Question: i need solution please E9-7 Presented below are two independent situations. (a) On March 3, Kitselman Appliances sells $650,000 of its receivables to Ervay Factors

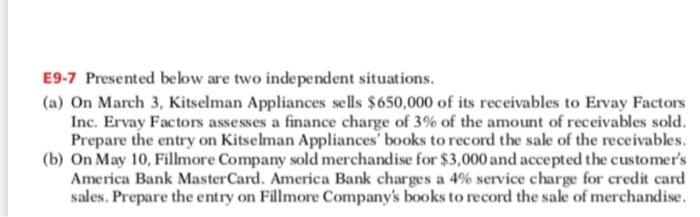

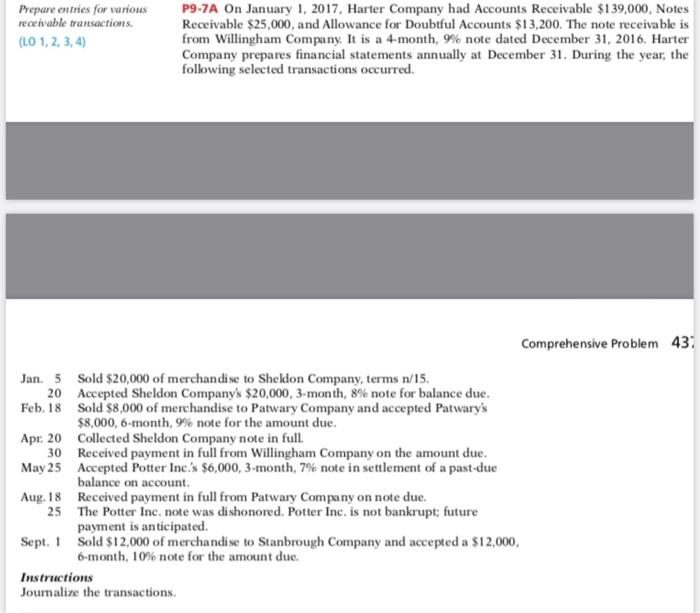

E9-7 Presented below are two independent situations. (a) On March 3, Kitselman Appliances sells $650,000 of its receivables to Ervay Factors Inc. Ervay Factors assesses a finance charge of 3% of the amount of receivables sold. Prepare the entry on Kitselman Appliances' books to record the sale of the receivables. (b) On May 10, Fillmore Company sold merchandise for $3,000 and accepted the customer's America Bank MasterCard, America Bank charges a 4% service charge for credit card sales. Prepare the entry on Fillmore Company's books to record the sale of merchandise. Prepare entries for various receivable transactions. (LO 1, 2, 3, 4) P9-7A On January 1, 2017, Harter Company had Accounts Receivable $139,000, Notes Receivable $25,000, and Allowance for Doubtful Accounts $13,200. The note receivable is from Willingham Company. It is a 4-month, 9% note dated December 31, 2016. Harter Company prepares financial statements annually at December 31. During the year, the following selected transactions occurred. Comprehensive Problem 437 Jan. 5 Sold $20,000 of merchandise to Sheldon Company, terms n/15. 20 Accepted Sheldon Company's $20,000, 3-month, 8% note for balance due. Feb. 18 Sold $8,000 of merchandise to Patwary Company and accepted Patwary's $8,000, 6-month, 9% note for the amount due Apr. 20 Collected Sheldon Company note in full. 30 Received payment in full from Willingham Company on the amount due. May 25 Accepted Potter Inc.'s $6,000, 3-month, 7% note in settlement of a past-due balance on account. Aug. 18 Received payment in full from Patwary Company on note due. 25 The Potter Inc. note was dishonored. Potter Inc. is not bankrupt; future payment is anticipated. Sept. 1 Sold S12,000 of merchandise to Stanbrough Company and accepted a $12,000, 6-month, 10% note for the amount due. Instructions Joumalize the transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts