Question: I need some help with this assignment. These are the hints i was given for questions A- E: Prepare adjusting entries, adjusted trial balance, and

I need some help with this assignment. These are the hints i was given for questions A- E:

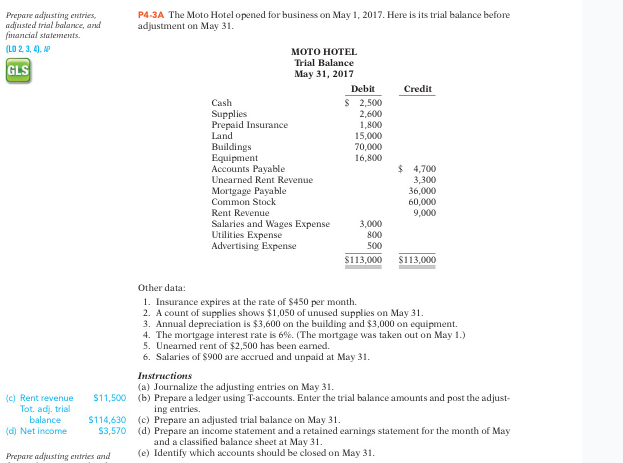

Prepare adjusting entries, adjusted trial balance, and financial statements. (L0 2 3, 4), N P4-3A The Moto Hotel opened for business on May 1, 2017.

Here is its trial balance before adjustment on May 31. Other data: 1. Insurance expires at the rate of $450 per month.

2. A count of supplies shows $1,050 of unused supplies on May 31 .

3. Annual depreciation is $3,600 on the building and $3,000 on equipment.

4. The mortgage interest rate is 6%. (The mortgage was taken out on May 1.)

5. Uneamed rent of $2,500 has been eamed. 6. Salaries of $900 are accrued and unpaid at May 31. Instructions

(a) Journalize the adjusting entries on May 31.

(b) Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries.

(c) Prepare an adjusted trial balance on May 31.

(d) Prepare an income statement and a retained earnings statement for the month of May and a classified balance sheet at May 31.

(e) Identify which accounts should be closed on May 31 .

Prepure adjusting eufries, adjusfed frial bolance, and funancial stafenents. (LO 2, 3, 4), AP P4-3A The Moto Hotel opened for business on May 1, 2017. Here is its trial balance before adjustment on May 31. Other data: 1. Insurance expires at the rate of $450 per month. 2. A count of supplies shows $1,050 of unused supplies on May 31 . 3. Annual depreciation is $3,600 on the building and $3,000 on equipment. 4. The mortgage interest rate is 6%. (The mortgage was taken out on May 1.) 5. Uneamed rent of $2,500 has been earmed. 6. Salaries of $900 are accrued and unpaid at May 31 . Instructions (a) Journalize the adjusting entries on May 31 . (c) Rent revenue Tot. adj. trial balance (d) Net income $11,500 $114,630 $3,570 (b) Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (c) Prepare an adjusted trial balance on May 31. (d) Prepare an income statement and a retained earnings statement for the month of May and a classified balance sheet at May 31. (e) Identify which accounts should be closed on May 31 . Prepue adjusting enfries and Prepure adjusting eufries, adjusfed frial bolance, and funancial stafenents. (LO 2, 3, 4), AP P4-3A The Moto Hotel opened for business on May 1, 2017. Here is its trial balance before adjustment on May 31. Other data: 1. Insurance expires at the rate of $450 per month. 2. A count of supplies shows $1,050 of unused supplies on May 31 . 3. Annual depreciation is $3,600 on the building and $3,000 on equipment. 4. The mortgage interest rate is 6%. (The mortgage was taken out on May 1.) 5. Uneamed rent of $2,500 has been earmed. 6. Salaries of $900 are accrued and unpaid at May 31 . Instructions (a) Journalize the adjusting entries on May 31 . (c) Rent revenue Tot. adj. trial balance (d) Net income $11,500 $114,630 $3,570 (b) Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (c) Prepare an adjusted trial balance on May 31. (d) Prepare an income statement and a retained earnings statement for the month of May and a classified balance sheet at May 31. (e) Identify which accounts should be closed on May 31 . Prepue adjusting enfries and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts