Question: I need some help with 2 and 3 please. They are highlighted. The Blue Nights Inn CAPACITY (Room days per monti) Tom and Lisa have

I need some help with 2 and 3 please. They are highlighted.

I need some help with 2 and 3 please. They are highlighted.

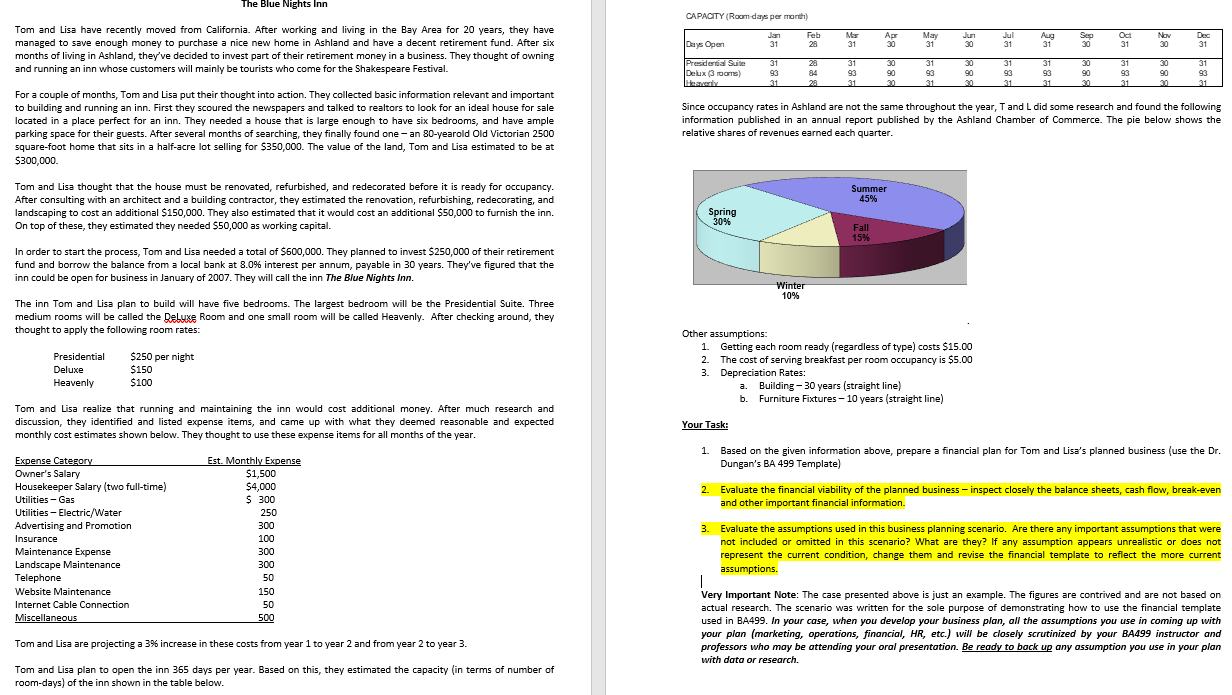

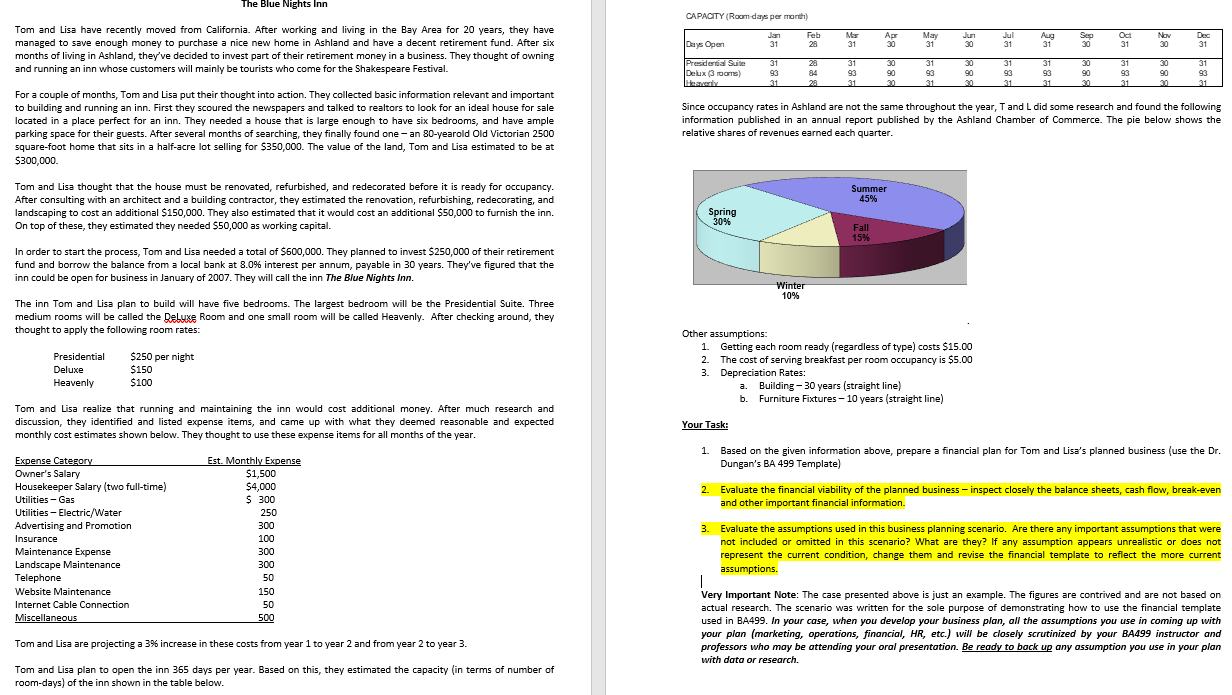

The Blue Nights Inn CAPACITY (Room days per monti) Tom and Lisa have recently moved from California. After working and living in the Bay Area for 20 years, they have managed to save enough money to purchase a nice new home in Ashland and have a decent retirement fund. After six months of living in Ashland, they've decided to invest part of their retirement money in a business. They thought of owning and running an inn whose customers will mainly be tourists who come for the Shakespeare Festival. Derys Open President Suite Deux ans) Home For a couple of months, Tom and Lisa put their thought into action. They collected basic information relevant and important to building and running an inn. First they scoured the newspapers and talked to realtors to look for an ideal house for sale located in a place perfect for an inn. They needed a house that is large enough to have six bedrooms, and have ample parking space for their guests. After several months of searching, they finally found one - an 80-yearold Old Victorian 2500 square-foot home that sits in a half-acre lot selling for $350,000. The value of the land, Tom and Lisa estimated to be at $300,000 Since occupancy rates in Ashland are not the same throughout the year, T and L did some research and found the following information published in an annual report published by the Ashland Chamber of Commerce. The pie below shows the relative shares of revenues earned each quarter. Summer Tom and Lisa thought that the house must be renovated, refurbished, and redecorated before it is ready for occupancy. After consulting with an architect and a building contractor, they estimated the renovation, refurbishing, redecorating, and landscaping to cost an additional $150,000. They also estimated that it would cost an additional $50,000 to furnish the inn. On top of these, they estimated they needed $50,000 as working capital. Spring Fall In order to start the process, Tom and Lisa needed a total of $600,000. They planned to invest $250,000 of their retirement fund and borrow the balance from a local bank at 8.0% interest per annum, payable in 30 years. They've figured that the inn could be open for business in January of 2007. They will call the inn The Blue Nights Inn. Winter 10% The inn Tom and Lisa plan to build will have five bedrooms. The largest bedroom will be the Presidential Suite. Three medium rooms will be called the Deluxe Room and one small room will be called Heavenly. After checking around, they thought to apply the following room rates: Presidential Deluxe Heavenly $250 per night $150 $100 Other assumptions: 1. Getting each room ready (regardless of type) costs $15.00 2. The cost of serving breakfast per room occupancy is $5.00 3. Depreciation Rates: a. Building - 30 years (straight line) b. Furniture Fixtures - 10 years (straight line) Tom and Lisa realize that running and maintaining the inn would cost additional money. After much research and discussion, they identified and listed expense items, and came up with what they deemed reasonable and expected monthly cost estimates shown below. They thought to use these expense items for all months of the year. Your Task: 1. Based on the given information above, prepare a financial plan for Tom and Lisa's planned business (use the Dr. Dungan's BA 499 Template) Evaluate the financial viability of the planned business inspect closely the balance sheets, cash flow, break-even and other important financial information. Expense Cateeory Owner's Salary Housekeeper Salary (two full-time) Utilities - Gas Utilities - Electric/Water Advertising and Promotion Insurance Maintenance Expense Landscape Maintenance Telephone Website Maintenance Internet Cable Connection Miscellaneous Est. Monthly Expense $1,500 $4,000 S 300 250 300 100 300 300 3. Evaluate the assumptions used in this business planning scenario. Are there any important assumptions that were not included or omitted in this scenario? What are they? If any assumption appears unrealistic or does not represent the current condition, change them and revise the financial template to reflect the more current assumptions. 50 150 50 500 Very Important Note: The case presented above is just an example. The figures are contrived and are not based on actual research. The scenario was written for the sole purpose of demonstrating how to use the financial template used in BA499. In your case, when you develop your business plan, all the assumptions you use in coming up with your plan (marketing, operations, financial, HR, etc.) will be closely scrutinized by your BA499 instructor and professors who may be attending your oral presentation. Be ready to back up any assumption you use in your plan with data or research. Tom and Lisa are projecting a 3% increase in these costs from year 1 to year 2 and from year 2 to year 3. Tom and Lisa plan to open the inn 365 days per year. Based on this, they estimated the capacity (in terms of number of room-days) of the inn shown in the table below. The Blue Nights Inn CAPACITY (Room days per monti) Tom and Lisa have recently moved from California. After working and living in the Bay Area for 20 years, they have managed to save enough money to purchase a nice new home in Ashland and have a decent retirement fund. After six months of living in Ashland, they've decided to invest part of their retirement money in a business. They thought of owning and running an inn whose customers will mainly be tourists who come for the Shakespeare Festival. Derys Open President Suite Deux ans) Home For a couple of months, Tom and Lisa put their thought into action. They collected basic information relevant and important to building and running an inn. First they scoured the newspapers and talked to realtors to look for an ideal house for sale located in a place perfect for an inn. They needed a house that is large enough to have six bedrooms, and have ample parking space for their guests. After several months of searching, they finally found one - an 80-yearold Old Victorian 2500 square-foot home that sits in a half-acre lot selling for $350,000. The value of the land, Tom and Lisa estimated to be at $300,000 Since occupancy rates in Ashland are not the same throughout the year, T and L did some research and found the following information published in an annual report published by the Ashland Chamber of Commerce. The pie below shows the relative shares of revenues earned each quarter. Summer Tom and Lisa thought that the house must be renovated, refurbished, and redecorated before it is ready for occupancy. After consulting with an architect and a building contractor, they estimated the renovation, refurbishing, redecorating, and landscaping to cost an additional $150,000. They also estimated that it would cost an additional $50,000 to furnish the inn. On top of these, they estimated they needed $50,000 as working capital. Spring Fall In order to start the process, Tom and Lisa needed a total of $600,000. They planned to invest $250,000 of their retirement fund and borrow the balance from a local bank at 8.0% interest per annum, payable in 30 years. They've figured that the inn could be open for business in January of 2007. They will call the inn The Blue Nights Inn. Winter 10% The inn Tom and Lisa plan to build will have five bedrooms. The largest bedroom will be the Presidential Suite. Three medium rooms will be called the Deluxe Room and one small room will be called Heavenly. After checking around, they thought to apply the following room rates: Presidential Deluxe Heavenly $250 per night $150 $100 Other assumptions: 1. Getting each room ready (regardless of type) costs $15.00 2. The cost of serving breakfast per room occupancy is $5.00 3. Depreciation Rates: a. Building - 30 years (straight line) b. Furniture Fixtures - 10 years (straight line) Tom and Lisa realize that running and maintaining the inn would cost additional money. After much research and discussion, they identified and listed expense items, and came up with what they deemed reasonable and expected monthly cost estimates shown below. They thought to use these expense items for all months of the year. Your Task: 1. Based on the given information above, prepare a financial plan for Tom and Lisa's planned business (use the Dr. Dungan's BA 499 Template) Evaluate the financial viability of the planned business inspect closely the balance sheets, cash flow, break-even and other important financial information. Expense Cateeory Owner's Salary Housekeeper Salary (two full-time) Utilities - Gas Utilities - Electric/Water Advertising and Promotion Insurance Maintenance Expense Landscape Maintenance Telephone Website Maintenance Internet Cable Connection Miscellaneous Est. Monthly Expense $1,500 $4,000 S 300 250 300 100 300 300 3. Evaluate the assumptions used in this business planning scenario. Are there any important assumptions that were not included or omitted in this scenario? What are they? If any assumption appears unrealistic or does not represent the current condition, change them and revise the financial template to reflect the more current assumptions. 50 150 50 500 Very Important Note: The case presented above is just an example. The figures are contrived and are not based on actual research. The scenario was written for the sole purpose of demonstrating how to use the financial template used in BA499. In your case, when you develop your business plan, all the assumptions you use in coming up with your plan (marketing, operations, financial, HR, etc.) will be closely scrutinized by your BA499 instructor and professors who may be attending your oral presentation. Be ready to back up any assumption you use in your plan with data or research. Tom and Lisa are projecting a 3% increase in these costs from year 1 to year 2 and from year 2 to year 3. Tom and Lisa plan to open the inn 365 days per year. Based on this, they estimated the capacity (in terms of number of room-days) of the inn shown in the table below

I need some help with 2 and 3 please. They are highlighted.

I need some help with 2 and 3 please. They are highlighted.