Question: I need step by step expalnation gor this problem? Required: - Use the following information to prepare a 2022 Form 1040 for Andrea Hopkins. -

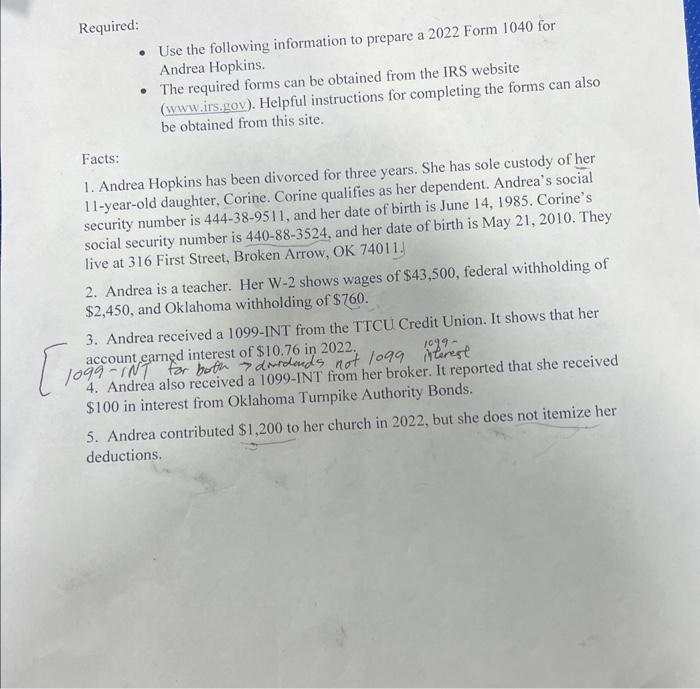

Required: - Use the following information to prepare a 2022 Form 1040 for Andrea Hopkins. - The required forms can be obtained from the IRS website (Ivww.irs.gov). Helpful instructions for completing the forms can also be obtained from this site. Facts: 1. Andrea Hopkins has been divorced for three years. She has sole custody of her 11-year-old daughter, Corine. Corine qualifies as her dependent. Andrea's social security number is 444-38-9511, and her date of birth is June 14, 1985. Corine's social security number is 440883524, and her date of birth is May 21, 2010. They live at 316 First Street, Broken Arrow, OK 74011. 2. Andrea is a teacher. Her W-2 shows wages of $43,500, federal witholding of $2,450, and Oklahoma withholding of $760. 3. Andrea received a 1099-INT from the TTCU Credit Union. It shows that her account earned interest of $10.76 in 2022. 10991NT for both dividends not 1099 inlenest 4. Andrea also received a 1099-INT from her broker. It reported that she received $100 in interest from Oklahoma Turnpike Authority Bonds. 5. Andrea contributed $1,200 to her church in 2022 , but she does not itemize her deductions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts