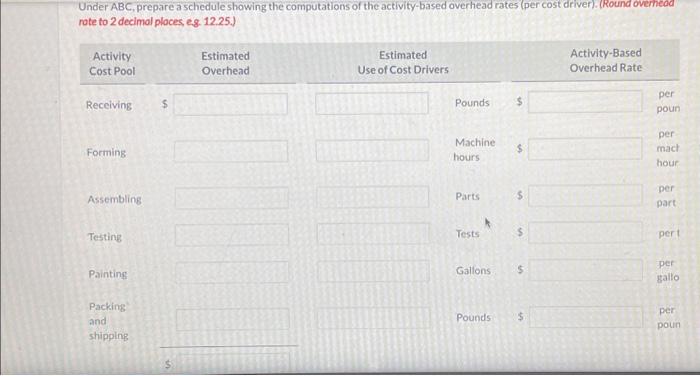

Question: I need some help with part 2: this is part 2: Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per

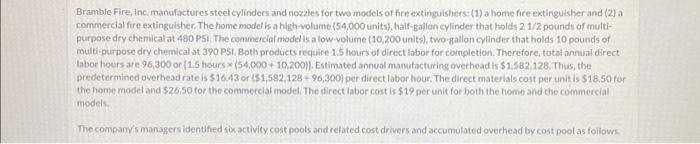

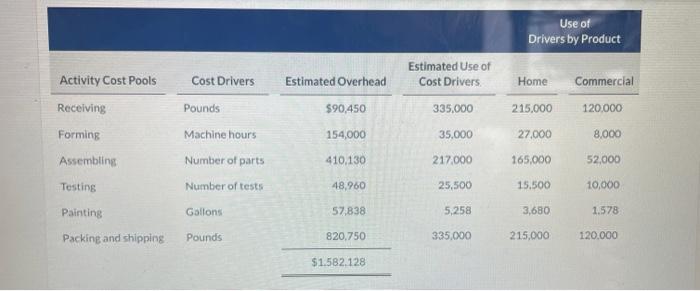

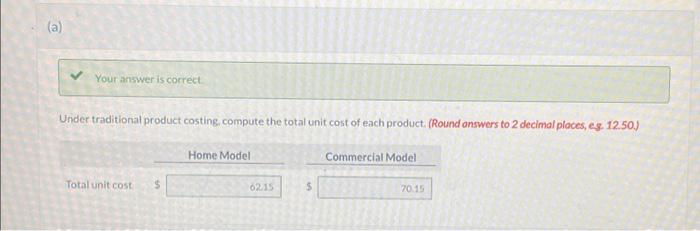

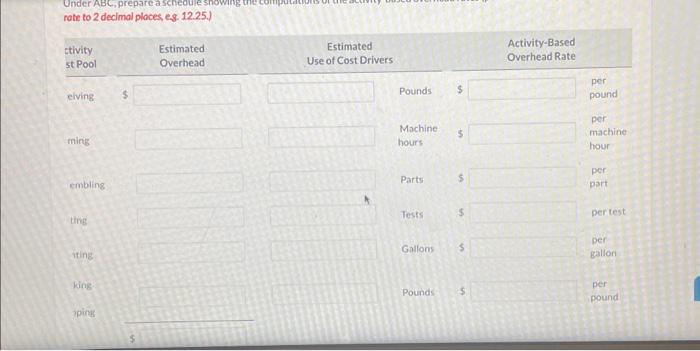

Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per cost driver). (Round ovemeod rote to 2 decimal places, es 12.25 J rate to 2 decimal places, es. 12.25 .) Under traditional product costing. compute the total unit cost of each product. (Round onswers to 2 decimal ploces, es. 12.50) Bramble Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commerciat fre extinguisher. The home model is a high-volume (54,000 units), balf-gallon cylinder that holds 21/2 pounds of multipurpose dry chemical at 480PSI. The commercial model is a low volume (10,200 units), two gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, totat annual direct labor hours are 96,300 or {1.5 hours (54,000+10.200)] Estimated annual manufacturing overhead is $1,582.128. Thus, the predetermined overhead rate is $16.43 or ($1,592,128+96,300) per direct fabor hour. The direct materials cost per unit is $18,50 for the home model and $26.50 for the commercial modet. The direct labor cost is $19 per unit for both the home and the commercial models. The company/s managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as foliows. \begin{tabular}{|c|c|c|c|c|c|} \hline & & & & \multicolumn{2}{|c|}{\begin{tabular}{l} Use of \\ Drivers by Product \end{tabular}} \\ \hline Activity Cost Pools & Cost Drivers & Estimated Overhead & \begin{tabular}{l} Estimated Use of \\ Cost Drivers. \end{tabular} & Home & Commercial \\ \hline Recelving & Pounds & $90,450 & 335,000 & 215.000 & 120,000 \\ \hline Forming & Machine hours & 154,000 & 35,000 & 27,000 & 8.000 \\ \hline Assembling & Number of parts & 410,130 & 217,000 & 165,000 & 52,000 \\ \hline Testing & Number of tests & 48,960 & 25,500 & 15.500 & 10,000 \\ \hline Painting & Gallons & 57,838 & 5,258 & 3,680 & 1.578 \\ \hline Packine and shipping. & Pounds & 820,750 & 335,000 & 215,000 & 120,000 \\ \hline & & $1.582.128 & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts