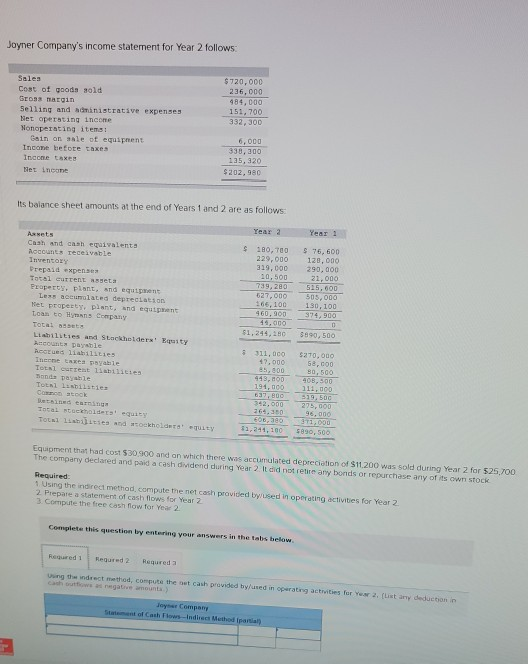

Question: I need some help with this question, please. Thanks Joyner Company's income statement for Year 2 follows: Sales Cost of goods sold Gross margin Selling

I need some help with this question, please. Thanks

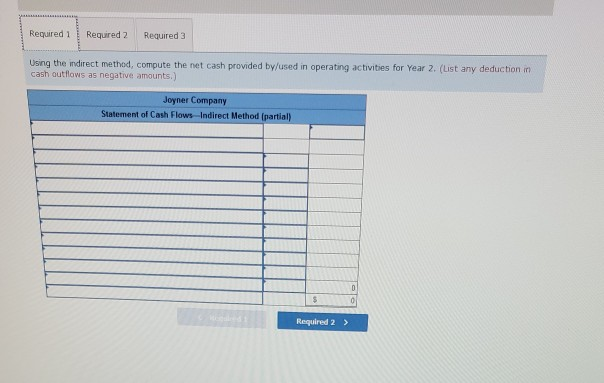

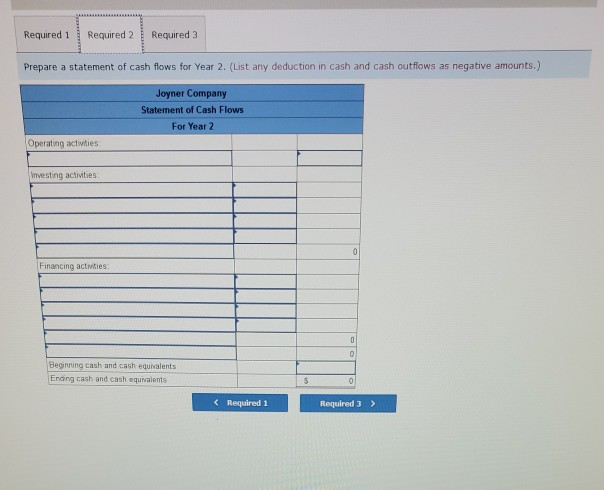

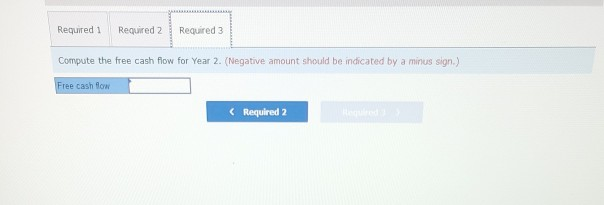

Joyner Company's income statement for Year 2 follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Het operating income Nonoperating items: Gain on anle of equipment Income befote taxes Income taxe Net Income $720,000 236,000 984,000 151,700 332,300 6,000 338,300 135,920 $ 202,980 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Year 1 Assets Cash and cash equivalents Rocounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less acumlated depreciation Het property, plant, and equipment toan tons Company $ 180,700 229,000 319.000 10,500 739,280 527,000 166,100 460,000 44.000 $1,244,110 S 76,600 120,000 290,000 21,000 515,600 505,000 130, 100 374,900 8890, 500 3 Lisbilities and Stockholders' Equity At payable AEG liabilities Insene taxes payable TOTAL rent liabilities Tenda payable Total Lusbilstie 311,000 17,000 85,800 449,000 191.000 63,00 $270,000 58.000 80, 500 408,300 111,000 319,500 275,000 96,000 Total stochotesty Total Listes and wohl.'y 264,350 $1,211,100 5890, 500 Equipment that had cost $30.900 and on which there was accumulated depreciation of S11200 was sold during Year 2 for $25,700 The company declared and paid a cash dividend during Year 2 It did not rere any bonds or repurchase any of its own stock Required Using the indirect method compute tenet cash provided by used in operating activities for Year 2 2 Prepare a statement of cash flows for Year 2 3 Compute the free cash flow for Year 2 Complete this question by entering your answers in the tabs below Recured 1 Heured2 Requreda Ung the indirect method, compute the cash provided by used in operating activities for Y 2. (ut any deduction in gative amount Hey Company Required 1 Required 2 Required 3 Using the indirect method, compute the net cash provided by/used in operating activities for Year 2. (List any deduction in cash outflows as negative amounts.) Joyner Company Statement of Cash Flows Indirect Method (partial) 0 0 Required 2 > Required 1 Required 2 Required 3 Prepare a statement of cash flows for Year 2. (List any deduction in cash and cash outfiows as negative amounts.) Joyner Company Statement of Cash Flows For Year 2 Operating activities Investing activities 0 Financing activities 0 0 Beginning cash and cash equivalents Ending cash and cash equivalents 5 0 Required 1 Required 2 Required 3 Compute the free cash flow for Year 2. (Negative amount should be indicated by a minus sign.) Free cash low (Required 2 Joyner Company's income statement for Year 2 follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Het operating income Nonoperating items: Gain on anle of equipment Income befote taxes Income taxe Net Income $720,000 236,000 984,000 151,700 332,300 6,000 338,300 135,920 $ 202,980 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Year 1 Assets Cash and cash equivalents Rocounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less acumlated depreciation Het property, plant, and equipment toan tons Company $ 180,700 229,000 319.000 10,500 739,280 527,000 166,100 460,000 44.000 $1,244,110 S 76,600 120,000 290,000 21,000 515,600 505,000 130, 100 374,900 8890, 500 3 Lisbilities and Stockholders' Equity At payable AEG liabilities Insene taxes payable TOTAL rent liabilities Tenda payable Total Lusbilstie 311,000 17,000 85,800 449,000 191.000 63,00 $270,000 58.000 80, 500 408,300 111,000 319,500 275,000 96,000 Total stochotesty Total Listes and wohl.'y 264,350 $1,211,100 5890, 500 Equipment that had cost $30.900 and on which there was accumulated depreciation of S11200 was sold during Year 2 for $25,700 The company declared and paid a cash dividend during Year 2 It did not rere any bonds or repurchase any of its own stock Required Using the indirect method compute tenet cash provided by used in operating activities for Year 2 2 Prepare a statement of cash flows for Year 2 3 Compute the free cash flow for Year 2 Complete this question by entering your answers in the tabs below Recured 1 Heured2 Requreda Ung the indirect method, compute the cash provided by used in operating activities for Y 2. (ut any deduction in gative amount Hey Company Required 1 Required 2 Required 3 Using the indirect method, compute the net cash provided by/used in operating activities for Year 2. (List any deduction in cash outflows as negative amounts.) Joyner Company Statement of Cash Flows Indirect Method (partial) 0 0 Required 2 > Required 1 Required 2 Required 3 Prepare a statement of cash flows for Year 2. (List any deduction in cash and cash outfiows as negative amounts.) Joyner Company Statement of Cash Flows For Year 2 Operating activities Investing activities 0 Financing activities 0 0 Beginning cash and cash equivalents Ending cash and cash equivalents 5 0 Required 1 Required 2 Required 3 Compute the free cash flow for Year 2. (Negative amount should be indicated by a minus sign.) Free cash low (Required 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts