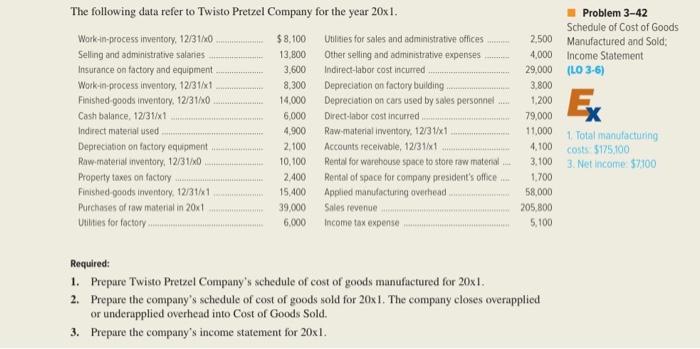

Question: i need problem (42 and 51) and the schedule for 51 you will find it in problem 50 The following data refer to Twisto Pretzel

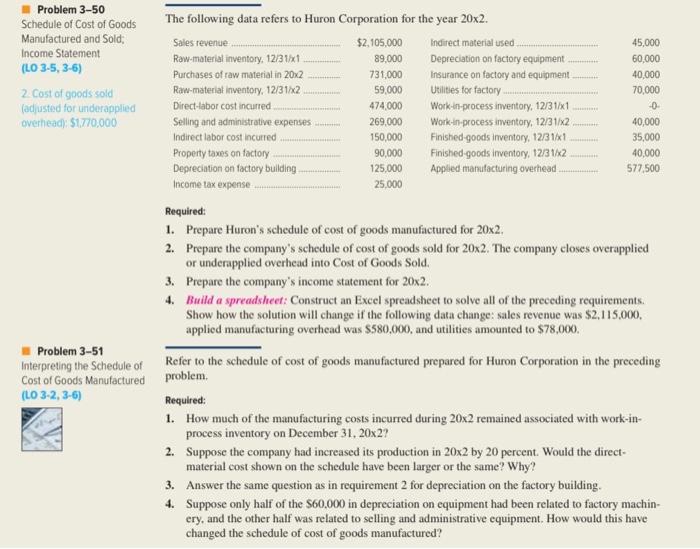

The following data refer to Twisto Pretzel Company for the year 201. Problem 3-42 Schedule of Cost of Goods 500 Manufactured and Sold; 300 Income Statement 100100costs5175,1003.Netincorne.57100 700 300 500 100 Required: 1. Prepare Twisto Pretzel Company's schedule of cost of goods manufactured for 201. 2. Prepare the company's schedule of cost of goods sold for 20x 1. The company closes overapplied or underapplied overhead into Cost of Goods Sold. 3. Prepare the company's income statement for 20x1. Problem 3-50 Schedule of Cost of Goods Manufactured and Sold; Income Statement (t0 35,36 ) 2 Cost of goods sold (adiusted for underapplied overhead) 51,770,000 Required: 1. Prepare Huron's schedule of cost of goods manufactured for 20x2. 2. Prepare the company's schedule of cost of goods sold for 202. The company closes overapplied or underapplied overhead into Cost of Goods Sold. 3. Prepare the company's income statement for 202. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: sales revenue was $2,115,000. applied manufacturing overhead was $580,000, and utilities amounted to $78,000. Interpreting the Schedule of Refer to Cost of Goods Manufactured problem. (LO 3-2, 3-6) Required: 1. How much of the manufacturing costs incurred during 202 remained associated with work-in- process inventory on December 31,202? 2. Suppose the company had increased its production in 202 by 20 percent. Would the direct- material cost shown on the schedule have been larger or the same? Why? 3. Answer the same question as in requirement 2 for depreciation on the factory building. 4. Suppose only half of the $60,000 in depreciation on equipment had been related to factory machin- ery, and the other half was related to selling and administrative equipment. How would this have changed the schedule of cost of goods manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts