Question: I need Task 5 Task 4 (Portfolio Return) The yield r and standard deviation o of shares a and B are given, Share A B

I need Task 5

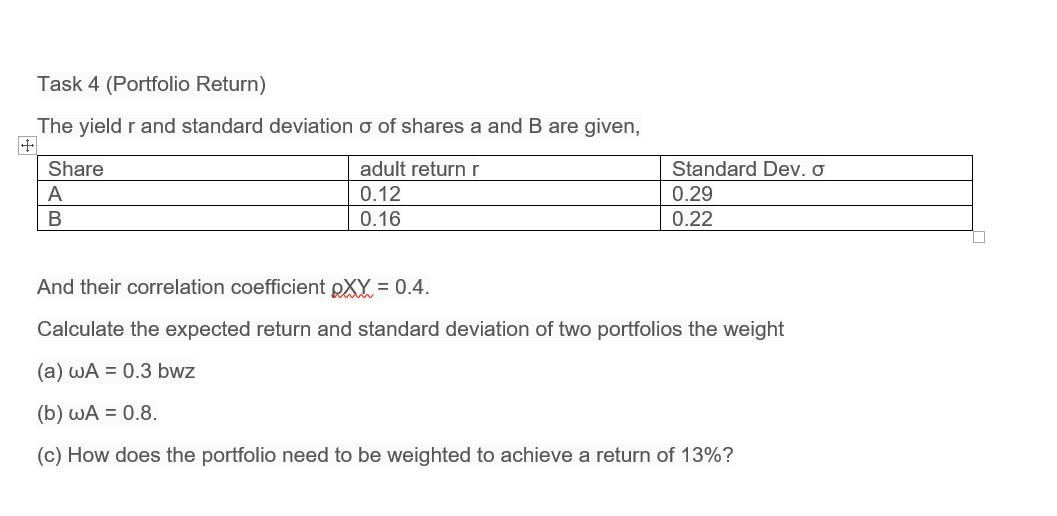

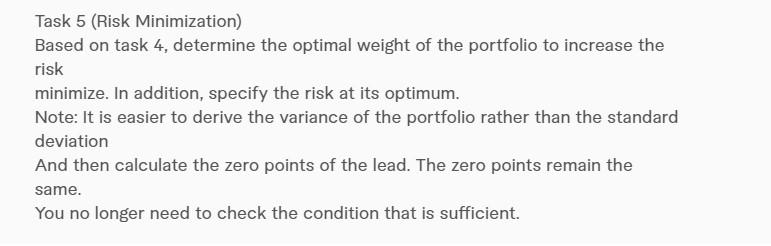

Task 4 (Portfolio Return) The yield r and standard deviation o of shares a and B are given, Share A B adult return 0.12 0.16 Standard Dev. o 0.29 0.22 And their correlation coefficient RXY = 0.4. Calculate the expected return and standard deviation of two portfolios the weight (a) WA = 0.3 bwz (b) WA = 0.8. (c) How does the portfolio need to be weighted to achieve a return of 13%? Task 5 (Risk Minimization) Based on task 4, determine the optimal weight of the portfolio to increase the risk minimize. In addition, specify the risk at its optimum. Note: It is easier to derive the variance of the portfolio rather than the standard deviation And then calculate the zero points of the lead. The zero points remain the same. You no longer need to check the condition that is sufficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts