Question: I need some help on a project. Please provide calculations! I am not sure how to find the income statement or balance sheet. CR DR

I need some help on a project. Please provide calculations! I am not sure how to find the income statement or balance sheet.

I need some help on a project. Please provide calculations! I am not sure how to find the income statement or balance sheet.

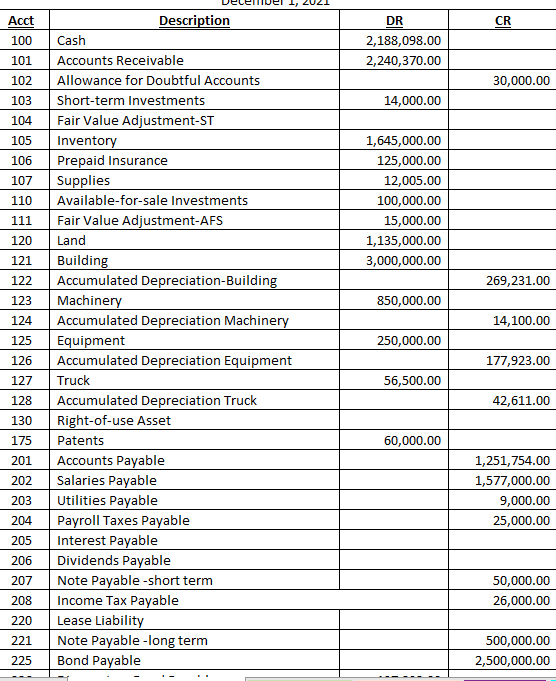

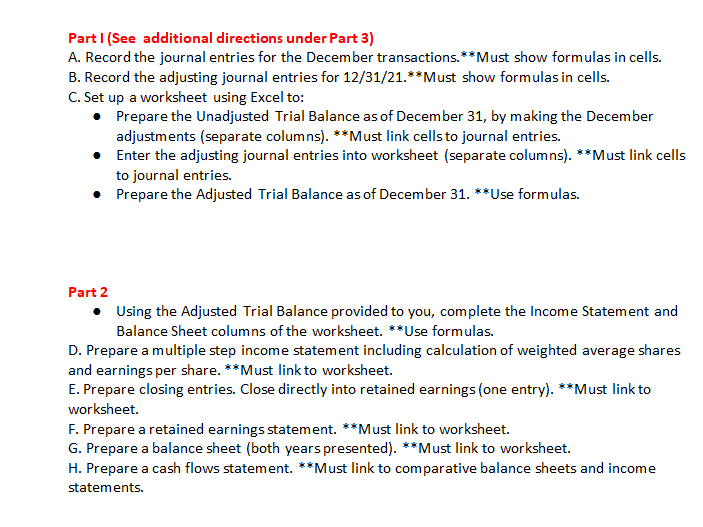

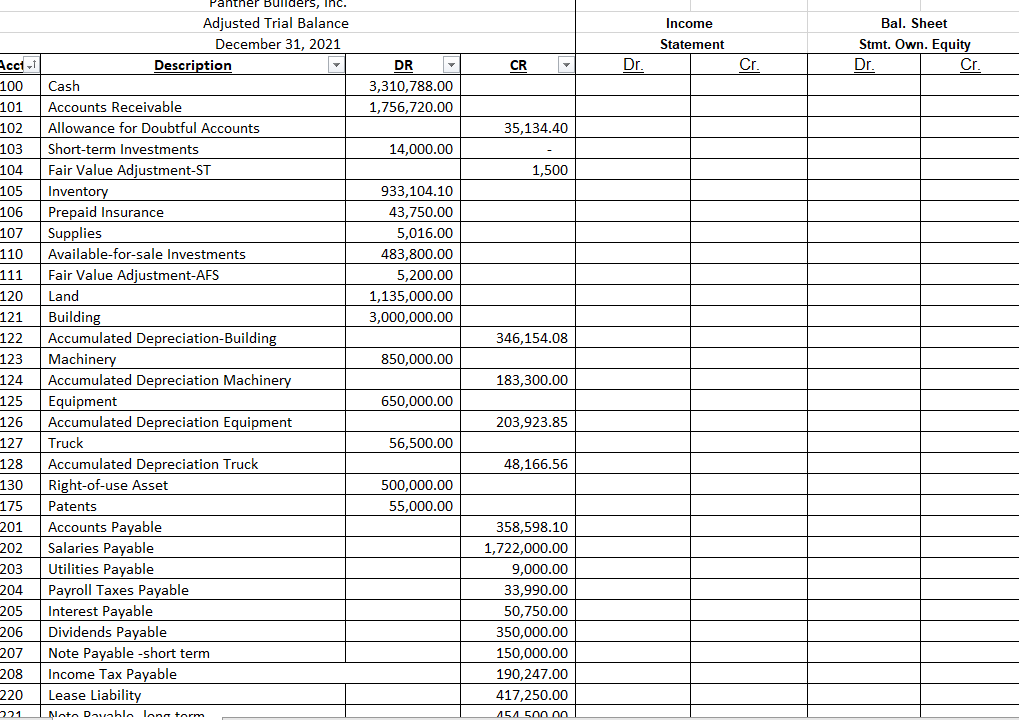

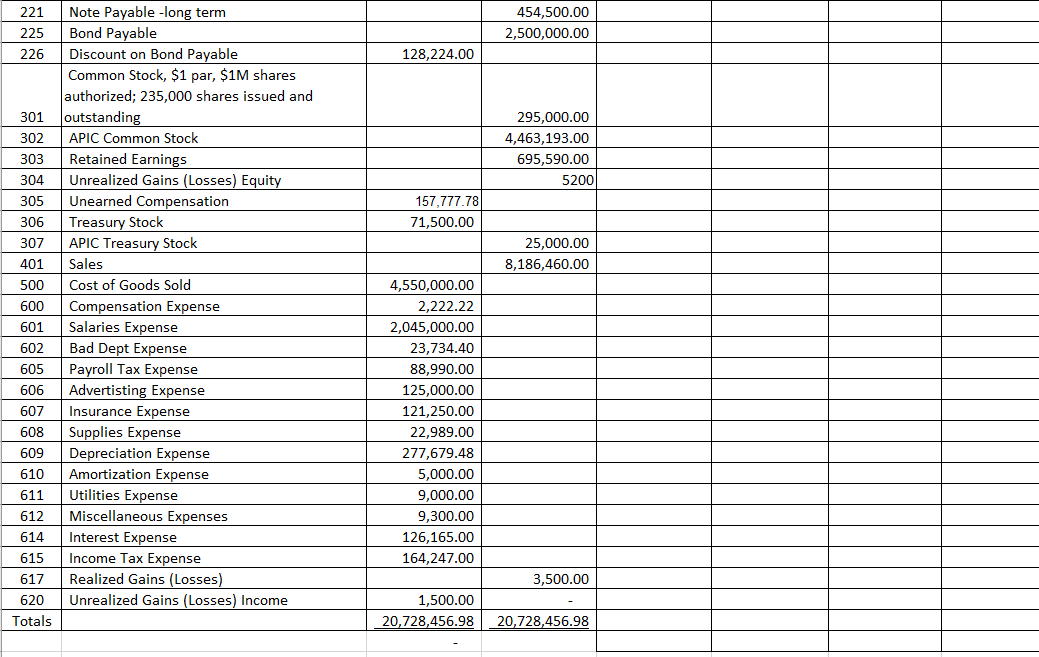

CR DR 2,188,098.00 2,240,370.00 30,000.00 14,000.00 Acct 100 101 102 103 104 105 106 107 110 111 1,645,000.00 125,000.00 12,005.00 100,000.00 15,000.00 1,135,000.00 3,000,000.00 120 121 122 269,231.00 123 850,000.00 124 14,100.00 125 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable 250,000.00 126 177,923.00 127 56,500.00 128 42,611.00 130 60,000.00 1,251,754.00 1,577,000.00 9,000.00 25,000.00 175 201 202 203 204 205 206 207 208 220 221 225 50,000.00 26,000.00 500,000.00 2,500,000.00 Part I (See additional directions under Part 3) A. Record the journal entries for the December transactions. **Must show formulas in cells. B. Record the adjusting journal entries for 12/31/21. **Must show formulas in cells. C. Set up a worksheet using Excel to: Prepare the Unadjusted Trial Balance as of December 31, by making the December adjustments (separate columns). **Must link cells to journal entries. Enter the adjusting journal entries into worksheet (separate columns). **Must link cells to journal entries. Prepare the Adjusted Trial Balance as of December 31. **Use formulas. Part 2 Using the Adjusted Trial Balance provided to you, complete the Income Statement and Balance Sheet columns of the worksheet. **Use formulas. D. Prepare a multiple step income statement including calculation of weighted average shares and earnings per share. **Must link to worksheet. E. Prepare closing entries. Close directly into retained earnings (one entry). **Must link to worksheet. F. Prepare a retained earnings statement. **Must link to worksheet. G. Prepare a balance sheet (both years presented). **Must link to worksheet. H. Prepare a cash flows statement. **Must link to comparative balance sheets and income statements. Income Statement Bal. Sheet Stmt. Own. Equity Dr. Cr CR Dr. Cr. DR 3,310,788.00 1,756,720.00 35,134.40 14,000.00 1,500 933,104.10 43,750.00 5,016.00 483,800.00 5,200.00 1,135,000.00 3,000,000.00 346,154.08 Panther Builders, Inc. Adjusted Trial Balance December 31, 2021 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Nato Davala lann torm 850,000.00 Acct 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 206 207 208 220 221 183,300.00 650,000.00 203,923.85 56,500.00 48,166.56 500,000.00 55,000.00 358,598.10 1,722,000.00 9,000.00 33,990.00 50,750.00 350,000.00 150,000.00 190,247.00 417,250.00 451 500.00 454,500.00 2,500,000.00 128,224.00 295,000.00 4,463,193.00 695,590.00 5200 157,777.78 71,500.00 25,000.00 8,186,460.00 221 Note Payable-long term 225 Bond Payable 226 Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and 301 outstanding 302 APIC Common Stock 303 Retained Earnings 304 Unrealized Gains (Losses) Equity 305 Unearned Compensation 306 Treasury Stock 307 APIC Treasury Stock 401 Sales 500 Cost of Goods Sold 600 Compensation Expense 601 Salaries Expense 602 Bad Dept Expense 605 Payroll Tax Expense 606 Advertisting Expense 607 Insurance Expense 608 Supplies Expense 609 Depreciation Expense 610 Amortization Expense 611 Utilities Expense 612 Miscellaneous Expenses 614 Interest Expense 615 Income Tax Expense 617 Realized Gains (Losses) 620 Unrealized Gains (Losses) Income Totals 4,550,000.00 2,222.22 2,045,000.00 23,734.40 88,990.00 125,000.00 121,250.00 22,989.00 277,679.48 5,000.00 9,000.00 9,300.00 126,165.00 164,247.00 3,500.00 1,500.00 20,728,456.98 20,728,456.98 CR DR 2,188,098.00 2,240,370.00 30,000.00 14,000.00 Acct 100 101 102 103 104 105 106 107 110 111 1,645,000.00 125,000.00 12,005.00 100,000.00 15,000.00 1,135,000.00 3,000,000.00 120 121 122 269,231.00 123 850,000.00 124 14,100.00 125 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable 250,000.00 126 177,923.00 127 56,500.00 128 42,611.00 130 60,000.00 1,251,754.00 1,577,000.00 9,000.00 25,000.00 175 201 202 203 204 205 206 207 208 220 221 225 50,000.00 26,000.00 500,000.00 2,500,000.00 Part I (See additional directions under Part 3) A. Record the journal entries for the December transactions. **Must show formulas in cells. B. Record the adjusting journal entries for 12/31/21. **Must show formulas in cells. C. Set up a worksheet using Excel to: Prepare the Unadjusted Trial Balance as of December 31, by making the December adjustments (separate columns). **Must link cells to journal entries. Enter the adjusting journal entries into worksheet (separate columns). **Must link cells to journal entries. Prepare the Adjusted Trial Balance as of December 31. **Use formulas. Part 2 Using the Adjusted Trial Balance provided to you, complete the Income Statement and Balance Sheet columns of the worksheet. **Use formulas. D. Prepare a multiple step income statement including calculation of weighted average shares and earnings per share. **Must link to worksheet. E. Prepare closing entries. Close directly into retained earnings (one entry). **Must link to worksheet. F. Prepare a retained earnings statement. **Must link to worksheet. G. Prepare a balance sheet (both years presented). **Must link to worksheet. H. Prepare a cash flows statement. **Must link to comparative balance sheets and income statements. Income Statement Bal. Sheet Stmt. Own. Equity Dr. Cr CR Dr. Cr. DR 3,310,788.00 1,756,720.00 35,134.40 14,000.00 1,500 933,104.10 43,750.00 5,016.00 483,800.00 5,200.00 1,135,000.00 3,000,000.00 346,154.08 Panther Builders, Inc. Adjusted Trial Balance December 31, 2021 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Nato Davala lann torm 850,000.00 Acct 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 206 207 208 220 221 183,300.00 650,000.00 203,923.85 56,500.00 48,166.56 500,000.00 55,000.00 358,598.10 1,722,000.00 9,000.00 33,990.00 50,750.00 350,000.00 150,000.00 190,247.00 417,250.00 451 500.00 454,500.00 2,500,000.00 128,224.00 295,000.00 4,463,193.00 695,590.00 5200 157,777.78 71,500.00 25,000.00 8,186,460.00 221 Note Payable-long term 225 Bond Payable 226 Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and 301 outstanding 302 APIC Common Stock 303 Retained Earnings 304 Unrealized Gains (Losses) Equity 305 Unearned Compensation 306 Treasury Stock 307 APIC Treasury Stock 401 Sales 500 Cost of Goods Sold 600 Compensation Expense 601 Salaries Expense 602 Bad Dept Expense 605 Payroll Tax Expense 606 Advertisting Expense 607 Insurance Expense 608 Supplies Expense 609 Depreciation Expense 610 Amortization Expense 611 Utilities Expense 612 Miscellaneous Expenses 614 Interest Expense 615 Income Tax Expense 617 Realized Gains (Losses) 620 Unrealized Gains (Losses) Income Totals 4,550,000.00 2,222.22 2,045,000.00 23,734.40 88,990.00 125,000.00 121,250.00 22,989.00 277,679.48 5,000.00 9,000.00 9,300.00 126,165.00 164,247.00 3,500.00 1,500.00 20,728,456.98 20,728,456.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts