Question: I need ONLY the answer for question #42. I have included all of the related questions in the series, in case you needed it to

I need ONLY the answer for question #42. I have included all of the "related" questions in the series, in case you needed it to solve for #42. Thanks.

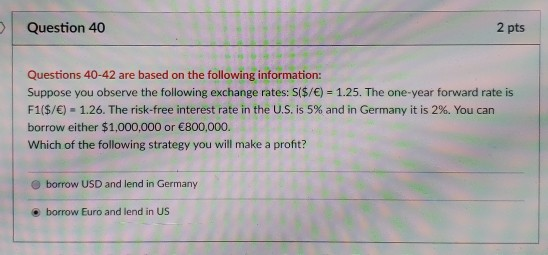

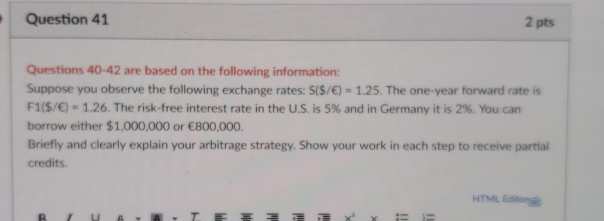

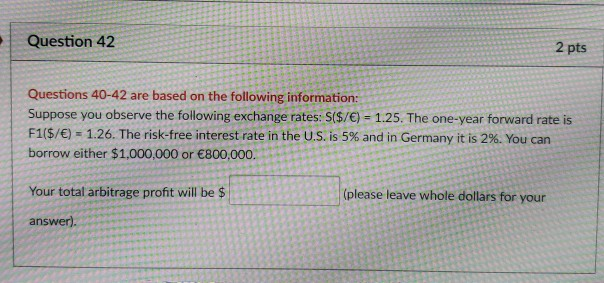

Question 40 2 pts Questions 40-42 are based on the following information: Suppose you observe the following exchange rates: S($/) 1.25. The one-year forward rate is F1($/C)-1.26. The risk-free interest rate in the U.S. is 5% and in Germany it is 2%. You can borrow either $1,000,000 or 800,000. Which of the following strategy you will make a proft? O borrow USD and lend in Germany o borrow Euro and lend in US Question 42 2 pts Questions 40-42 are based on the following information: Suppose you observe the following exchange rates: sis/e)- 1.25. The one-year forward rate is F1($/E-1.26. The risk-free interest rate in the US, is 5% and in Germany it is 2%. You can borrow either $1,000,000 or 800,000. Your total arbitrage profit will be $ (please leave whole dollars for your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts