Question: I NEED SOLUTION FOR 13 13. Calculating Project OCF (L03) Hubrey Home Inc. is considering a new three- year expansion project that requires an initial

I NEED SOLUTION FOR 13

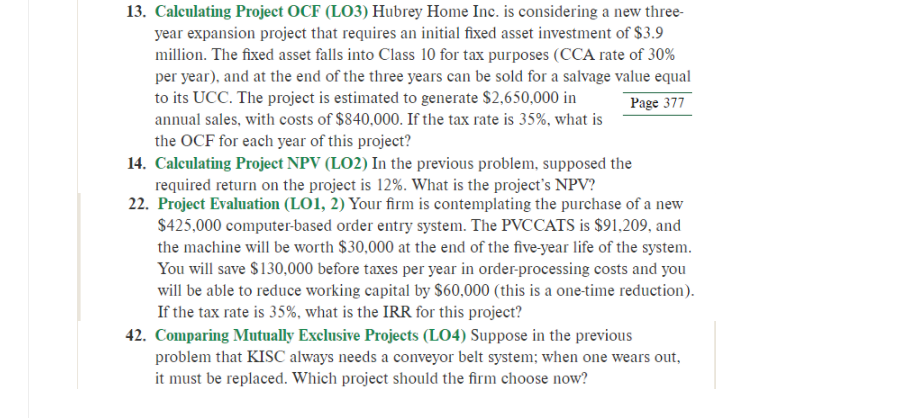

13. Calculating Project OCF (L03) Hubrey Home Inc. is considering a new three- year expansion project that requires an initial fixed asset investment of $3.9 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,650,000 in Page 377 annual sales, with costs of $840,000. If the tax rate is 35%, what is the OCF for each year of this project? 14. Calculating Project NPV (L02) In the previous problem, supposed the required return on the project is 12%. What is the project's NPV? 22. Project Evaluation (LO1, 2) Your firm is contemplating the purchase of a new $425,000 computer-based order entry system. The PVCCATS is $91,209, and the machine will be worth $30,000 at the end of the five-year life of the system. You will save $130,000 before taxes per year in order processing costs and you will be able to reduce working capital by $60,000 (this is a one-time reduction). If the tax rate is 35%, what is the IRR for this project? 42. Comparing Mutually Exclusive Projects (LO4) Suppose in the previous problem that KISC always needs a conveyor belt system; when one wears out, it must be replaced. Which project should the firm choose now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts