Question: I need somone to explain this to me please. Consider the following cash flows for two types of models: Salvage values represent the new proceeds

I need somone to explain this to me please.

I need somone to explain this to me please.

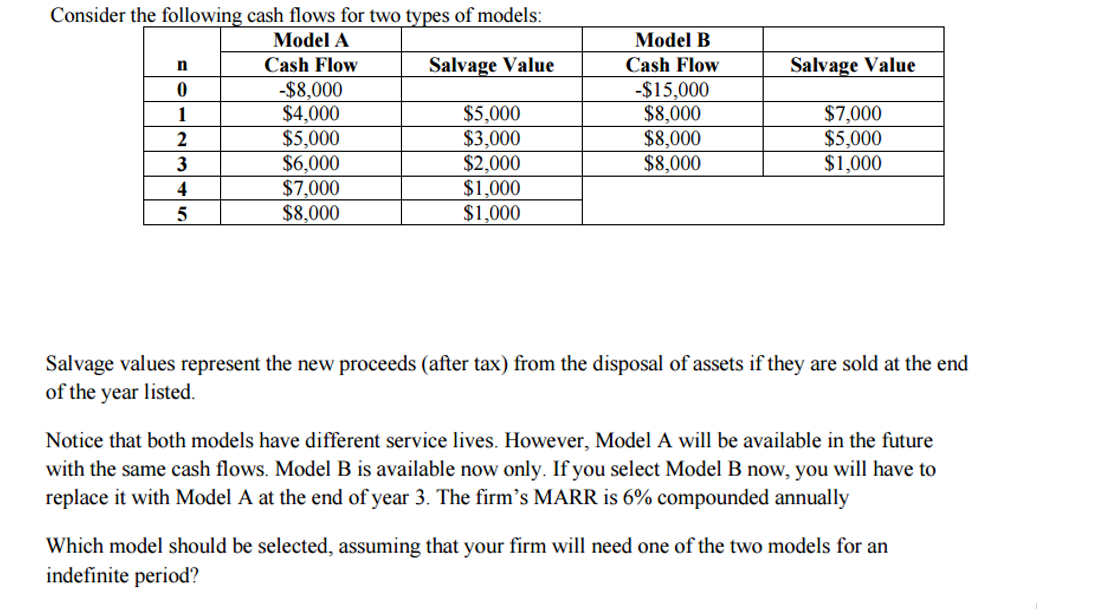

Consider the following cash flows for two types of models: Salvage values represent the new proceeds (after tax) from the disposal of assets if they are sold at the end of the year listed. Notice that both models have different service lives. However, Model A will be available in the future with the same cash flows. Model B is available now only. If you select Model B now, you will have to replace it with Model A at the end of year 3. The firm^?s MARR is 6% compounded annuallyWhich model should be selected, assuming that your firm will need one of the two models for an indefinite period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts