Question: I need some help on b,c, d. If could provide explanation process that would be great, thank you. 2Exercise 14-04 Question 2 of 2 Check

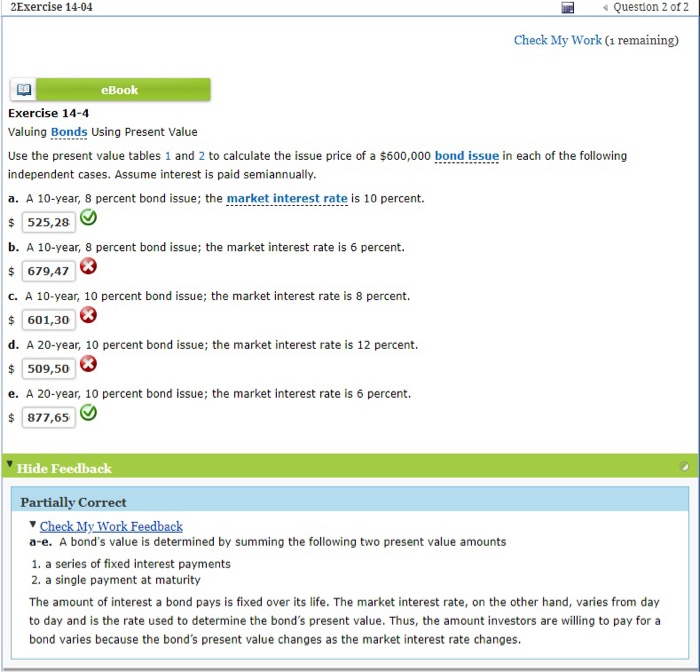

2Exercise 14-04 Question 2 of 2 Check My Work (1 remaining) eBook Exercise 14-4 Valuing Bonds Using Present Value Use the present value tables 1 and 2 to calculate the issue price of a $600,000 bond issue in each of the following independent cases. Assume interest is paid semiannually. a. A 10-year, 8 percent bond issue; the market interest rate is 10 percent. $ 525,28 b. A 10-year, 8 percent bond issue; the market interest rate is 6 percent. $679,47 c. A 10-year, 10 percent bond issue; the market interest rate is 8 percent. $601,30 d. A 20-year, 10 percent bond issue; the market interest rate is 12 percent. $509,50 e. A 20-year, 10 percent bond issue; the market interest rate is 6 percent. $877,65 Hide Feedback Partially Correct a-e. A bond's value is determined by summing the following two present value amounts 1. a series of fixed interest payments 2. a single payment at maturity The amount of interest a bond pays is fixed over its life. The market interest rate, on the other hand, varies from day to day and is the rate used to determine the bond's present value. Thus, the amount investors are willing to pay for a bond varies because the bond's present value changes as the market interest rate changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts