Question: I need some help with this problem please. Thank you very much. 23. Whitley Motors Inc. has the following capital. Debt: The firm issued 900

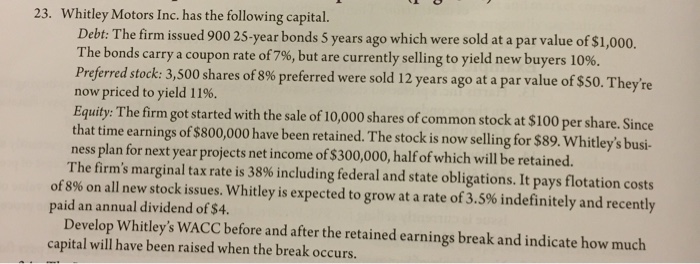

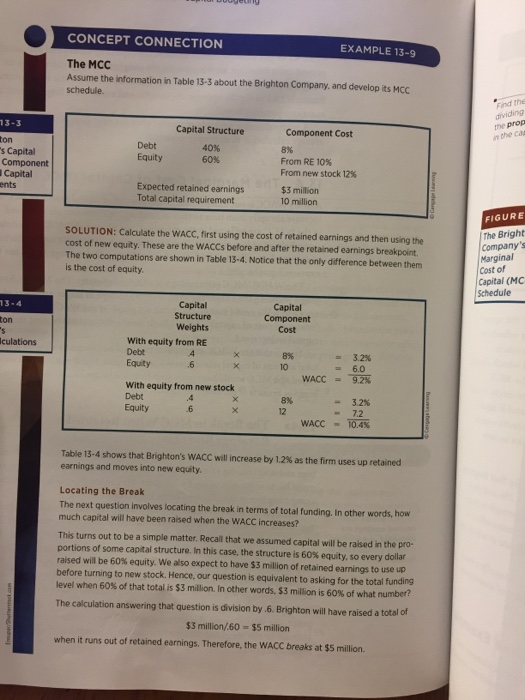

23. Whitley Motors Inc. has the following capital. Debt: The firm issued 900 25-year bonds 5 years ago which were sold at a par value of $1,000. The bonds carry a coupon rate of796, but are currently selling to yield new buyers 10%. Preferred stock: 3,5 now priced to yield 11%. Equity: The firm got started with the sale of 10,000 shares of common stock at $100 per share. Since that time earnings of $800,000 have been retained.The stock is now selling for $89. Whitley's busi- ness plan for next year projects net income of $300,000, half of which will be retained. The firms rmarginal tax rate is 38% including federal and state obligations. It pays flotation costs 00 shares of 8% preferred were sold 12 years ago at a par value of $50. They're of 8% on all new stock issues, whitley is expected to grow at a rate of 3.5% indefinitely and recently paid an annual dividend of $4. Develop Whitley's WACC before and after the retained earnings break and indicate how much capital will have been raised when the break occurs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts