Question: I need some assitance with forming the decision tree!!!! The senior executives of an oil company are trying to decide whether to drill for oil

I need some assitance with forming the decision tree!!!!

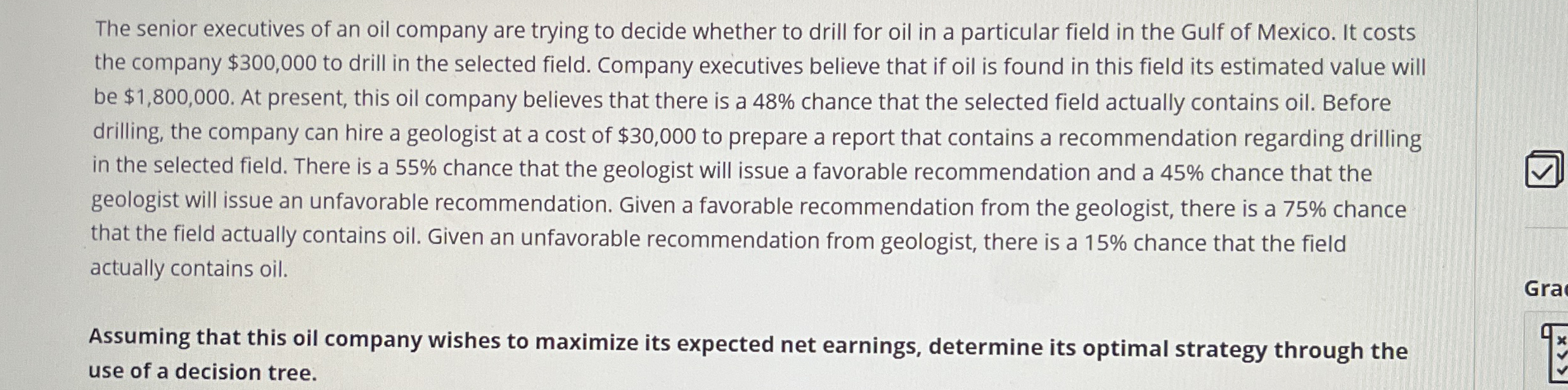

The senior executives of an oil company are trying to decide whether to drill for oil in a particular field in the Gulf of Mexico. It costs the company $ to drill in the selected field. Company executives believe that if oil is found in this field its estimated value will be $ At present, this oil company believes that there is a chance that the selected field actually contains oil. Before drilling, the company can hire a geologist at a cost of $ to prepare a report that contains a recommendation regarding drilling in the selected field. There is a chance that the geologist will issue a favorable recommendation and a chance that the geologist will issue an unfavorable recommendation. Given a favorable recommendation from the geologist, there is a chance that the field actually contains oil. Given an unfavorable recommendation from geologist, there is a chance that the field actually contains oil.

Assuming that this oil company wishes to maximize its expected net earnings, determine its optimal strategy through the use of a decision tree.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock