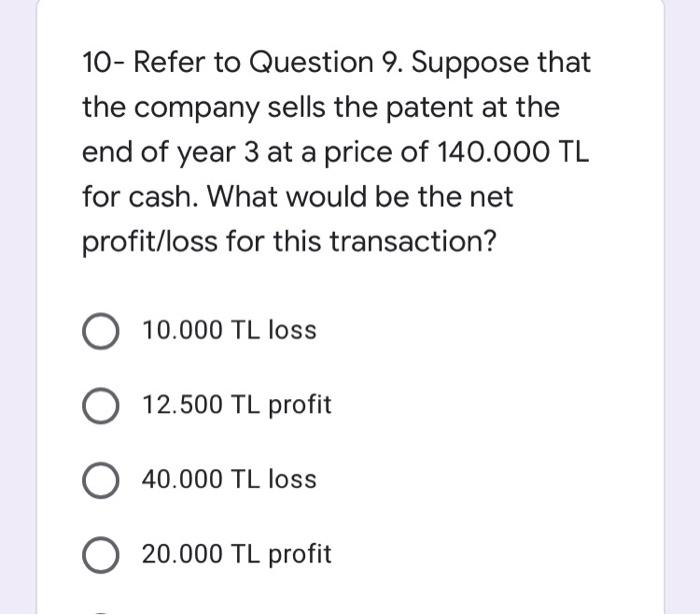

Question: i need question 10. i shared question 9 10- Refer to Question 9. Suppose that the company sells the patent at the end of year

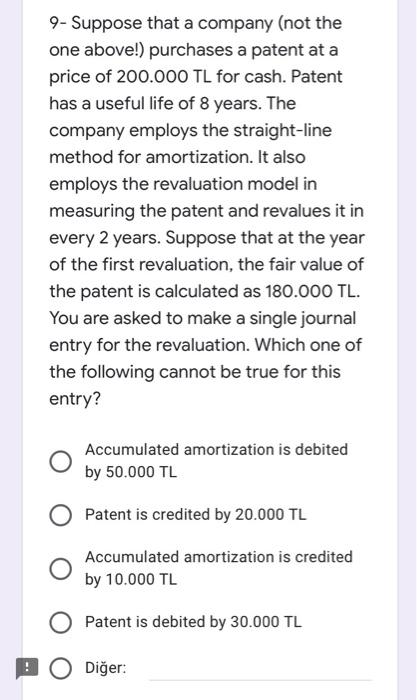

10- Refer to Question 9. Suppose that the company sells the patent at the end of year 3 at a price of 140.000 TL for cash. What would be the net profit/loss for this transaction? 10.000 TL loss O 12.500 TL profit 40.000 TL loss 0 20.000 TL profit 9- Suppose that a company (not the one above!) purchases a patent at a price of 200.000 TL for cash. Patent has a useful life of 8 years. The company employs the straight-line method for amortization. It also employs the revaluation model in measuring the patent and revalues it in every 2 years. Suppose that at the year of the first revaluation, the fair value of the patent is calculated as 180.000 TL. You are asked to make a single journal entry for the revaluation. Which one of the following cannot be true for this entry? Accumulated amortization is debited by 50.000 TL Patent is credited by 20.000 TL Accumulated amortization is credited by 10.000 TL Patent is debited by 30.000 TL P O Dier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts