Question: I need question 9 - - - - - - - - - - - - - - - - - - - - -

I need question Question to Question is based on this problem

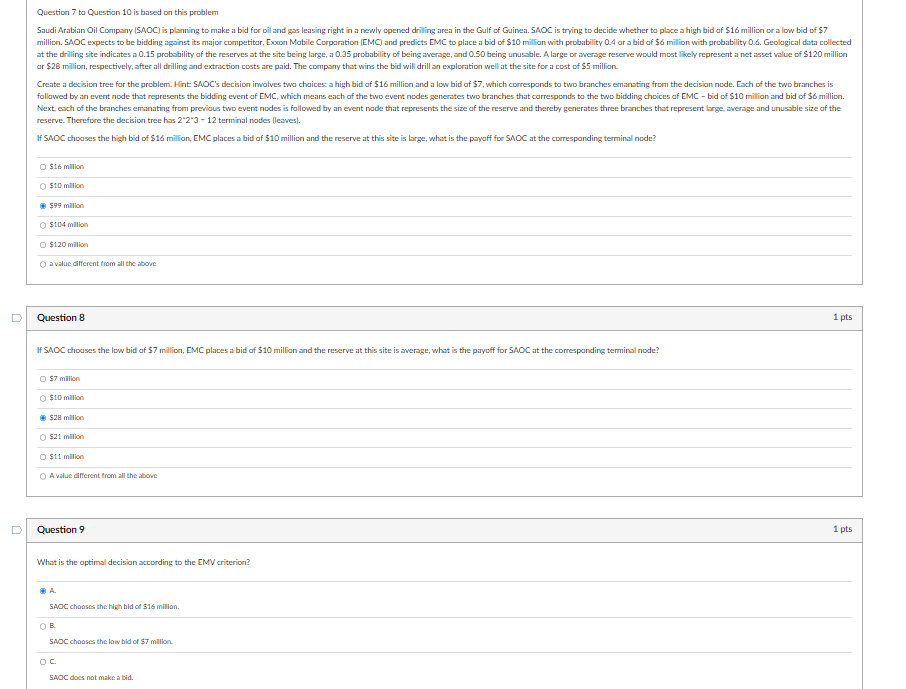

or $milion, respectively, after all drilling and extraction costs are paid. The company that wins the bid will drill an exploration well at the site for a cost of $ millian.

reserve. Therefore the decision tree has terminal nodes leawes

If SAOC chooses the high bid of $ million, EMC places a bid of $ millien and the reserve at this site is large, what is the payoff for SAOC at the corresponding terminal node?

$ milion

$ mallion

$ milion

$ milion

$ milion

a value different from all the above

Question

$ milion

$ milion

$ milion

$ milion

$ milion

A value different from all the above

Question

pts

What is the optimal decision according to the EMV criterion?

A

SAOC chooses the high bid of $ million.

B

SAOC chooses the low bid of $ million.

c

SAOC does not make a bid.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock