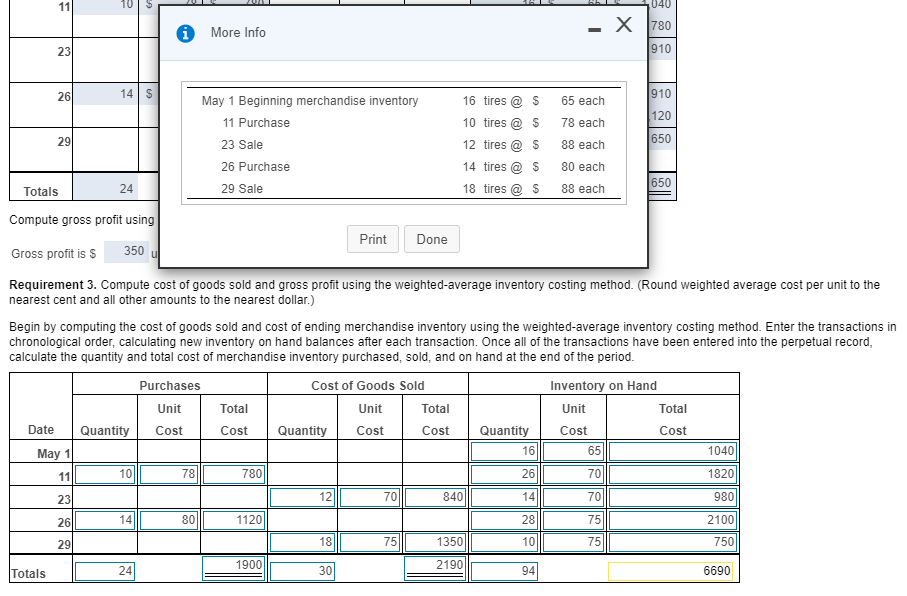

Question: I need some help with this. Apparently something in this is incorrect but I can't figure out what it is or how to fix it.

I need some help with this. Apparently something in this is incorrect but I can't figure out what it is or how to fix it. Chegg Textbook Solutions gives the wrong answer. This table is for the weighted-average inventory costing method

11 10 - X 780 i More Info 23 910 26 14 $ 910 65 each 120 78 each 29 May 1 Beginning merchandise inventory 11 Purchase 23 Sale 26 Purchase 29 Sale 650 16 tires @ $ 10 tires @ $ 12 tires @ $ 14 tires @ $ 18 tires @ $ 88 each 80 each 650 Totals 24 88 each Compute gross profit using Print Done Gross profit is $ 350 Requirement 3. Compute cost of goods sold and gross profit using the weighted average inventory costing method. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost May 1 16 65 1040 11 10 78 780 26 70 1820 23 12 840 14 70 980 26 14 80 11201 28 75 2100 29 18 75 1350 10 75 750 1900 24 2190 Totals 94 6690 70 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts