Question: I need step-by-step steps on how to get the explanations. Thanks :) Money and Banking CM17 Homework #1 If a bank doubles the amount of

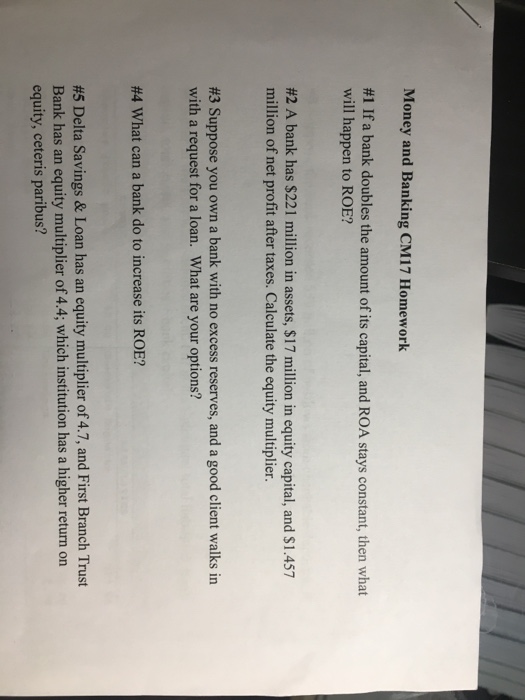

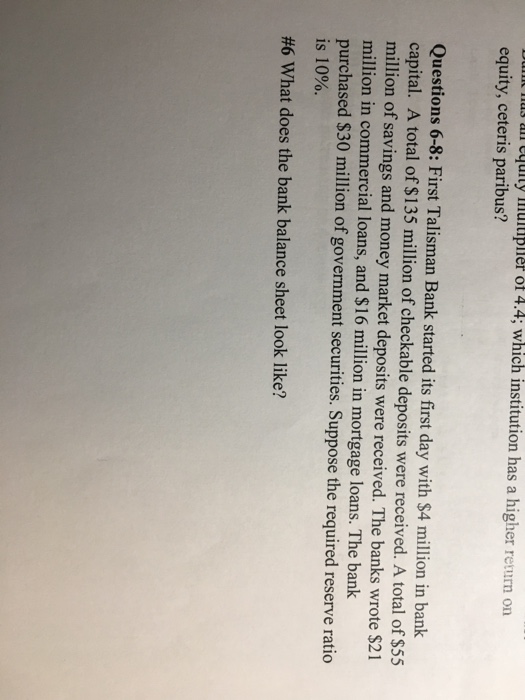

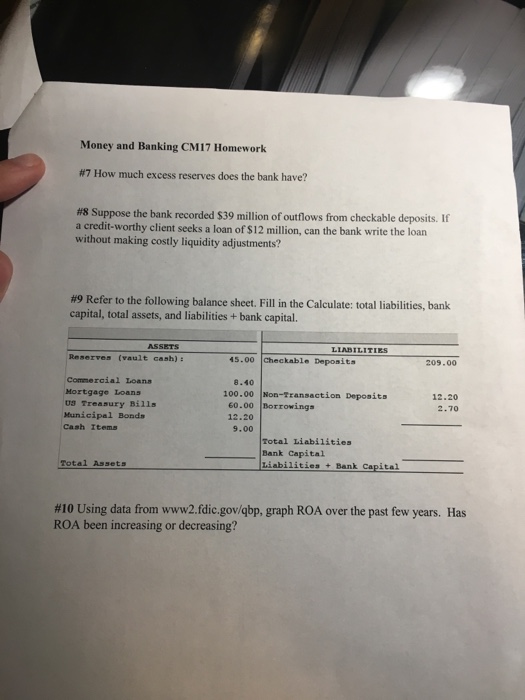

Money and Banking CM17 Homework #1 If a bank doubles the amount of its capital, and ROA stays constant, then what will happen to ROE? #2 A bank has $221 million in assets, $17 million in equity capital, and $1.457 million of net profit after taxes. Calculate the equity multiplier. #3 Suppose you own a bank with no excess reserves, and a good client walks in with a request for a loan. What are your options? #4 What can a bank do to increase its ROE? #5 Delta Savings & Loan has an equity multiplier of4.7, and First Branch Trust Bank has an equity multiplier of 4.4; which institution has a higher return on equity, ceteris paribus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts