Question: i need steps for question 21, 22,23 &24 A call hedge ratio of .80 implies that a hedged portfolio should consist of writing 125 call

i need steps for question 21, 22,23 &24

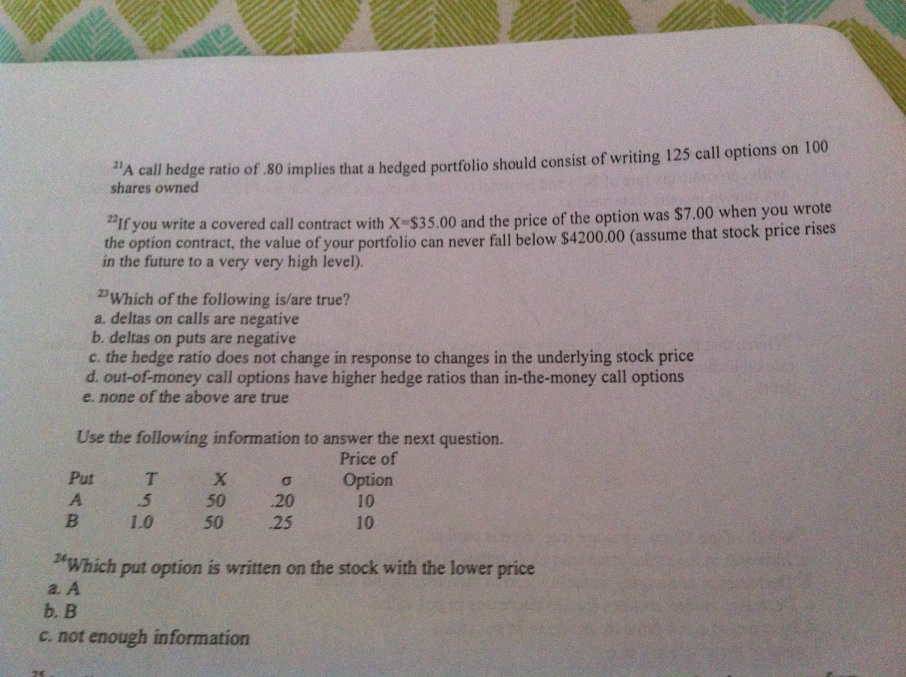

A call hedge ratio of .80 implies that a hedged portfolio should consist of writing 125 call option on 100 shares owned lf you write a covered call contract with X = $35.00 and the price of the option was $7.00 wrote the option contract, the value of your portfolio can never fall below $4200.00 (assume that stock price rises in the future to a very very high level). Which of the following is/are true? deltas on calls are negative deltas on puts are negative the hedge ratio does not change in response to changes in the underlying stock price out-of-money call options have higher hedge ratios than in-the-money call options none of the above are true Use the following information to answer the next question Which put option is written on the stock with the lower price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts