Question: i need solution along with the explaination of the calculation Consider the problem defined below. Provide solutions to all questions, including detailed numerical calculations, whenever

i need solution along with the explaination of the calculation

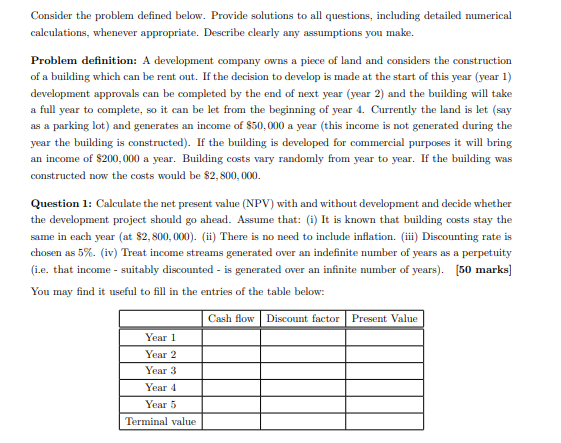

Consider the problem defined below. Provide solutions to all questions, including detailed numerical calculations, whenever appropriate. Describe clearly any assumptions you make. Problem definition: A development company owns a piece of land and considers the construction of a building which can be rent out. If the decision to develop is made at the start of this year (year 1) development approvals can be completed by the end of next year (year 2) and the building will take a full year to complete, so it can be let from the beginning of year 4. Currently the land is let (say as a parking lot) and generates an income of $50,000 a year (this income is not generated during the year the building is constructed). If the building is developed for commercial purposes it will bring an income of $200,000 a year. Building costs vary randomly from year to year. If the building was constructed now the costs would be $2,800,000. Question 1: Calculate the net present value (NPV) with and without development and decide whether the development project should go ahead. Assume that: (1) It is known that building costs stay the same in each year (at $2,800,000). (ii) There is no need to include inflation. (iii) Discounting rate is chosen as 5%. (iv) Treat income streams generated over an indefinite number of years as a perpetuity (i.e. that income - suitably discounted - is generated over an infinite number of years). [50 marks] You may find it useful to fill in the entries of the table below: - Cash flow Discount factor Present Value Year 1 Year 2 Year 3 Year 4 Year 5 Terminal value Consider the problem defined below. Provide solutions to all questions, including detailed numerical calculations, whenever appropriate. Describe clearly any assumptions you make. Problem definition: A development company owns a piece of land and considers the construction of a building which can be rent out. If the decision to develop is made at the start of this year (year 1) development approvals can be completed by the end of next year (year 2) and the building will take a full year to complete, so it can be let from the beginning of year 4. Currently the land is let (say as a parking lot) and generates an income of $50,000 a year (this income is not generated during the year the building is constructed). If the building is developed for commercial purposes it will bring an income of $200,000 a year. Building costs vary randomly from year to year. If the building was constructed now the costs would be $2,800,000. Question 1: Calculate the net present value (NPV) with and without development and decide whether the development project should go ahead. Assume that: (1) It is known that building costs stay the same in each year (at $2,800,000). (ii) There is no need to include inflation. (iii) Discounting rate is chosen as 5%. (iv) Treat income streams generated over an indefinite number of years as a perpetuity (i.e. that income - suitably discounted - is generated over an infinite number of years). [50 marks] You may find it useful to fill in the entries of the table below: - Cash flow Discount factor Present Value Year 1 Year 2 Year 3 Year 4 Year 5 Terminal value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts