Question: I NEED ONLY ANSWER ASAP Suppose the risk-free return is 4.6% and the market portfolio has an expected return of 8.3% and a standard deviation

I NEED ONLY ANSWER ASAP

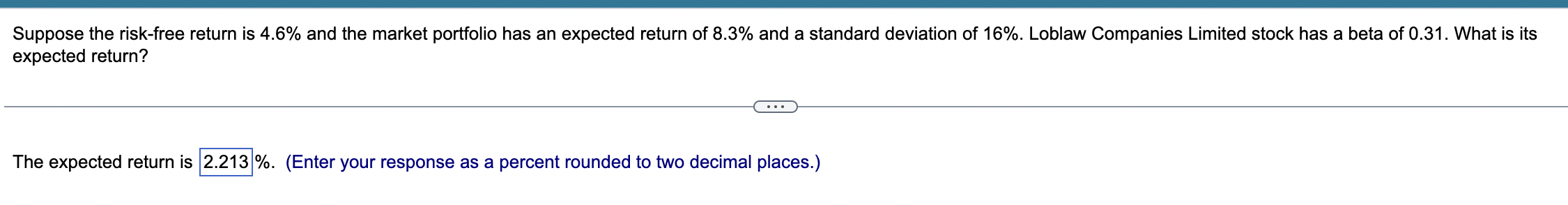

Suppose the risk-free return is 4.6% and the market portfolio has an expected return of 8.3% and a standard deviation of 16%. Loblaw Companies Limited stock has a beta of 0.31.

What is its expected return?

Suppose the risk-free return is 4.6% and the market portfolio has an expected return of 8.3% and a standard deviation of 16%. Loblaw Companies Limited stock has a beta of 0.31 . What is its expected return? The expected return is 2.213 \%. (Enter your response as a percent rounded to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock