Question: i need Q B and c please B. Rather than using the vesting table above, assume that Larry's company had the following vesting schedule: .

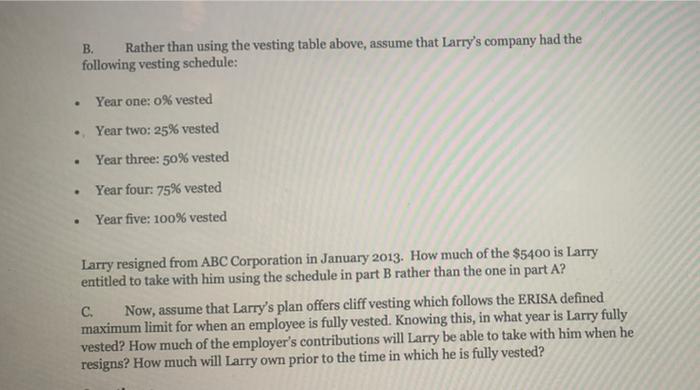

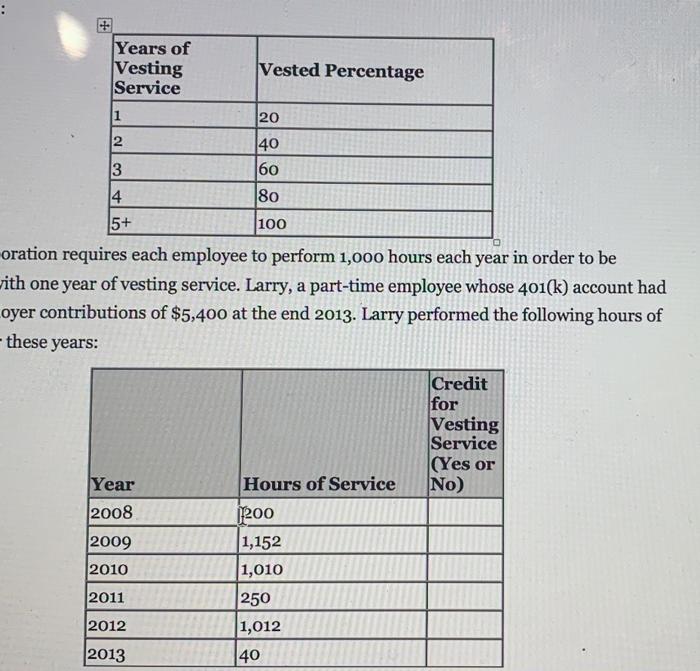

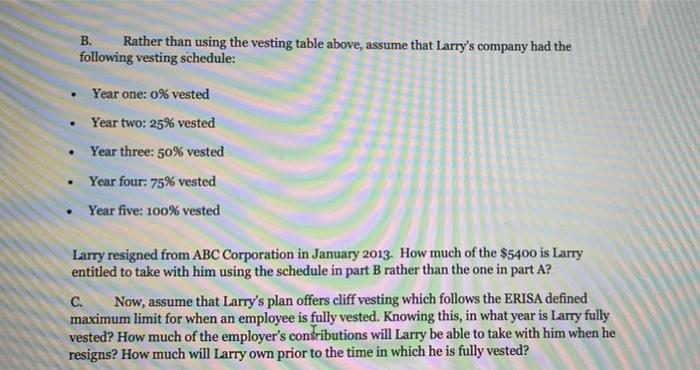

B. Rather than using the vesting table above, assume that Larry's company had the following vesting schedule: . Year one: 0% vested . Year two: 25% vested Year three: 50% vested Year four: 75% vested Year five: 100% vested . Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested? Years of Vesting Service Vested Percentage 1 2 20 40 60 3 80 14 5+ 100 oration requires each employee to perform 1,000 hours each year in order to be ith one year of vesting service. Larry, a part-time employee whose 401(k) account had Loyer contributions of $5,400 at the end 2013. Larry performed the following hours of - these years: Credit for Vesting Service (Yes or No) Year 2008 Hours of Service 1200 1,152 2009 2010 2011 1,010 250 1,012 2012 2013 40 B. Rather than using the vesting table above, assume that Larry's company had the following vesting schedule: . Year one: 0% vested Year two: 25% vested Year three: 50% vested Year four: 75% vested Year five: 100% vested . . Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested? B. Rather than using the vesting table above, assume that Larry's company had the following vesting schedule: . Year one: 0% vested . Year two: 25% vested Year three: 50% vested Year four: 75% vested Year five: 100% vested . Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested? Years of Vesting Service Vested Percentage 1 2 20 40 60 3 80 14 5+ 100 oration requires each employee to perform 1,000 hours each year in order to be ith one year of vesting service. Larry, a part-time employee whose 401(k) account had Loyer contributions of $5,400 at the end 2013. Larry performed the following hours of - these years: Credit for Vesting Service (Yes or No) Year 2008 Hours of Service 1200 1,152 2009 2010 2011 1,010 250 1,012 2012 2013 40 B. Rather than using the vesting table above, assume that Larry's company had the following vesting schedule: . Year one: 0% vested Year two: 25% vested Year three: 50% vested Year four: 75% vested Year five: 100% vested . . Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts