the month of September. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65%FICA tax on employee and employer on a maximum of $106,800. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $106,800 per employee. (a) - Your answer is partially correct. Complete the payroll sheet. (Round answers to 2 decimal places, eg. 15.26.) Make the necessary entry to record the payment of the payroll. (Round answers to 2 decimal places, e. 15.26. If no entry is required, select "No Entry" for the account fitles and enter O for the amounts. Credit account titles are automatically indented wherl amount is entered. Do not indent manually.) The following is a payroll sheet for Shamrock Imports for the month of September. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65\% FICA tax on employee and employer on a maximum of $106,800. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $106,800 per employee. (a) Your answer is partially correct. Complete the payroll sheet. (Round answers to 2 decimal places, e.g. 15.26.) Make the necessary entry to record the payment of the payroll. (Round answers to 2 decimal places, e.g. 15.26. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Make the necessary entry to record the payment of the payroll. (Round answers to 2 decimal places, e.g. 15.26. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) eTextbook and Media Last saved 2 minutes ago. Attempts: 2 of 5 used Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts