Question: i need ONLY beta ii plus solution, pleaze do not solve it if you are not willing to solve that way nterest Value Ul Uncy.

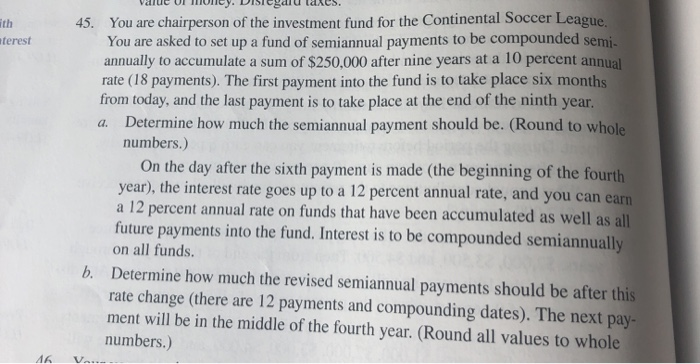

nterest Value Ul Uncy. Dibegalu lales. 45. You are chairperson of the investment fund for the Continental Soccer League. You are asked to set up a fund of semiannual payments to be compounded semi- annually to accumulate a sum of $250,000 after nine years at a 10 percent annual rate (18 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end of the ninth year. a. Determine how much the semiannual payment should be. (Round to whole numbers.) On the day after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to a 12 percent annual rate, and you can earn! a 12 percent annual rate on funds that have been accumulated as well as all! future payments into the fund. Interest is to be compounded semiannually! on all funds. b. Determine how much the revised semiannual payments should be after this rate change (there are 12 payments and compounding dates). The next pay- ment will be in the middle of the fourth year. (Round all values to whole numbers.) Var 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts