Question: i need solution as soon as possible (ff information opprons ro be missiog, chasge the row height to see it.) Senices, CVI rutahished a solid

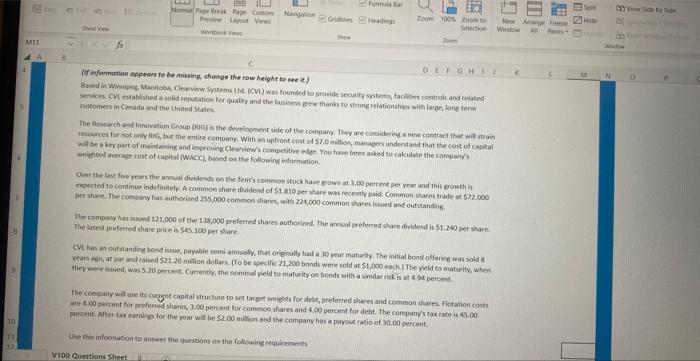

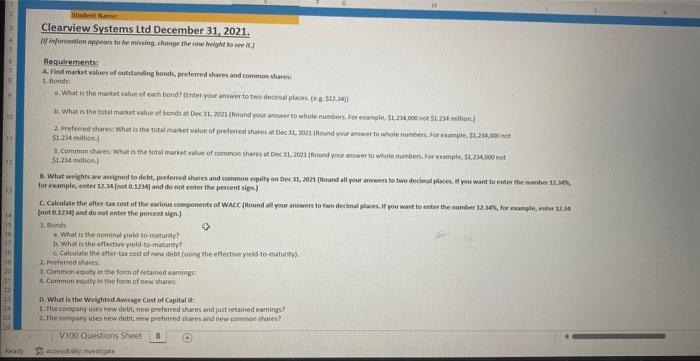

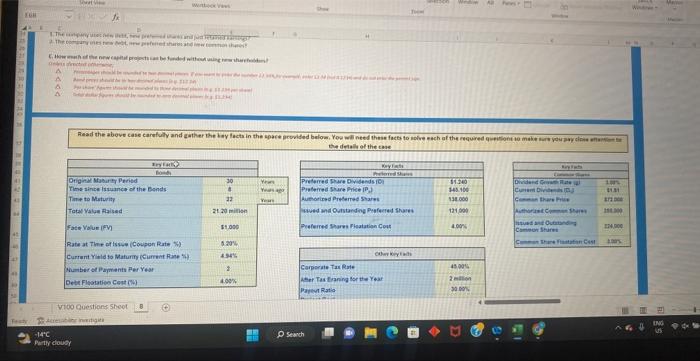

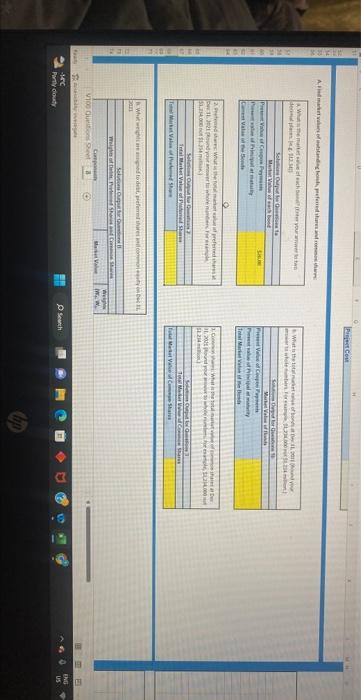

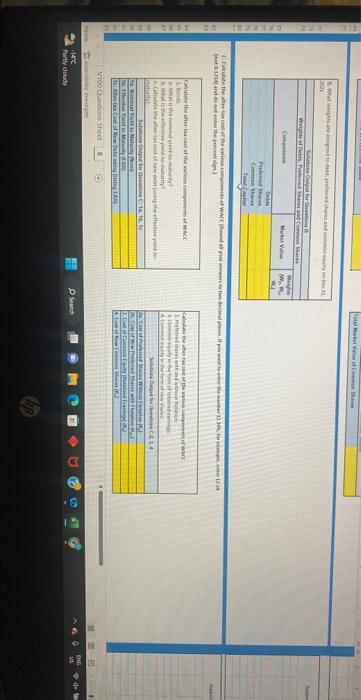

(ff information opprons ro be missiog, chasge the row height to see it.) Senices, CVI rutahished a solid reputation for qualty and the fushens gew thanks to strong relationsher with large, long term cuntomer in Cinada and the United States. The Desearch and tinovatian Group (KIG) is the develosment dide of the conspary, They are conadering a new contract that wis strain will be a kry part of maintaking and inproving ClearvieWs competitive ethe You have been asked to caiculase the camparys. meiphted aversige cost of capital fwiccch, bssed on the following information. Owe the last the reass the answat dividends on the fem's conmign stock have pown at 3.00 percent per yrar and this growth is rexected to continue indelinitely. Acommon share diwidend of 51.310 per thare was recestly paid. Common whares trade at 572.000 net shace. The company has authoriced 255,000 common shares, with 224,000 commen shares issued and outsanding. The campacy has inwed 121,000 of the 138,000 preferted shares authorioed. The annual preferred thare dividend is 51.240 zeer atare. The lateit prefered share price is $15.100 per share. CVL has an outstanding bond isue, payable semi annusly, that originally had a jo year maturity. The initial bond offaring was vold 8 Years ab0, at par and raised $71,20 milian dotlars, (fo be ipecific 21,200 bonds were sold at $1,000 each.) The yeld to otaturity, when they were anwed, was 520 peroedt. Currently, the nominal vield to matirity on bonds with a wimilar risk is at 4 at percent. The company wit use its cugget capital structure to see target weighty for debt, preferred shares and comenon whares. Flatation costs ane 4.00 percent for preferred shares, 1.00 percent for common shares and 4.00 percent for debt. The company's tax rate is 45,00 percent. After twx zarnizss for the wear wit be 32.00 mixion and the company has a payout ratio of 30.00 percent. Wse tha infomstion to answer the puestians on the following requirments (1) irfonation appears to de missing change the row helght to see ie) Requirementsy 1. llonds: 5. 204 million) S1.2.4 minion) for example, enter 12.34 (eot 0.124t) and do not enter the percent sign.) C. Calculate the after-tax cost of the various components of whcc (found all your ansuren to two ifetimal plakes. If you wast to enter the number 12 . atk, for example, enter 12.34 (not a.1234) and do not enter the perceet sign.) 1. ponat 2. What to the neminal yield-to-meturar?? b. What is the offectioe yield to-maturity? c. Calculate the atter-tax cast af now debt foung the efiective yoeds to-matuntp?. 2. Preferredstate. 3. Cimman kquifi in the form of retained earmingn c. Common resily in the form of new thanec 0. Whach the Wrighted Avetage Cost of Capital it 1. The ed cppany user new debt, new preferted shoves and just retained eamings? the defally of the case (ff information opprons ro be missiog, chasge the row height to see it.) Senices, CVI rutahished a solid reputation for qualty and the fushens gew thanks to strong relationsher with large, long term cuntomer in Cinada and the United States. The Desearch and tinovatian Group (KIG) is the develosment dide of the conspary, They are conadering a new contract that wis strain will be a kry part of maintaking and inproving ClearvieWs competitive ethe You have been asked to caiculase the camparys. meiphted aversige cost of capital fwiccch, bssed on the following information. Owe the last the reass the answat dividends on the fem's conmign stock have pown at 3.00 percent per yrar and this growth is rexected to continue indelinitely. Acommon share diwidend of 51.310 per thare was recestly paid. Common whares trade at 572.000 net shace. The company has authoriced 255,000 common shares, with 224,000 commen shares issued and outsanding. The campacy has inwed 121,000 of the 138,000 preferted shares authorioed. The annual preferred thare dividend is 51.240 zeer atare. The lateit prefered share price is $15.100 per share. CVL has an outstanding bond isue, payable semi annusly, that originally had a jo year maturity. The initial bond offaring was vold 8 Years ab0, at par and raised $71,20 milian dotlars, (fo be ipecific 21,200 bonds were sold at $1,000 each.) The yeld to otaturity, when they were anwed, was 520 peroedt. Currently, the nominal vield to matirity on bonds with a wimilar risk is at 4 at percent. The company wit use its cugget capital structure to see target weighty for debt, preferred shares and comenon whares. Flatation costs ane 4.00 percent for preferred shares, 1.00 percent for common shares and 4.00 percent for debt. The company's tax rate is 45,00 percent. After twx zarnizss for the wear wit be 32.00 mixion and the company has a payout ratio of 30.00 percent. Wse tha infomstion to answer the puestians on the following requirments (1) irfonation appears to de missing change the row helght to see ie) Requirementsy 1. llonds: 5. 204 million) S1.2.4 minion) for example, enter 12.34 (eot 0.124t) and do not enter the percent sign.) C. Calculate the after-tax cost of the various components of whcc (found all your ansuren to two ifetimal plakes. If you wast to enter the number 12 . atk, for example, enter 12.34 (not a.1234) and do not enter the perceet sign.) 1. ponat 2. What to the neminal yield-to-meturar?? b. What is the offectioe yield to-maturity? c. Calculate the atter-tax cast af now debt foung the efiective yoeds to-matuntp?. 2. Preferredstate. 3. Cimman kquifi in the form of retained earmingn c. Common resily in the form of new thanec 0. Whach the Wrighted Avetage Cost of Capital it 1. The ed cppany user new debt, new preferted shoves and just retained eamings? the defally of the case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts